In the fast-paced world of modern life, the task of managing household finances can often feel overwhelming. As a woman, you have unique needs and priorities when it comes to protecting your most valuable assets — your home and your family’s transportation. That’s why finding the right insurance coverage at the best possible price is crucial. To help you navigate this process, we’ve compiled a comprehensive guide to finding the best insurance quotes auto and home.

Unlock the Power of Insurance Quotes Auto and Home Bundling

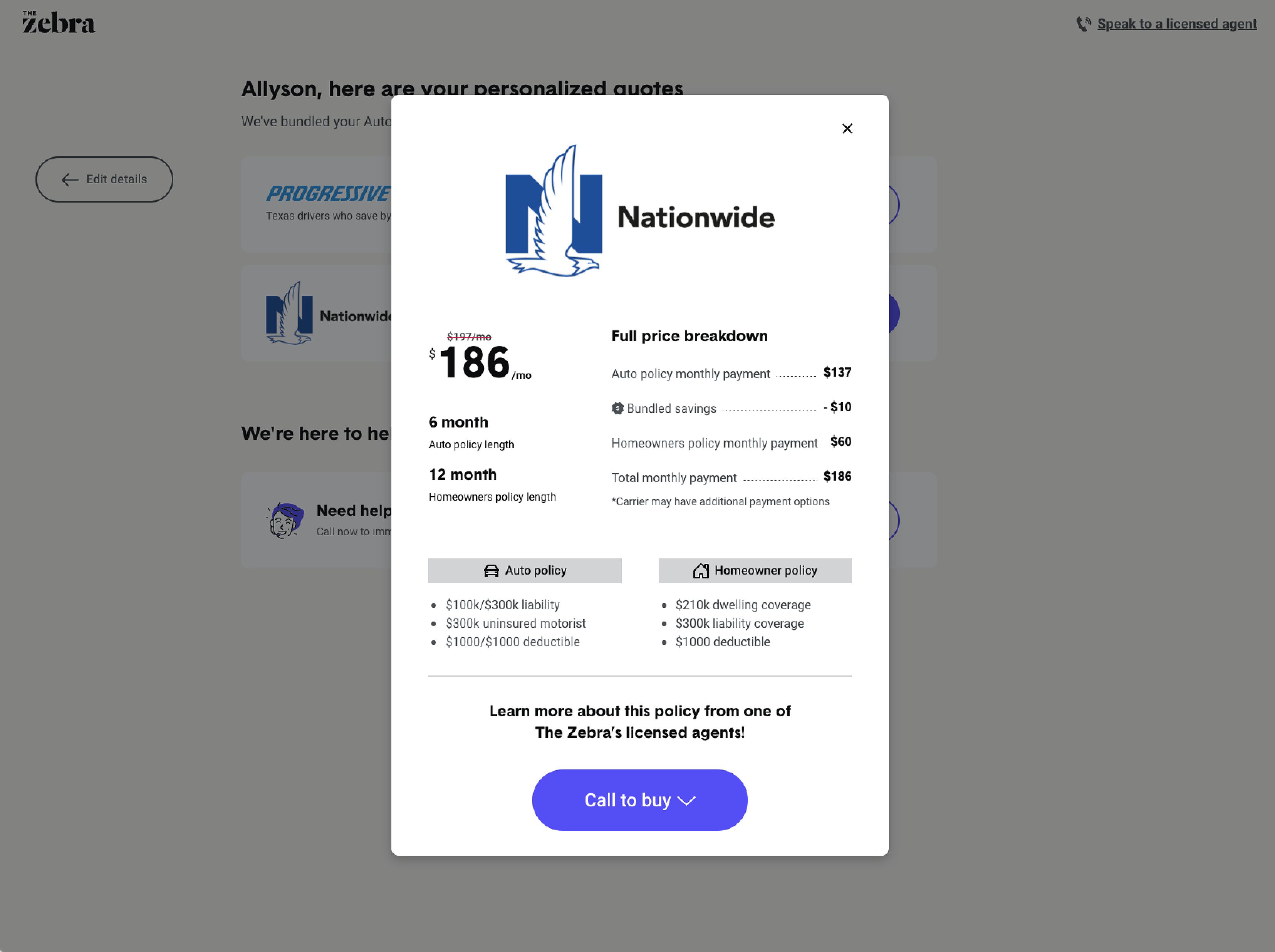

One of the most effective ways to save money on your insurance costs is by bundling your home and auto policies. This approach not only simplifies your insurance management but also unlocks significant discounts that can lead to substantial annual savings.

Imagine a scenario where you could enjoy up to 20% off your combined home and auto insurance premiums. By taking the time to explore bundling options, you can free up funds to invest in your family’s well-being or put towards other important financial goals.

The convenience of bundling is equally appealing. Imagine the relief of having a single provider handle all your insurance needs — from policy updates and claims processing to seamless payment management. This streamlined experience can save you valuable time and mental energy, allowing you to focus on the things that matter most.

Weighing the Pros and Cons

While the potential savings are enticing, it’s crucial to carefully consider the pros and cons of bundling your home and auto insurance. On the plus side, the simplicity and cost-effectiveness can be a game-changer for busy women juggling multiple responsibilities.

However, it’s important to ensure that the bundled policy provides the level of coverage and customer service you require. Some insurers may have limitations or exclusions that could leave you vulnerable. Thorough research and comparison shopping are essential to finding the right balance between cost and comprehensive protection.

Navigating the Insurance Landscape

Comparing insurance quotes can be a daunting task, but with the right approach, you can uncover the most favorable rates and coverage options for your unique needs.

Gather Accurate Information

Start by gathering detailed information about your home and vehicles, including the age, condition, and location of your property, as well as the make, model, and year of your cars. This data will enable insurance providers to generate accurate quotes tailored to your specific circumstances.

Prioritize Your Coverage Needs

Next, take the time to understand the various types of coverage available for both your home and auto policies. Identify your must-have protections, such as liability coverage and comprehensive protection, and weigh them against your budget and risk tolerance. This strategic approach will help you make informed decisions without compromising your family’s safety.

Leverage Online Comparison Tools

In today’s digital landscape, online comparison websites have become invaluable resources for women seeking the best insurance deals. These platforms allow you to input your information and instantly view side-by-side quotes from multiple insurers, empowering you to make an informed choice.

Explore Discounts and Incentives

As you compare insurance options, be sure to inquire about any available discounts or incentives. Many providers offer a range of savings opportunities, such as bundling discounts, safe driving rewards, and home security system credits. Leveraging these can significantly boost your potential savings.

Trusted Insurance Providers for Women

When it comes to securing your home and auto insurance, several reputable companies stand out for their competitive rates, comprehensive coverage, and exceptional customer service. As you navigate the insurance landscape, consider the following providers:

Average Bundled Rates

While your personal rates may vary, the following figures provide a general snapshot of the potential savings you could unlock by bundling your home and auto insurance:

- Bundled Home and Auto: $1,100 annually

- Home Insurance Only: $750 annually

- Auto Insurance Only: $550 annually

These averages illustrate the substantial savings that can be achieved by combining your policies, but it’s crucial to compare quotes from multiple insurers to find the best fit for your specific needs.

Real-Life Success Stories

Women across the country have successfully leveraged bundled insurance policies to protect their families and maximize their savings. Take the story of Sarah, a young mother in a suburban neighborhood, who combined her home and auto coverage and secured a 15% discount on her total premium. By working closely with her insurance agent and carefully reviewing her options, she was able to find a policy that provided the coverage she needed without straining her budget.

Key Considerations for Choosing a Bundled Policy

As you embark on your journey to find the perfect bundled insurance solution, keep the following factors in mind:

- Coverage Limits and Deductibles: Carefully review the coverage limits and deductibles for both your home and auto policies, ensuring they align with your financial situation and risk tolerance.

- Policy Exclusions: Understand the limitations and exclusions in your policy, as these can significantly impact your level of protection.

- Customer Service Reputation: Research the insurance provider’s track record for customer service and claims handling, as these can make a significant difference when you need assistance.

- Financial Stability: Consider the financial strength and rating of the insurance company, as a stable and reliable provider is more likely to fulfill their obligations when you need them most.

By staying informed and prioritizing your unique needs, you can confidently select a bundled insurance policy that safeguards your home, your vehicles, and your family’s well-being.

Frequently Asked Questions

How much can I save by bundling my home and auto insurance?

You can potentially save anywhere from 5% to 20% on your combined premium by bundling your home and auto insurance policies. The exact amount will depend on your specific circumstances and the insurance provider you choose.

What are the best ways to compare insurance quotes?

The most effective ways to compare insurance quotes include using online comparison tools, contacting multiple insurers directly, and consulting with a knowledgeable insurance agent. This comprehensive approach will help you identify the best rates and coverage options for your needs.

What are some common mistakes to avoid when choosing a bundled policy?

Some key mistakes to avoid include settling for the first quote you receive, overlooking important coverage details, and failing to explore all available discounts and incentives. Take the time to thoroughly research your options and make an informed decision.

Conclusion

As a woman navigating the complex world of home and auto insurance, you have the power to make informed choices that protect your family’s financial security and well-being. By embracing the benefits of bundling your policies, you can unlock substantial savings, streamline your insurance management, and enjoy the peace of mind that comes with comprehensive coverage.

Remember, the journey to finding the perfect insurance solution is a personal one. Take the time to gather accurate information, prioritize your needs, and leverage the various tools and resources available to you. With a little diligence and a keen eye for value, you can confidently safeguard your most valuable assets while maximizing your hard-earned dollars.

Empower yourself to make the best insurance decisions for your family. Embrace the opportunity to save big and secure the protection you deserve.