Hey there, fellow insurance enthusiasts! As The Insurance Guru, I’m here to share a secret that could save you a bundle on your home and car insurance. Want to know how to get the best deal on a home car insurance quote? Bundling these two essential policies can be a total game-changer.

The Power of Bundling: Why Its a Smart Move

Let’s start with the basics – what exactly is bundling, and why should you care? Well, my friends, bundling is the simple act of purchasing multiple insurance policies from the same provider. And let me tell you, the benefits are nothing short of amazing.

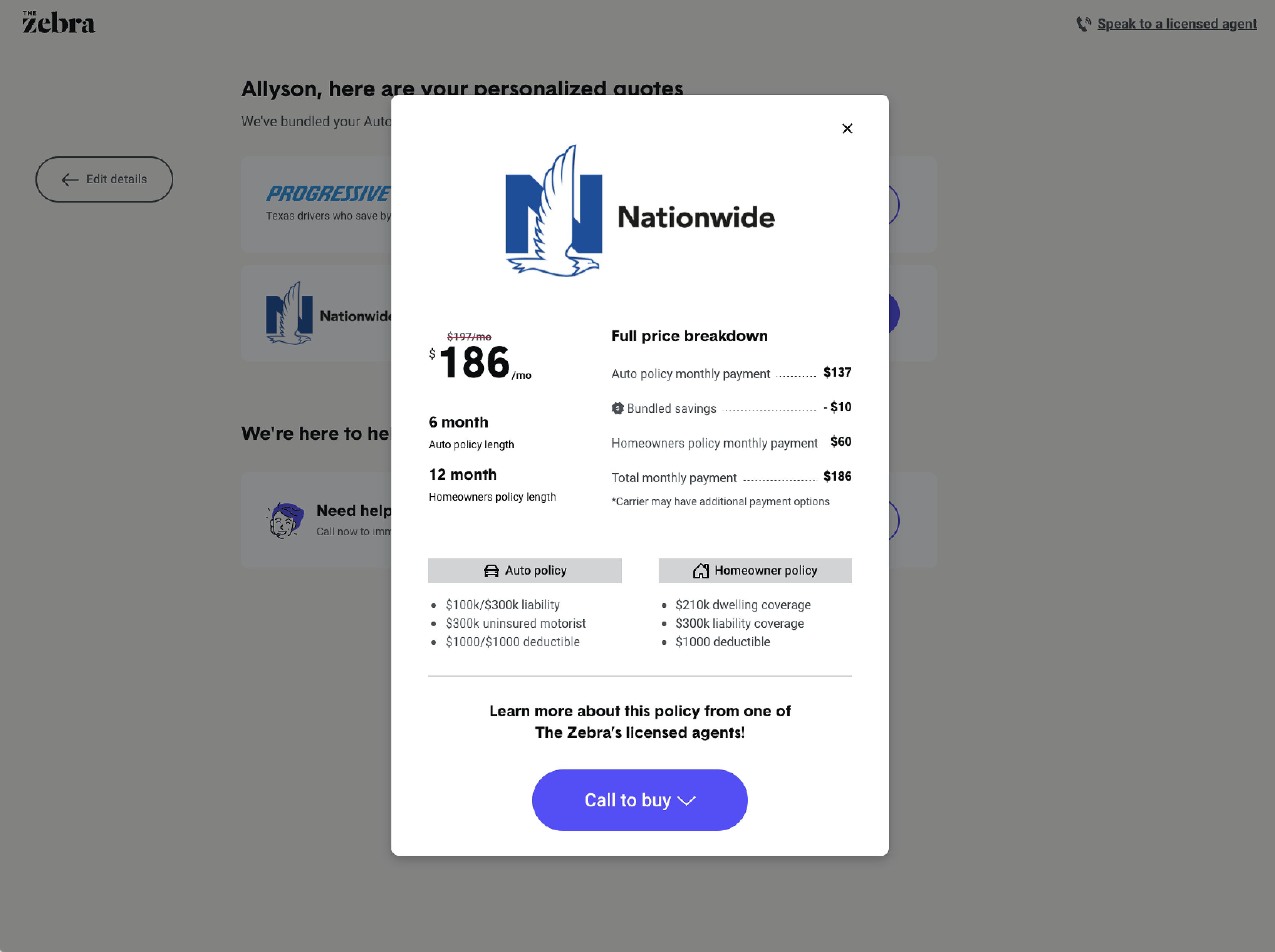

When you bundle your home and car insurance, you can qualify for a multi-policy discount, which can translate to some serious savings. I’m talking about an average of 10-20% off your total premium. That’s like finding a fiver on the sidewalk every time you pay your bill!

But the perks don’t stop there. Bundling also makes your life a whole lot easier. Instead of juggling separate bills and customer service lines, you’ll have everything neatly consolidated under one roof. It’s like having a personal insurance concierge, and trust me, your future self will thank you.

Finding the Best Home Car Insurance Quote for You

Alright, now that I’ve got you excited about the savings and convenience, let’s talk about how to actually find the perfect home car insurance bundle. The key is to do your homework and explore your options.

Compare Quotes from Multiple Insurers

First things first, don’t just settle for the first offer that comes your way. Take the time to gather quotes from a few different providers. This will allow you to compare not only the prices but also the coverage options and discounts available. Remember, what might be the best deal for your neighbor might not be the best fit for you.

To make this process a breeze, I recommend using online comparison tools. These nifty little platforms let you input your information once and receive multiple quotes in return. You can also reach out to insurance agents directly for personalized assistance. They can provide valuable insights and help you find the perfect bundle.

Consider Your Insurance Needs

Before you dive in, it’s crucial to take a good, hard look at your insurance needs. Think about the current value of your home, the make and model of your vehicle, and any personal liability risks you might face. Understanding these factors will help you determine the appropriate coverage levels for both your home and auto policies.

And don’t forget to check if you have any existing policies that you can transfer to your new insurer. This could be the key to maximizing your savings.

Evaluate Bundling Discounts

Now, let’s talk about those all-important bundling discounts. Here’s the deal – not all insurers offer the same level of savings, so it pays to do your research. Some companies are known for their competitive bundling deals, while others may not be as generous.

As you’re comparing quotes, keep an eye out for the best bundling discounts. This could be the deciding factor in choosing the right provider for your home and car insurance needs.

Tips for Getting the Most Out of Your Home Car Insurance Bundle

Alright, you’ve found the perfect bundle, but the job’s not done yet. Here are a few tips to help you squeeze every last drop of savings out of your new insurance setup.

Negotiate with Your Insurer

Don’t be afraid to flex your negotiation skills, my friends. Insurance companies often have some wiggle room when it comes to pricing, and a little friendly discussion can go a long way. Chat with a representative about potential discounts, such as those for safety features in your vehicle or your stellar driving record. You might be surprised by how much you can save.

Review Your Policies Regularly

As the saying goes, “the only constant is change,” and that applies to your insurance needs as well. Make it a habit to review your policies at least once a year. This will help you stay on top of any new discounts or coverage options that may have become available. Plus, it’s a great way to ensure your policies still meet your changing needs as life throws you curveballs.

Shop Around for Better Rates

Even after you’ve locked in your bundle, don’t get too comfortable. The insurance market is constantly evolving, and what was once the best deal may not be the case anymore. Set a calendar reminder to check in with various providers every 12-24 months. You might just find an even sweeter deal out there, and who doesn’t love saving even more?

Common Questions About Home Car Insurance Bundling

Before we wrap up, let’s address a few common questions that folks often have about bundling home and car insurance:

Is it cheaper to have home and car insurance together?

Absolutely! Bundling these policies can lead to significant savings, with the average homeowner seeing a 10-20% discount on their total premium.

How much can you save by bundling insurance?

The exact savings can vary, but you’re typically looking at an average of 5-20% off your combined home and car insurance costs.

What are the best auto and home insurance companies for bundling?

Some of the top-rated insurers for bundling include State Farm, Allstate, and Progressive. But the best option for you will depend on your specific needs and the discounts available.

What are the risks of bundling?

While the benefits of bundling are numerous, it’s important to ensure that the insurer you choose provides adequate coverage and doesn’t limit your options. Always do your due diligence to find a provider that meets your needs.

Maximizing Your Savings with a Home Car Insurance Bundle

In July 2024, the insurance landscape is evolving rapidly, and savvy consumers are taking advantage of the latest opportunities to save big. One of the most effective strategies? Bundling your home and car insurance.

By combining these two essential policies, you can unlock a treasure trove of benefits, from substantial cost savings to streamlined management. As The Insurance Guru, I’ve helped countless clients navigate the world of insurance bundles, and I’m here to share my insider tips and tricks with you.

First and foremost, let’s talk numbers. Bundling your home and auto insurance can lead to an average savings of 10-20% on your total premium. That’s a significant chunk of change that can go towards other important financial goals, like saving for a down payment on a new home or taking that dream vacation.

But the perks of bundling go beyond just the bottom line. When you consolidate your policies under a single provider, you’ll enjoy the convenience of a one-stop-shop for all your insurance needs. Imagine having a dedicated customer service team that knows your unique situation and can provide personalized support whenever you need it.

Of course, finding the perfect home car insurance bundle isn’t as simple as just signing up with the first provider that offers a discount. You need to do your homework, compare quotes, and ensure that the coverage levels meet your specific requirements.

That’s where I come in. As an experienced insurance guru, I’ve mastered the art of navigating the market and identifying the most lucrative bundling opportunities. Whether you’re a first-time homeowner or a seasoned driver, I can guide you through the process of finding the right insurer and maximizing your savings.

One of the key strategies I recommend is to leverage online comparison tools. These powerful platforms allow you to input your details just once and receive multiple quotes from top-rated insurers. This makes it easy to apples-to-apples comparison, ensuring you don’t miss out on any hidden discounts or coverage gaps.

But the work doesn’t stop there. Once you’ve found your ideal bundle, it’s important to stay proactive and continue reviewing your policies on a regular basis. Life is full of unexpected twists and turns, and your insurance needs can change just as quickly. By conducting an annual review, you can make sure you’re always getting the best deal and the coverage you need.

And let’s not forget the art of negotiation. Insurance companies often have some wiggle room when it comes to pricing, and a little friendly discussion can go a long way. Don’t be afraid to chat with a representative about potential discounts or ways to lower your premiums. You’d be surprised by how much you can save simply by asking the right questions.

So, there you have it, my friends. Bundling your home and car insurance is a surefire way to unlock massive savings and simplify your life. By following the strategies I’ve outlined, you’ll be well on your way to finding the perfect insurance bundle and keeping more of your hard-earned cash in your pocket.

What are you waiting for? Get out there and start exploring your options for a home car insurance bundle that works for you. Trust me, your wallet (and your future self) will thank you. Happy bundling!