As the Insurance Maven, I’m here to share my expertise and insights to help you, the first-time homebuyer, navigate the world of home and auto insurance. I understand the excitement and uncertainty that comes with taking that big step into homeownership, but don’t worry – I’ve got your back.

When you become a homeowner, you’re making a significant investment, and protecting that investment should be a top priority. Homeowners insurance can provide coverage for the structure of your home, your personal belongings, and even liability in case of accidents or incidents on your property. Meanwhile, car insurance is not only required by law but also essential in safeguarding your financial well-being in the event of a collision or other vehicle-related incident.

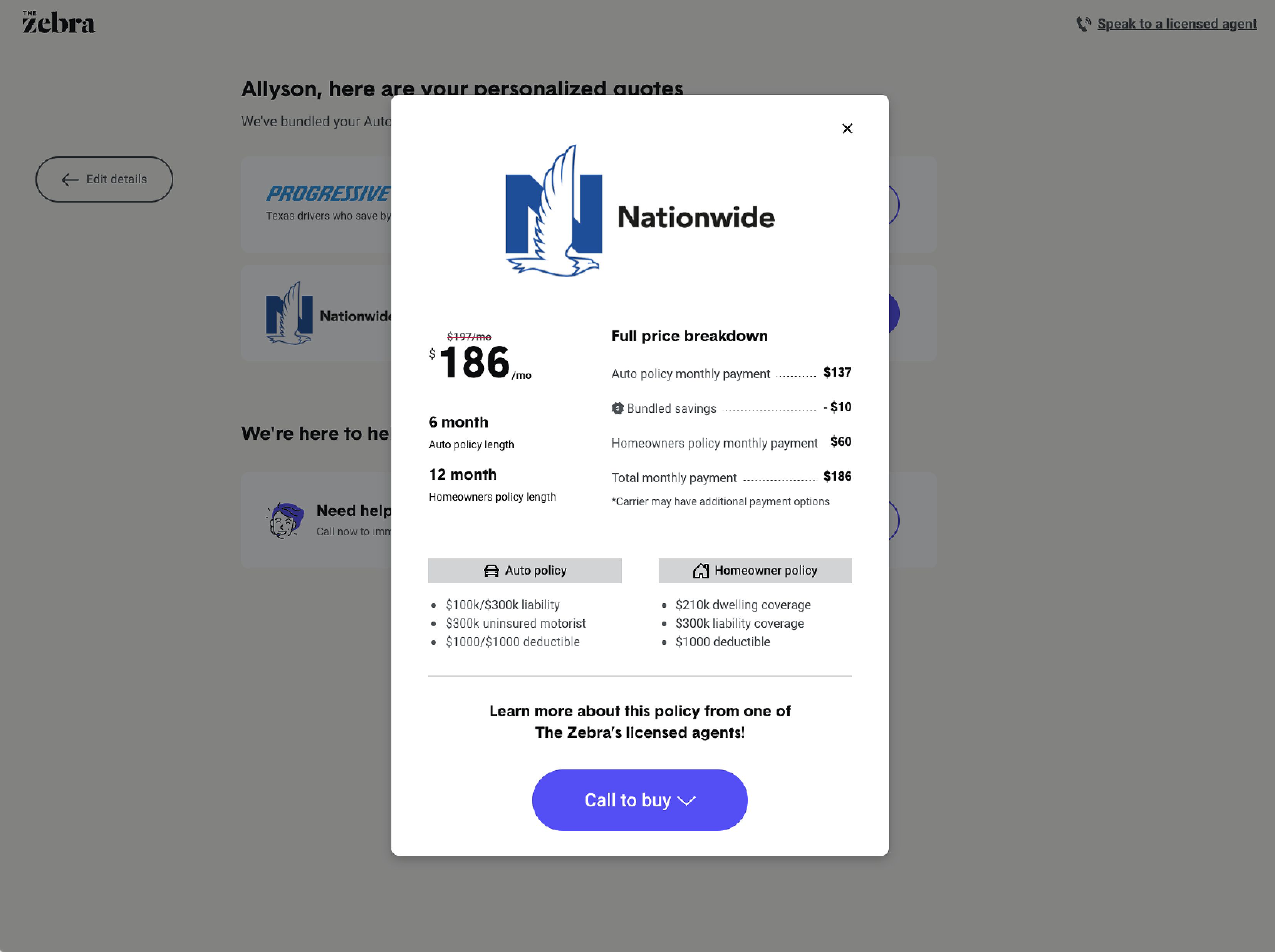

As a savvy first-time homebuyer, you can take advantage of bundling your home and auto insurance policies, which may lead to discounts and streamlined policy management. Imagine the peace of mind of knowing that you’ve protected your investment and your family’s financial security, all while potentially saving hundreds or even thousands of dollars each year. To get started, you can explore home and auto insurance quotes from various providers to compare coverage options and pricing. That’s the power of bundling your policies, and I’m here to show you how to make it happen.

Understanding Home and Auto Insurance Quotes

Insurance quotes are the estimated costs of your coverage, and they can vary based on a variety of factors. When it comes to homeowners insurance, your location plays a significant role, as insurers consider factors like natural disaster risk, crime rates, and proximity to fire hydrants. The age and condition of your home, as well as the coverage levels you select, can also impact your premiums.

For car insurance, your driving record is a crucial factor, as a clean history can lead to lower rates. The type of vehicle you drive, including its make, model, and safety features, also affects your car insurance costs. Your location, again, can play a role, as insurers consider factors like traffic density, crime rates, and weather conditions in the area.

It’s important to understand that the insurance industry is constantly evolving, and the factors that influence your home and auto insurance quotes can change over time. That’s why it’s crucial for you, as a first-time homebuyer, to stay informed and regularly review your coverage to ensure you’re getting the best deal.

How to Get the Best Home and Auto Insurance Quotes

To ensure you’re getting the best deals on your home and auto insurance, consider the following strategies:

Shop Around

Don’t settle for the first quote you receive. Use online comparison tools or work with an independent insurance agent to obtain quotes from multiple providers. This allows you to compare options and find the most competitive rates. Remember, the insurance market is constantly changing, so it’s essential to shop around regularly to ensure you’re still getting the best deal.

Bundle Home and Auto Insurance

Bundling your home and auto insurance policies with the same provider can potentially lead to significant savings, often in the range of 10% or more. However, be sure to compare the bundled rate to the non-bundled rates from other insurers to ensure you’re getting the best deal. Some insurers may offer even higher discounts for bundling, so it’s worth exploring this option.

Ask About Discounts

Insurance companies often offer a variety of discounts, such as those for good driving records, safety features in your home or car, and even being a first-time homebuyer. Make sure to inquire about any discounts you may be eligible for to maximize your savings. Some insurers may also offer discounts for being a member of certain organizations or professional associations, so be sure to ask about those as well.

Consider Your Needs

When comparing quotes, focus on finding the coverage levels that best suit your specific needs and budget. Avoid the temptation to overspend on unnecessary coverage, but also make sure you have adequate protection for your home and vehicle. This means carefully evaluating the coverage limits, deductibles, and any exclusions in your policy.

Common Mistakes to Avoid When Getting Home and Auto Insurance Quotes

As a first-time homebuyer, it’s important to be aware of some common pitfalls to avoid when seeking insurance quotes:

Settling for the First Quote

Don’t assume the first quote you receive is the best option. Take the time to shop around and compare quotes from multiple insurers to ensure you’re getting the most competitive rate. The insurance market can be quite dynamic, with companies constantly adjusting their rates and offerings, so it’s essential to explore your options thoroughly.

Ignoring Discounts

Don’t overlook potential discounts that could save you money. Be sure to ask about any available discounts, even if you don’t see them listed upfront. Insurers may offer a variety of discounts for things like bundling, safety features, or even your occupation or professional affiliations.

Underestimating Coverage Needs

It’s essential to have adequate coverage to protect your home and car. Avoid the temptation to underinsure in an effort to save money, as this could leave you vulnerable to significant out-of-pocket expenses in the event of a claim. Take the time to carefully evaluate your coverage needs and ensure you have the right level of protection.

Tips for First-Time Homebuyers

As you navigate the process of obtaining home and auto insurance quotes, consider the following tips:

Get Pre-Approved for a Mortgage

Before shopping for insurance, it’s a good idea to get pre-approved for a mortgage. This will give you a clear understanding of your budget, which can help you determine the appropriate coverage levels for your home and car. Knowing your budget upfront can also help you make informed decisions when comparing insurance quotes.

Review Your Existing Car Insurance

If you already have an auto insurance policy, take the time to review it and consider whether you can bundle it with your new homeowners insurance to maximize your savings. Keep in mind that your existing policy may need to be updated or adjusted to reflect your new home and location.

Understand Your Policy

Carefully read and understand the details of your insurance policy, including the coverage limits, deductibles, and any exclusions. This will help you avoid surprises down the line and ensure you have the right level of protection for your needs.

Ask Questions

Don’t hesitate to reach out to your insurance agent or representative if you have any questions or concerns about your home or auto insurance coverage. They can provide valuable guidance to ensure you make the best decisions for your needs. Remember, insurance can be complex, so don’t be afraid to ask for clarification or additional information.

FQAs

Q: What is a deductible, and how does it affect my insurance premiums?

A: A deductible is the amount you’ll need to pay out-of-pocket before your insurance coverage kicks in. Generally, the higher your deductible, the lower your insurance premiums will be. However, you’ll want to choose a deductible that you can comfortably afford in the event of a claim. For example, if you have a $1,000 deductible and your home sustains $5,000 in damage, you would pay the first $1,000, and your insurance would cover the remaining $4,000.

Q: What is liability coverage, and why is it important?

A: Liability coverage protects you from financial responsibility if you’re found legally liable for an accident or incident that causes injury or damage to someone else. This coverage can help cover the costs of medical expenses, property damage, and even legal fees, making it an essential component of both homeowners and auto insurance. Without liability coverage, you could be personally responsible for these costs, which could potentially put your financial well-being at risk.

Q: How do I know if I have enough insurance coverage?

A: When determining the appropriate coverage levels, consider the value of your home, your personal belongings, and the potential risks you may face. Your insurance agent can provide guidance on the recommended coverage amounts to ensure you have adequate protection for your specific situation. It’s important to review your coverage regularly, as your needs may change over time, such as when you acquire new valuable items or make home improvements.

Conclusion

As a first-time homebuyer, navigating the world of home and auto insurance can be daunting, but with the right information and strategies, you can find the coverage you need at a competitive price. By understanding the factors that affect your insurance quotes, exploring bundling options, and avoiding common mistakes, you can protect your investment and enjoy the peace of mind that comes with being a homeowner.

Remember, the insurance industry is constantly evolving, so it’s crucial for you, as the Insurance Maven, to stay informed and regularly review your coverage to ensure you’re getting the best deal. Start getting quotes today and take the first step toward a secure financial future. With the right insurance in place, you can focus on the exciting journey of homeownership and all the memories you’ll create in your new home.