Hey there, fellow contractors! As The Insurance Whiz, I’m here to let you in on a little secret that can make all the difference for your small business: small business general liability insurance. Now, I know insurance can be a real snooze-fest for some of you, but hear me out. This coverage is like your superhero cape when it comes to protecting your hard-earned business from the dangers lurking out there.

Understanding the Basics: Your Financial Safety Net

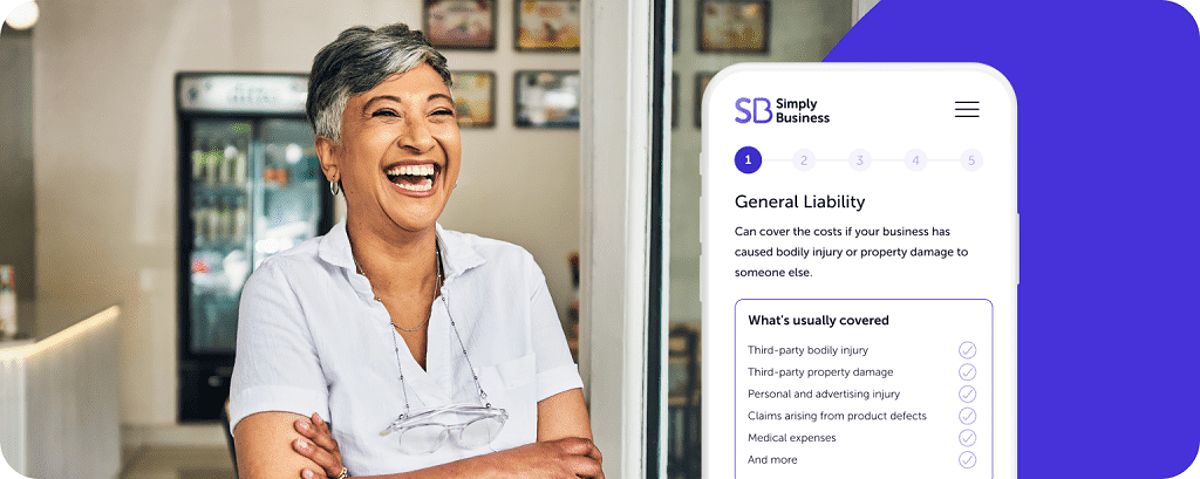

General liability insurance, or GL for short, is the best sidekick a contractor could ask for. It’s got your back when it comes to third-party claims of bodily injury, property damage, and even personal or advertising mishaps. Imagine you’re working on a job site and a client takes a tumble — your GL policy can step in and cover the medical expenses and legal fees. Or say your crew accidentally breaks a neighbor’s window — no sweat, your GL insurance has got you covered.

The way I see it, a GL policy has three key superpowers:

1- Bodily Injury Liability

This is a must-have if you want to protect your business from the financial fallout of someone getting hurt on your watch. Whether it’s a client or a member of the public, your GL insurance will be there to save the day.

2- Property Damage Liability

Accidents happen, and if your crew accidentally causes damage to a client’s property or someone else’s, this coverage has your back. No more sweating over who’s going to foot the repair bill.

3- Personal and Advertising Injury Liability

This one’s for when things get a little spicy in the marketing world. If a competitor claims your advertising is playing dirty, your GL insurance can help you fight back without draining your bank account.

On top of that, GL insurance often includes “premises liability” coverage, which shields your business if someone gets injured or their property gets damaged at your office or shop. It’s like a force field for your home base.

Now, when you’re choosing your GL policy, you’ll need to pick a deductible — that’s the amount you’ll pay out of pocket before your insurance kicks in. Higher deductibles usually mean lower monthly premiums, but just remember, you’ll be responsible for more if you need to file a claim. It’s all about finding the sweet spot that works for your budget and risk tolerance.

Why Small Business General Liability Insurance is Essential for Contractors

Alright, let’s get down to the nitty-gritty. As a contractor, general liability insurance isn’t just a nice-to-have — it’s often a must-have. Many states require you to have GL coverage before they’ll even issue you a contractor’s license. Fail to comply, and you could be facing some serious fines or even having your license suspended. That’s not a risk I’d be willing to take!

But it’s not just about keeping the authorities happy. Clients, especially the big-time commercial and government ones, often won’t even consider hiring a contractor unless they can prove they’ve got GL insurance in place. It’s all about building trust and demonstrating that you’re a responsible, professional outfit. And let’s face it, in today’s litigious world, it’s better to be safe than sorry.

According to the latest industry data, construction-related lawsuits and insurance claims have skyrocketed by over 30% in the last five years. Just one accident or lawsuit could be enough to send a small contracting business into a tailspin. With GL insurance, you can breathe easy, knowing your financial stability is protected, and you can focus on what you do best — kicking butt and taking names on the job site.

Choosing the Right Coverage for Your Contracting Superpowers

Now, when it comes to selecting your GL insurance policy, there are a few key factors that can influence the cost of your premiums. The type of construction work you specialize in is a big one — contractors in riskier trades like roofing or excavation tend to pay higher rates than those in less hazardous fields like HVAC or painting.

The size and scope of your projects also come into play. Bigger commercial or industrial jobs generally carry higher liability exposure than smaller residential gigs. And the more employees you have on your team, the greater the chances of an accident or injury occurring, which can also impact your insurance costs.

But here’s the good news — you can actually lower your GL insurance premiums by being a total superhero when it comes to safety and risk management. If you’ve got a squeaky-clean track record and killer safety protocols in place, your insurance provider is more likely to give you the red-carpet treatment. And let’s not forget about location — where your business is based can also influence your rates, with areas prone to natural disasters or high litigation tendencies often seeing higher premiums.

To get the best deal on your GL coverage, I always recommend working with an insurance broker or agent who’s well-versed in contractor policies. They can help you navigate the market, compare quotes from multiple providers, and identify any potential discounts you might be eligible for. It’s a small investment that can pay off big-time in the long run.

Bringing in the Proof: Your Certificate of Insurance (COI)

Alright, let’s say you’ve nailed down your awesome GL insurance policy — now it’s time to show it off to your clients. That’s where your Certificate of Insurance (COI) comes into play. This nifty little document serves as proof of your coverage, and it’s often required before you can even set foot on a new job site.

Your COI will include all the juicy details like your policy number, coverage limits, effective dates, and the name of your insurance provider. It’s like your superhero ID card that says, “Yep, I’ve got this covered.” Whenever you need to hand over a COI, just give your insurance company a shout, and they’ll help you out.

Clients love seeing that COI because it means they can rest easy, knowing you’ve got their backs covered. It’s a great way to build trust and demonstrate your commitment to responsible business practices. And let’s be real, who doesn’t love a contractor who’s on top of their insurance game?

The Supporting Cast: Other Insurance Superpowers

While general liability insurance is the ultimate sidekick for your contracting business, it’s not the only superpower you might need. Depending on the nature of your work and the unique risks you face, you may want to consider adding a few more caped crusaders to your team:

-

Workers’ Compensation Insurance: This one’s a must-have if you’ve got employees. It covers medical expenses and lost wages if they get injured on the job, so you don’t have to worry about them draining your bank account.

-

Commercial Auto Insurance: If your crew uses company vehicles to get to and from job sites, this coverage can protect those wheels from damage and liability claims.

-

Equipment Insurance: Safeguard your most valuable tools and machinery against theft or damage. Trust me, you don’t want to be caught without this one.

-

Professional Liability Insurance (E&O): If you offer any design or consulting services, this coverage can shield you from claims of negligence or errors in your work.

Navigating the insurance world can feel a bit like a superhero origin story, but that’s where your friendly neighborhood insurance broker comes in. They can help you assemble the perfect squad of coverage to protect your contracting business, no matter what challenges come your way.

FAQ

Q: Is general liability insurance required by law for contractors?

A: While it’s not always mandatory at the federal level, many states require contractors to have GL coverage as part of their licensing requirements. It’s crucial to check the regulations in your neck of the woods.

Q: How much does general liability insurance cost for contractors?

A: The cost can vary quite a bit, depending on factors like your type of work, project size, location, and overall risk profile. The best way to get an accurate quote is to work with an insurance broker who specializes in contractor policies.

Q: What happens if I have a claim under my general liability policy?

A: If you need to file a GL claim, your insurance provider will investigate the incident, negotiate with the claimant, and potentially cover any resulting damages or legal expenses — up to the limits of your policy. Your out-of-pocket costs would be limited to your deductible.

Suit Up, Superheroes!

There you have it, my fellow contractors — the lowdown on small business general liability insurance. This coverage is your financial safety net, your client-winning superpower, and your ticket to long-term business success. Trust me, with the right GL policy in place, you’ll be able to tackle any job with confidence, knowing that your hard-earned business is protected.

So, what are you waiting for? Suit up and let’s go show the world what your contracting superpowers can do! Just be sure to give me a call when you need help finding the perfect GL insurance policy to shield your business from the dangers out there. I’ll be your sidekick any day.