Finding the right home and car insurance can be a complex process, but bundling your policies can offer significant savings. This article explores the benefits of bundling and provides practical tips for finding the best home car insurance quotes.

The Power of Bundling Home and Car Insurance

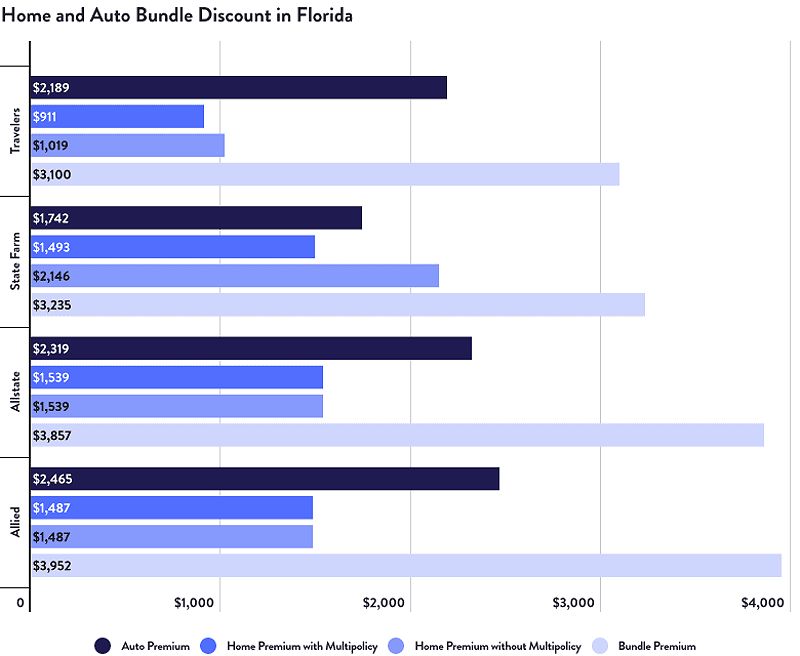

Bundling your home and car insurance policies is a strategic move that can yield substantial savings. When you purchase multiple policies from the same insurance company, they often reward you with a multi-policy discount, typically ranging from 5% to 20% off your total premium.

How Bundling Works

The concept is fairly straightforward: by consolidating your insurance needs with a single provider, you create a mutually beneficial relationship. The insurer is willing to offer you a discounted rate because they view you as a valuable, long-term customer who provides a stable stream of revenue.

To illustrate the power of bundling, let’s consider a hypothetical example. Suppose your annual home insurance premium is $800, and your car insurance costs $1,000 per year. If you bundle these policies with a 10% discount, your total cost would be $1,620 instead of the original $1,800 – a savings of $180 per year.

Factors Affecting Bundling Discounts

The specific discount you receive will depend on the insurance company’s policies, your individual risk profile, and the types of coverage you choose. Factors like your claims history, the age and location of your home, and the make and model of your vehicle can all influence the size of the bundling discount.

Pros and Cons of Bundling

Bundling your home and car insurance can be a smart strategy, but it’s essential to consider both the advantages and potential drawbacks:

Pros:

- Potential cost savings

- Convenience of managing policies with a single provider

- Simplified claims process

Cons:

- Limited options compared to shopping separately

- Possibility of higher overall premiums compared to individual policies

- Potential coverage restrictions or limitations

How to Compare Home Car Insurance Quotes Effectively

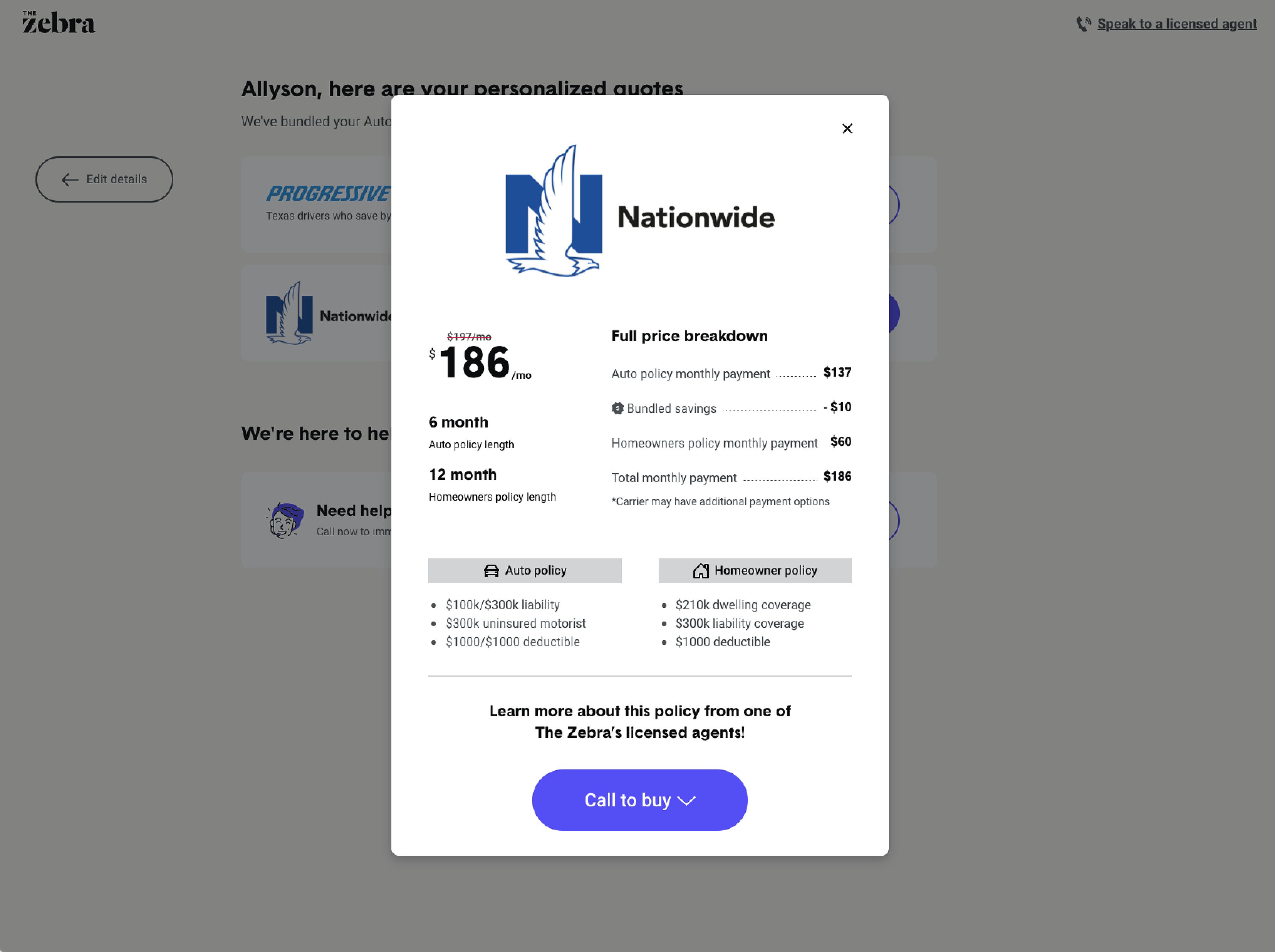

To find the best home car insurance quotes, it’s crucial to compare quotes from multiple insurers. Follow these steps to gather and analyze quotes effectively:

Gathering Quotes

Start by using online comparison tools or contacting local insurance agents directly to collect quotes from at least 3-5 different companies. This will give you a comprehensive understanding of the market and the available options.

Analyzing Quotes

When comparing the quotes, look closely at the premiums (both bundled and unbundled), coverage options, deductibles, available discounts, and customer service ratings. This meticulous review will help you identify the insurer that offers the best balance of affordability and comprehensive protection.

Negotiating with Insurers

If you discover a significantly better deal from another provider, you can leverage that information to negotiate a lower rate with your current insurer. Highlight the specific discounts or coverage features offered by the competition and see if they’re willing to match or beat the competing quote.

Top Insurance Companies for Home and Car Bundles

When it comes to bundling home and car insurance, some insurers stand out as top contenders in the market:

USAA: A Trusted Veteran-Focused Insurer

USAA consistently ranks among the best for customer satisfaction with both home and auto insurance. As a provider focused on serving the military community, USAA offers comprehensive coverage and personalized service.

State Farm: A Balance of Affordability and Personalization

State Farm is a perennial favorite, earning high marks for its ease of use and customer-centric approach. In addition to competitive bundled rates, State Farm’s policies often include unique add-ons, such as mold coverage and home systems protection.

GEICO: Streamlined Online Experience

While GEICO’s overall reviews are mixed, the insurer excels in providing a seamless digital experience for bundling home and car policies. For tech-savvy consumers who value convenience, GEICO’s user-friendly platform can be a significant draw.

Tips for Choosing the Right Home and Car Insurance Bundle

As you navigate the process of finding the perfect home and car insurance bundle, keep these essential tips in mind:

- Verify Coverage Consistency: Ensure that bundling your policies won’t result in any unexpected coverage restrictions or limitations, such as exclusions for owning a specific dog breed or having a pool.

- Consider Insurer’s Claims Management: Choose an insurer with a proven track record of handling claims efficiently and fairly.

- Explore “Mix and Match” Options: Compare individual home and auto policies from different insurers to see if combining them is more cost-effective than a traditional bundled policy.

- Seek Professional Guidance: Consult with a local independent insurance agent who can provide personalized recommendations and assist you with the quote comparison process.

Additional Factors to Consider

When evaluating home and car insurance bundles, there are a few additional factors you may want to consider:

Policy Customization

Some insurers offer the ability to customize your bundled policies, allowing you to tailor the coverage to your specific needs. This can be especially beneficial if you have unique insurance requirements or want to add specialized coverage.

Discounts and Loyalty Programs

In addition to the standard bundling discount, insurers may offer additional discounts for factors like good driving records, home security systems, or loyalty to the company. Be sure to inquire about all available discounts to maximize your savings.

Customer Service and Reputation

The quality of an insurer’s customer service can have a significant impact on your experience, especially if you need to file a claim. Research the company’s reputation, reviews, and complaint history to ensure you’re choosing a provider that will support you when you need it most.

FAQ

Q: Is it always cheaper to bundle home and car insurance?

A: Not necessarily. While bundling often leads to substantial savings, it’s crucial to compare both bundled and unbundled quotes from multiple insurers to determine the best option for your specific needs and budget.

Q: How much can I save by bundling?

A: The average bundling discount typically ranges from 5% to 20%, but the actual amount you can save will depend on the insurance company and your individual circumstances.

Q: What are the best insurance companies for bundling?

A: Based on factors like customer satisfaction, affordability, and unique policy features, some of the top insurers for bundling home and car insurance include USAA, State Farm, and GEICO.

Q: What should I do if I’m not happy with my current bundled policy?

A: If you’re unhappy with your current bundled policy, you can shop around for better rates and coverage options from other insurance providers. Be sure to compare quotes and thoroughly review the new policy before making a switch.

Bundling home and car insurance can be a smart strategy for saving money. By comparing quotes, understanding coverage options, and choosing the right insurer, you can find a bundle that meets your needs and budget. Start exploring your home car insurance quote options today and unlock the potential savings of bundling.