As an insurance expert, I understand the importance of getting the right coverage at the most competitive rates, especially as the cost of living continues to rise. Whether you’re a homeowner, renter, or driver, finding the perfect home and car insurance policies can make a significant difference in your household budget. This guide will walk you through the process of obtaining personalized home and car insurance quotes, leveraging bundling discounts, and selecting reputable insurance providers to ensure you get the protection you need at the lowest possible cost.

Understanding Your Insurance Needs

Before we dive into the quote-gathering process, it’s crucial that you have a clear understanding of the coverage you require for both your home and your vehicle. Homeowners insurance typically includes protection for your dwelling, personal belongings, liability, and additional living expenses in the event of a covered loss. On the other hand, auto insurance provides coverage for your vehicle, liability in case of an accident, and optional features like collision, comprehensive, and uninsured/underinsured motorist protection.

The cost of your home and car insurance premiums can be influenced by a variety of factors, including your location, age, driving record, credit score, the value of your home, and the make and model of your vehicle. By understanding these key variables, you’ll be better equipped to assess your insurance needs and find the most suitable policies.

Homeowners Insurance Coverage

Homeowners insurance is designed to safeguard your investment in your home and provide financial assistance in the event of unexpected circumstances. The primary components of homeowners insurance include:

-

Dwelling Coverage: This coverage protects the structure of your home against risks such as fire, wind, hail, and vandalism. It’s crucial to ensure that this coverage reflects the current market value of your home and any recent improvements you’ve made.

-

Personal Property Coverage: This coverage protects your personal belongings, such as furniture, electronics, and clothing, from theft or damage. It’s important to take a comprehensive inventory of your possessions to determine the appropriate level of coverage.

- Liability Coverage: This coverage protects you from legal claims resulting from injuries or damages that occur on your property. For example, if a guest slips and falls in your home, liability coverage can help cover their medical expenses and legal fees.

- Additional Living Expenses (ALE): If your home becomes uninhabitable due to a covered loss, ALE coverage can help cover your temporary living expenses, such as hotel bills and restaurant meals.

Auto Insurance Coverage

Auto insurance is essential for safeguarding yourself and your vehicle on the road. Here are the main types of coverage to consider:

- Liability Coverage: This coverage is required by law in most states and protects you from financial liability for damages you cause to other vehicles and property in an accident. It also covers medical expenses for injuries to others.

-

Collision Coverage: This coverage pays for damages to your vehicle resulting from a collision with another vehicle or object, regardless of fault.

-

Comprehensive Coverage: This coverage protects your vehicle from non-collision-related damages, such as theft, vandalism, or natural disasters.

-

Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage to pay for your damages.

By understanding the specific coverage options available, you can tailor your policies to fit your needs and ensure that your assets are adequately protected.

Comparing Home and Car Insurance Quotes

In today’s digital age, there are numerous ways to obtain home and car insurance quotes. The most convenient option is to use online quote tools, which allow you to input your information and receive personalized quotes from multiple insurers. However, it’s important to remember that online quotes may not always provide the most accurate or complete picture of your insurance needs. Complementing your online research with phone or in-person consultations with insurance agents can help ensure you’re getting the most comprehensive and competitive quotes.

How to Obtain Quotes

When seeking home and car insurance quotes, consider the following methods:

- Online Quote Tools: Many insurance companies offer online platforms where you can input your details and receive instant quotes. This is a quick way to compare multiple insurers at once.

-

Phone Quotes: Calling insurance agents can provide you with personalized service and the opportunity to ask questions. Agents can clarify coverage options and help you understand the details of your quotes.

-

In-Person Consultations: Meeting with an agent in person can be beneficial if you prefer face-to-face interactions. This allows for a more thorough discussion of your insurance needs and preferences.

Tips for Accurate Quotes

When comparing quotes, be sure to provide accurate and complete information to ensure you’re getting the most accurate estimates. This includes details about your home, such as its age, square footage, and construction materials, as well as information about your vehicle, including the make, model, year, and intended use. Additionally, be sure to compare apples to apples by ensuring the coverage levels are consistent across all the quotes you’re considering.

-

Consistency: Ensure that each quote includes the same coverage limits and deductibles to make a fair comparison.

-

Discounts: Inquire about any available discounts, such as those for bundling policies, being claims-free, or having safety features installed.

-

Review Policy Details: Look beyond the premium cost and examine policy details, including exclusions, coverage limits, and the claims process.

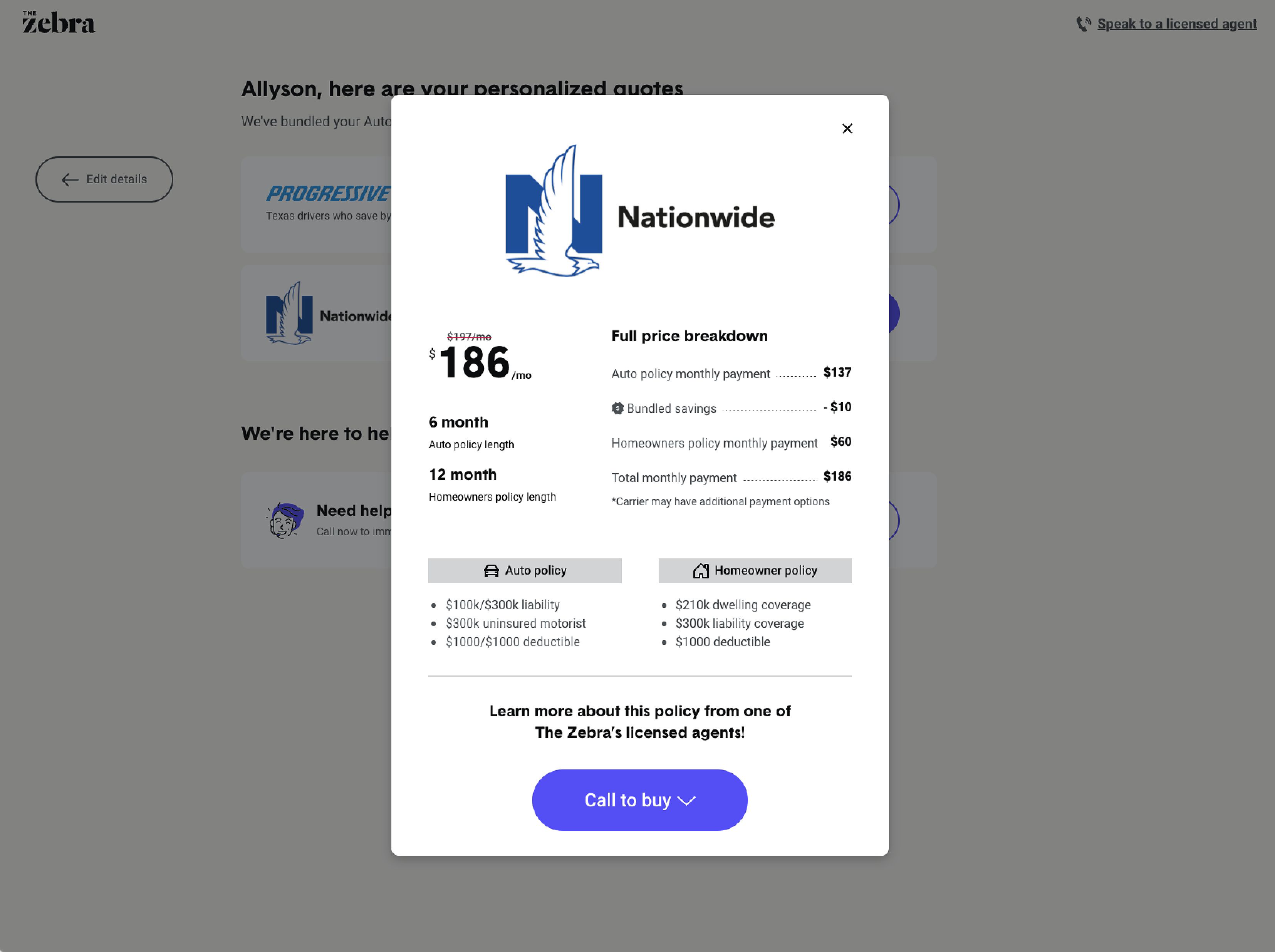

Leveraging Bundling Discounts

One of the most effective ways to save money on home and car insurance is to bundle your policies with a single insurance provider. Many insurers offer significant discounts, often ranging from 5% to 20% or more, for customers who choose to combine their home and auto insurance policies. This not only provides cost savings but also simplifies the management of your insurance policies, as you’ll have a single point of contact and a unified billing system.

Benefits of Bundling

Bundling your home and car insurance offers several advantages:

-

Cost Savings: By combining policies, you can often secure lower rates compared to purchasing them separately. This can lead to substantial savings over time.

-

Convenience: Managing multiple policies through one provider streamlines the process of making payments, filing claims, and updating coverage. It can save you time and reduce the hassle of dealing with different companies.

-

Improved Customer Service: Having a single insurer can lead to better customer service, as your agent will have a comprehensive view of your insurance needs and history.

Finding the Best Bundling Deals

When exploring bundling options, be sure to compare the bundled rates with quotes for individual home and auto policies from multiple providers. While bundling can be a great way to save, it’s important to ensure that the discounted rate you’re receiving is still competitive and provides the coverage you need. Don’t be afraid to shop around and negotiate with insurers to find the best possible deal.

-

Research Multiple Insurers: Not all insurance companies offer the same bundling discounts, so it’s worth checking various providers to find the best deal.

-

Ask About Additional Discounts: Some insurers may offer extra discounts if you have certain safety features in your home or car, or if you pay your premium in full.

-

Review Policy Terms: Ensure that bundling does not limit your coverage options or restrict your choice of insurers.

Choosing the Best Insurance Company

With so many insurance providers to choose from, it can be challenging to determine which one is the best fit for your needs. When selecting an insurance company, I consider factors such as financial stability, customer service, and claims handling. Look for insurers with strong ratings from independent agencies and read online reviews to gauge customer satisfaction.

Factors to Consider

-

Financial Stability: Research the financial strength of potential insurers through ratings from agencies like AM Best or Standard & Poor’s. A financially stable company is more likely to meet its obligations in the event of a claim.

-

Customer Service: Look for companies known for excellent customer service. Reading reviews and asking friends or family for recommendations can provide insight into the experiences of others.

-

Claims Handling: Investigate the claims process for each insurer. Companies with a reputation for efficient claims handling can save you time and stress when you need to file a claim.

Compelling Examples and Case Studies

Many satisfied customers have shared their experiences with various insurance companies. For example, one homeowner reported saving hundreds of dollars by bundling their home and auto insurance with a reputable provider. They praised the insurer’s customer service and quick claims response, which made a significant difference during a stressful time.

Tips for Saving Money on Home and Car Insurance

Beyond bundling, there are several other strategies you can employ to lower your home and car insurance premiums:

-

Improve Your Credit Score: A higher credit score can lead to significant savings on your insurance rates. Paying bills on time and reducing debt can improve your score over time.

-

Increase Your Deductible: Raising your deductible can lower your monthly premiums, but be sure you have the financial resources to cover the higher out-of-pocket costs if you need to file a claim.

-

Install Safety Features: Outfitting your home and car with security systems, smoke detectors, and other safety features can qualify you for additional discounts.

-

Avoid Filing Unnecessary Claims: Maintaining a clean claims history can help you avoid rate hikes and keep your premiums low. Consider paying for minor repairs out of pocket rather than filing a claim.

-

Regularly Review Your Policies: As your life circumstances change, so do your insurance needs. Regularly reviewing your policies can help you identify areas where you can save money or improve coverage.

By considering these tips and exploring all your options, you can ensure you’re getting the best possible value for your home and car insurance dollars.

Frequently Asked Questions

Q: How often should I compare insurance quotes?

A: It’s a good idea to compare home and car insurance quotes at least every 12-24 months, as rates can change frequently due to market conditions and other factors.

Q: What is a good credit score for insurance?

A: Generally, the higher your credit score, the better your insurance rates will be. Aim for a credit score of at least 700 to qualify for the most favorable insurance premiums.

Q: What if I have a poor driving record?

A: If you have a history of accidents or traffic violations, you may face higher car insurance rates. Consider taking a defensive driving course to help improve your driving record and potentially lower your premiums.

Q: What is the best way to get an insurance quote?

A: The best approach is to use a combination of online quote tools, phone calls, and in-person consultations with insurance agents. This multi-pronged strategy can help you obtain the most comprehensive and accurate quotes.

Conclusion

As an insurance expert, I understand the importance of finding the right home and car insurance policies at the most competitive rates. By taking the time to understand your coverage needs, comparing quotes from multiple providers, leveraging bundling discounts, and choosing a reputable insurance company, you can save hundreds or even thousands of dollars each year on your home and auto insurance premiums.

Remember, getting the best quotes is not a one-time event. It’s an ongoing process that requires regular review and adjustment as your circumstances change. Start your search for the perfect home and car insurance policies today, and enjoy the peace of mind that comes with knowing you’re protected without overpaying.