As a seasoned freelance professional, I understand the unique challenges and uncertainties that come with navigating the world of independent work. Whether you’re a graphic designer, a web developer, or a marketing consultant, your business relies on building trust and delivering exceptional results for your clients. However, even the most meticulous and cautious among us face the occasional unexpected accident or legal hurdle that could jeopardize everything we’ve worked so hard to achieve.

That’s where general liability insurance online comes into play — providing the essential coverage and peace of mind you need to focus on growing your freelance empire. As a fellow freelancer, I’ve witnessed firsthand the devastating financial consequences that can arise from a simple mishap, such as accidentally damaging a client’s property or a third party suffering an injury on your worksite. Without the right insurance coverage, you could be left responsible for the costly consequences, potentially leading to financial ruin.

Understanding the Importance of General Liability Protection

General liability insurance is designed to cover common business risks, including third-party bodily injury, property damage, and personal/advertising injury. Imagine a scenario where you’re setting up for a client’s event, and you accidentally knock over a valuable vase, causing significant damage. Or perhaps a client trips over a loose wire in your workspace and sustains an injury. In these instances, your general liability policy can step in to cover the medical expenses, legal fees, and any settlements or judgments that may arise.

The financial implications of these types of incidents can be devastating, especially for freelancers and independent contractors who often operate on tighter budgets. In fact, studies show that nearly half of all freelancers and independent contractors in the United States are currently uninsured, putting their personal assets at serious risk.

The Convenience of Securing General Liability Insurance Online

Fortunately, the advent of online insurance platforms has made it easier than ever for freelancers like us to secure comprehensive general liability protection. By exploring your options online, you can quickly compare quotes from multiple providers, customize your coverage to meet your specific needs, and even purchase a policy in as little as 24 hours.

One of the key benefits of finding general liability insurance online is the ability to easily compare quotes and coverage options. Rather than having to schedule in-person meetings or navigate complex paperwork, you can simply fill out a single application and receive multiple quotes from top-rated insurance providers. This allows you to make an informed decision, balancing your coverage needs with your budget.

Additionally, many online insurance platforms specialize in policies tailored for freelancers and independent contractors, ensuring you can select the right coverage limits, deductibles, and endorsements to meet the unique requirements of your business. This personalized approach can provide you with the protection you need without breaking the bank.

Building Client Confidence and Meeting Requirements

Obtaining general liability insurance online not only safeguards your personal assets but also demonstrates your professionalism and commitment to responsible business practices. Many clients, especially in industries like construction, food service, and event planning, require freelancers and contractors to have general liability coverage before awarding a contract. By being able to provide proof of insurance, you instantly become a more attractive candidate for lucrative projects, setting you apart from the competition.

Furthermore, the peace of mind that comes with having general liability coverage can be invaluable. Instead of constantly worrying about the financial risks associated with potential accidents or lawsuits, you can focus your energy on growing your freelance business and delivering exceptional results for your clients.

Protecting Your Freelance Hustle

While general liability insurance is the foundation of protection for your freelance business, there may be additional coverages you should consider to build a comprehensive insurance portfolio. As a freelance professional, you may also benefit from:

- Product Liability Insurance: Protects against claims related to defective products or services you provide.

- Professional Liability Insurance (E&O): Safeguards you against allegations of negligence, mistakes, or failure to perform your professional services as expected.

- Cyber Liability Insurance: Shields your business from the financial consequences of data breaches, cyber attacks, and other digital risks.

By exploring these supplementary policies, you can tailor your insurance coverage to address the unique risks and liabilities associated with your freelance work, providing an even stronger layer of protection.

Securing Your Proof of Coverage

Obtaining and maintaining a Certificate of Insurance (COI) is a crucial step in the freelance insurance journey. This document serves as proof of your general liability coverage and is often required by clients before awarding a contract. When you purchase a policy online, your insurance provider will typically issue a COI that you can easily access and share with your clients.

It’s essential to keep your COIs organized, both electronically and physically, and to review them for accuracy before submitting them to clients. Remember to update your COI whenever your policy is renewed or modified to ensure you’re always providing current information.

Finding Affordable General Liability Insurance for Freelancers

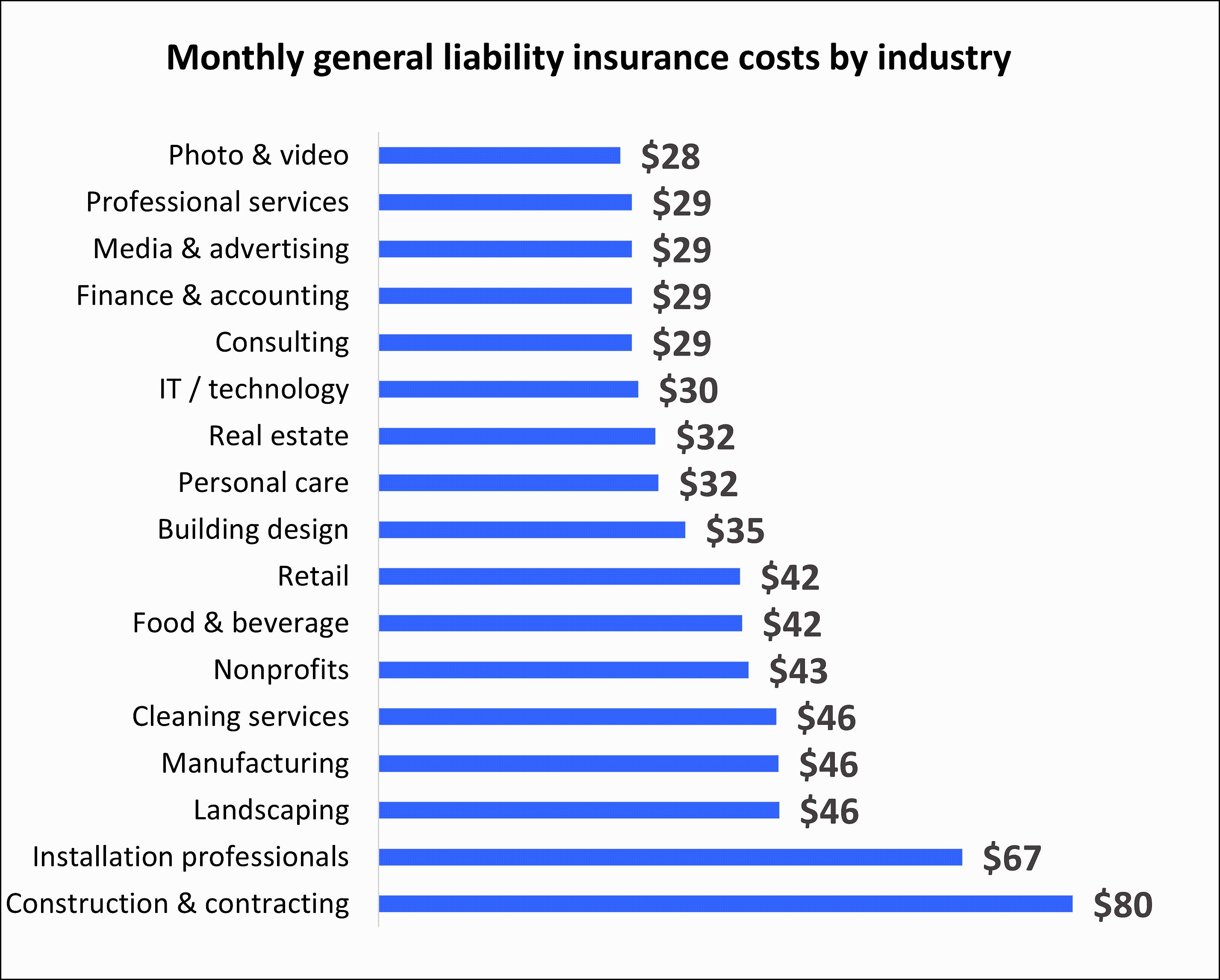

The cost of general liability insurance for freelancers can vary depending on several factors, such as your industry, coverage limits, and location. However, with the convenience of online insurance platforms, you can often find affordable options that fit within your budget.

In fact, policies can start as low as $21.25 per month, making general liability coverage accessible for freelance businesses of all sizes. While it may be tempting to opt for the minimum coverage, it’s important to carefully consider the potential financial consequences of a claim and choose limits that adequately protect your livelihood.

Staying Ahead of the Curve

As a forward-thinking freelance professional, I’m always on the lookout for ways to enhance my business and stay ahead of the curve. That’s why, in July 2024, I decided to take a deeper dive into the world of general liability insurance online.

After researching various providers and coverage options, I settled on a comprehensive policy that not only met my basic needs but also provided additional protection for my specialized services. By bundling my general liability coverage with product liability and professional liability insurance, I was able to create a robust insurance portfolio that gave me the confidence to take on more ambitious projects without worrying about the potential risks.

One of the biggest game-changers for me was the seamless online experience provided by the insurance platform I chose. Instead of spending hours on the phone or shuffling through paperwork, I was able to compare quotes, customize my coverage, and even obtain a Certificate of Insurance — all within a matter of minutes. This convenience allowed me to focus on what I do best: delivering exceptional results for my clients.

FAQ

Q: How much does general liability insurance for freelancers cost?

A: The cost of general liability insurance for freelancers can vary depending on factors such as your industry, coverage limits, and risk profile. However, many online insurance platforms offer affordable options, with policies starting as low as $21.25 per month.

Q: Is general liability insurance required for all freelancers?

A: While general liability insurance is not always legally required, it is highly recommended for freelancers and independent contractors. Many clients will not work with you unless you have proof of coverage, and the potential financial consequences of an accident or lawsuit can be devastating without this protection.

Q: What happens if I have a claim?

A: If you need to file a general liability claim, contact your insurance provider immediately. They will guide you through the claims process and ensure your coverage responds to the incident, helping to protect your business and personal assets.

Conclusion

As a freelance professional, your work is the foundation of your livelihood and the key to your long-term success. Investing in general liability insurance online is an essential step in safeguarding your operations and providing the peace of mind you need to focus on growth and innovation.

By securing comprehensive coverage and meeting client requirements, you can demonstrate your professionalism, build trust, and position your freelance business for long-term success. Don’t wait until it’s too late — explore your options for affordable general liability insurance online today and take the first step towards protecting the future of your freelance hustle.