Homeownership is an exciting milestone, but it also comes with a whole new set of responsibilities. One of the most crucial tasks is ensuring you have the right insurance coverage to protect your investment and your wheels. But let’s be honest, navigating the world of home and auto insurance can feel like wading through a maze of jargon and complicated policies.

Fear not, my fellow first-time homebuyers! In this comprehensive guide, we’re going to uncover the secrets to getting the best home and auto insurance quote tailored just for you. We’ll dive into the nitty-gritty of homeowners and auto insurance, explore the power of bundling, and share our top insider tips to save you a bundle.

Unveiling the Essentials of Homeowners Insurance

Your home is likely the biggest investment you’ll ever make, so protecting it should be a top priority. Homeowners insurance is the shield that safeguards your castle against unexpected events, from natural disasters to theft and vandalism.

But what exactly does homeowners insurance cover? Glad you asked! A standard policy typically includes:

- Dwelling Coverage: This safeguards the physical structure of your home, including the roof, walls, and foundation, in case of covered perils like fire, wind, or hail damage.

- Personal Property Coverage: This has your back when it comes to replacing or repairing your personal belongings, from furniture and electronics to your favorite pair of jeans.

- Liability Coverage: This protects you if someone is injured on your property or if you’re held responsible for damaging someone else’s stuff.

- Additional Living Expenses: If your home becomes unlivable due to a covered event, this coverage can help pay for temporary living expenses, like hotel stays or restaurant meals.

Now, you might be wondering, “Why is homeowners insurance even required?” Well, most mortgage lenders won’t even consider your loan application without proof of adequate coverage. Failing to secure the right policy could leave you on the hook for costly repairs or replacements, potentially leading to financial disaster. It’s a non-negotiable step in the homebuying process.

Navigating the Auto Insurance Landscape as a New Homeowner

As a freshly-minted homeowner, your auto insurance needs may have changed. It’s time to review your coverage and ensure you’re getting the best protection for your wheels and your ever-growing financial responsibilities.

One of the key things to consider is how your new homeowner status can impact your auto insurance rates. Many insurers offer discounts to homeowners, as they’re often viewed as more financially responsible. However, you might also need to increase your liability coverage to reflect your enhanced assets and potential liabilities.

When shopping for auto insurance, make sure to look into the following essential coverages:

- Liability Coverage: This shields you if you cause an accident that damages someone else’s property or injures them. With your growing assets as a homeowner, you’ll want to make sure you have adequate liability limits.

- Collision Coverage: This covers the cost of repairing your vehicle if you’re in an accident, regardless of who’s at fault.

- Comprehensive Coverage: This protects your car against non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage has your back if you’re involved in an accident with a driver who has insufficient or no insurance.

The Dynamic Duo: Bundling Home and Auto Insurance

Now, let’s talk about the secret sauce to saving money on your insurance coverage: bundling. Yep, that’s right — by insuring both your home and your car with the same provider, you can unlock some serious discounts.

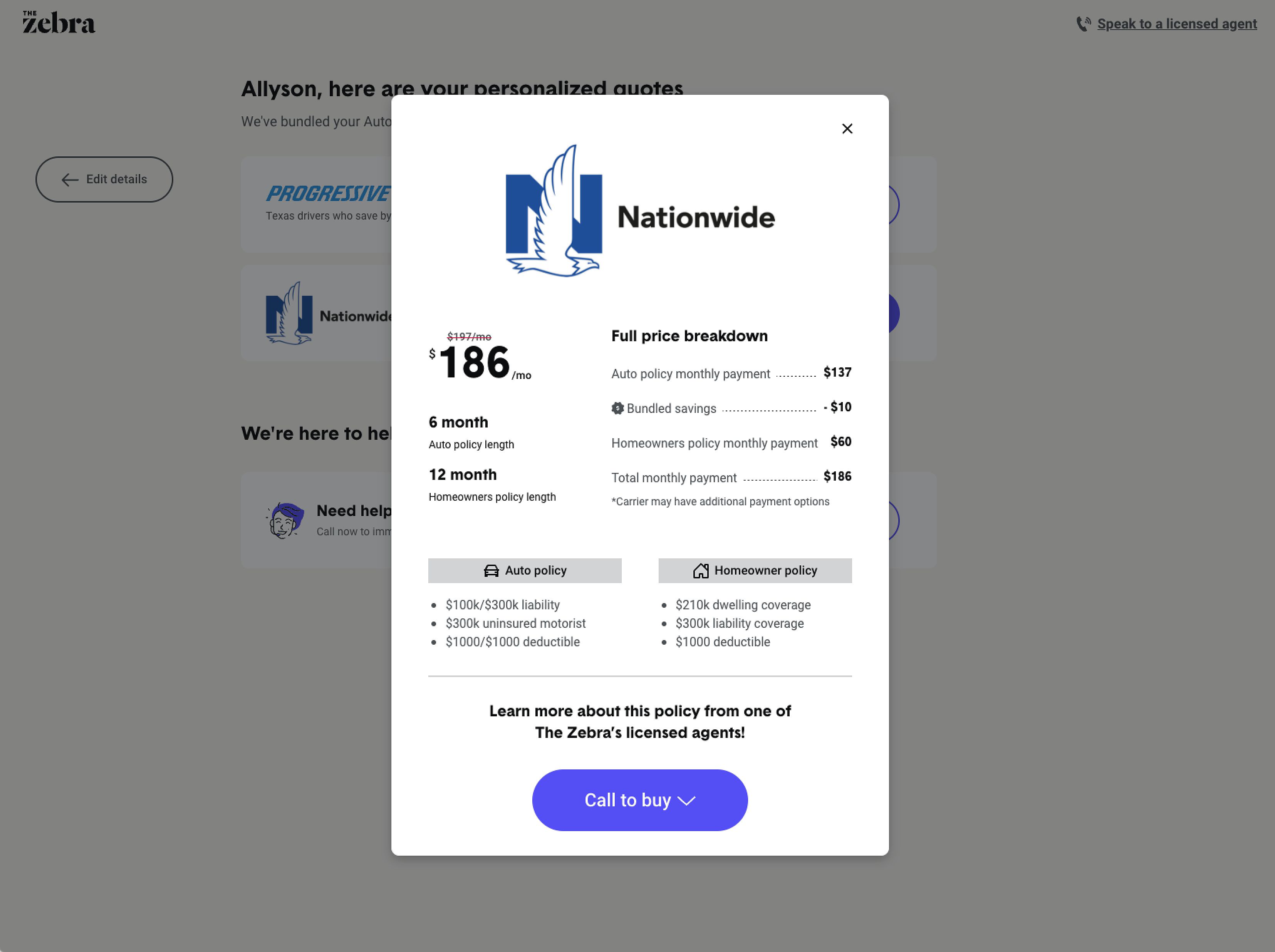

According to industry data, homeowners who bundle their home and auto insurance policies can save an average of 10% or more on their premiums. That’s hundreds of dollars in annual savings — a no-brainer for first-time homebuyers like you.

Beyond the cost savings, bundling your policies also streamlines your insurance management. Imagine dealing with just one billing cycle, one claims process, and one point of contact for any updates or changes to your coverages. It’s a recipe for convenience and stress-free insurance management.

The Art of Finding the Perfect Home and Auto Insurance Quote

Okay, let’s get down to business. How do you actually find the best “home and auto insurance quote” for your unique needs? Well, my friends, it’s all about doing your homework and exploring your options.

One of the most efficient ways to compare quotes is to use online quote comparison tools. These nifty platforms allow you to input your information and receive personalized quotes from a variety of insurers in just a few clicks. Websites like The Zebra, Policygenius, and Insurance.com are great places to start your search.

But don’t just stop there. Working with a local insurance agent can also be incredibly valuable. These experts have an in-depth understanding of the insurance industry and can provide personalized guidance to help you navigate the quote process and choose the right coverage.

Insider Tips to Score the Best Deal

Now, let’s dive into our top secret tips to help you get the best possible “home and auto insurance quote”:

- Improve Your Credit Score: Insurance companies often use your credit score as a factor in determining your rates. Keep that score shining, and you could qualify for lower premiums on both your home and auto policies.

- Invest in Safety Features: Many insurers offer discounts for homes equipped with security systems, smoke detectors, and other safety features. Adding these upgrades can help you save a bundle on your homeowners insurance.

- Shop Around Regularly: Insurance rates can change over time, so it’s important to periodically review your coverage and compare quotes to ensure you’re still getting the best deal. Set a reminder to shop around at least once a year.

The Power of Bundling: Unlocking Savings and Convenience

One of the best ways to maximize your savings on home and auto insurance is by bundling your policies. When you insure both your home and your car with the same provider, you can unlock some truly impressive discounts.

According to industry data, homeowners who bundle their policies can save an average of 10% or more on their premiums. That’s hundreds of dollars in annual savings — a game-changer for first-time homebuyers like you.

But the benefits of bundling go beyond just the cost savings. By consolidating your coverage with a single insurer, you’ll also enjoy the convenience of simplified management. Imagine dealing with just one billing cycle, one claims process, and one point of contact for any updates or changes to your policies. It’s a recipe for stress-free insurance bliss.

Maximizing Your Savings with Discounts

In addition to bundling your home and auto insurance, there are other ways to save money on your premiums. Look for discounts offered by your insurance provider, such as:

- Loyalty Discounts: If you’ve been with the same insurance company for several years, you may qualify for a loyalty discount.

- Claims-Free Discounts: Maintaining a claims-free record can also earn you a discount on your premiums.

- Safety Feature Discounts: Installing security systems, smoke detectors, or other safety features in your home can help you save on your homeowners insurance.

FAQ

Q: What factors affect my homeowners insurance premium? A: Your home’s value, location, coverage level, and claims history are all factors that can influence your homeowners insurance premium.

Q: What should I do if I have a claim on my homeowners insurance? A: If you need to file a homeowners insurance claim, contact your insurance company immediately to report the incident and follow their instructions for the claims process.

Q: How can I save money on my auto insurance? A: You can save money on auto insurance by bundling your policies, maintaining a good driving record, and taking advantage of discounts for safety features and driver training courses.

Conclusion: Unlocking the Key to Insurance Bliss

Phew, that was a lot of information to digest, but you made it! Now you’re armed with the knowledge to navigate the world of home and auto insurance like a true pro.

Remember, the key to finding the best “home and auto insurance quote” is to do your research, explore your options, and take advantage of every available discount. Bundling your policies, investing in safety features, and maintaining a healthy credit score can all help you save a substantial amount on your premiums.

So, what are you waiting for? It’s time to unlock the secrets to insurance bliss and protect your home and wheels with the perfect coverage. Happy hunting, my fellow homebuyers — may the insurance gods be ever in your favor!