As a seasoned professional in the insurance industry, I’ve seen firsthand the immense value that general liability insurance for businesses can bring, especially for those in the contracting field. In today’s litigious landscape, where the unexpected can strike at any moment, having the right coverage in place is not just a luxury — it’s a necessity.

Understanding the Risks Contractors Face

As a contractor, you navigate a complex web of risks on a daily basis. From handling sensitive client property to managing job sites teeming with potential hazards, your line of work exposes you to a myriad of liabilities. Imagine, for instance, a scenario where one of your employees accidentally causes a fire that destroys a client’s valuable equipment. Or picture a homeowner who sustains a serious injury after tripping on a loose floorboard while you’re in the middle of a renovation project. These types of incidents can quickly escalate into costly lawsuits, putting your business’s very survival at stake.

The financial repercussions of such claims can be staggering. Court-ordered judgments, legal fees, and settlement costs can easily reach into the hundreds of thousands of dollars — an astronomical sum that could cripple even the most well-established contracting company. Without the safeguard of general liability insurance, these expenses would have to be paid out of your own pocket, jeopardizing your hard-earned assets and compromising your company’s long-term viability.

The Power of General Liability Insurance for Businesses

This is where general liability insurance steps in as the cornerstone of a comprehensive risk management strategy for contractors. This essential policy acts as a protective shield, shielding your business from the financial burden of lawsuits, settlements, and judgments resulting from covered incidents. By understanding the key features and benefits of general liability insurance, you can ensure that your contracting enterprise is fortified against the unexpected.

Comprehensive Coverage for Bodily Injury and Property Damage

One of the primary advantages of general liability insurance is the coverage it provides for injuries sustained by third parties on your job site or due to your work. This includes medical expenses, lost wages, and any associated legal costs. Additionally, the policy safeguards your business from the financial impact of property damage claims, ensuring that the repair or replacement costs, as well as any related legal fees, are covered.

Image: Small business owner and agent look at insurance portfolio documents together.

Image: Small business owner and agent look at insurance portfolio documents together.

Protection Against Personal and Advertising Injury

General liability insurance also shields your contracting business from claims related to personal and advertising injury, such as libel, slander, copyright infringement, or other offenses that can arise from your marketing and promotional activities. This coverage can be particularly valuable if you engage in any form of advertising or online promotion to showcase your services.

Image: Business people smile as they discuss general liability insurance in an office.

Image: Business people smile as they discuss general liability insurance in an office.

The Power of Additional Insured Provisions

Many general liability policies include “additional insured” provisions, which extend coverage to third parties, such as your clients, when they are named as additional insureds on your policy. This can be a game-changer for contractors, as it helps protect the clients you work for from liability claims arising from your work, fostering stronger business relationships and making it easier to secure new projects.

Finding the Right Coverage for Your Contracting Business

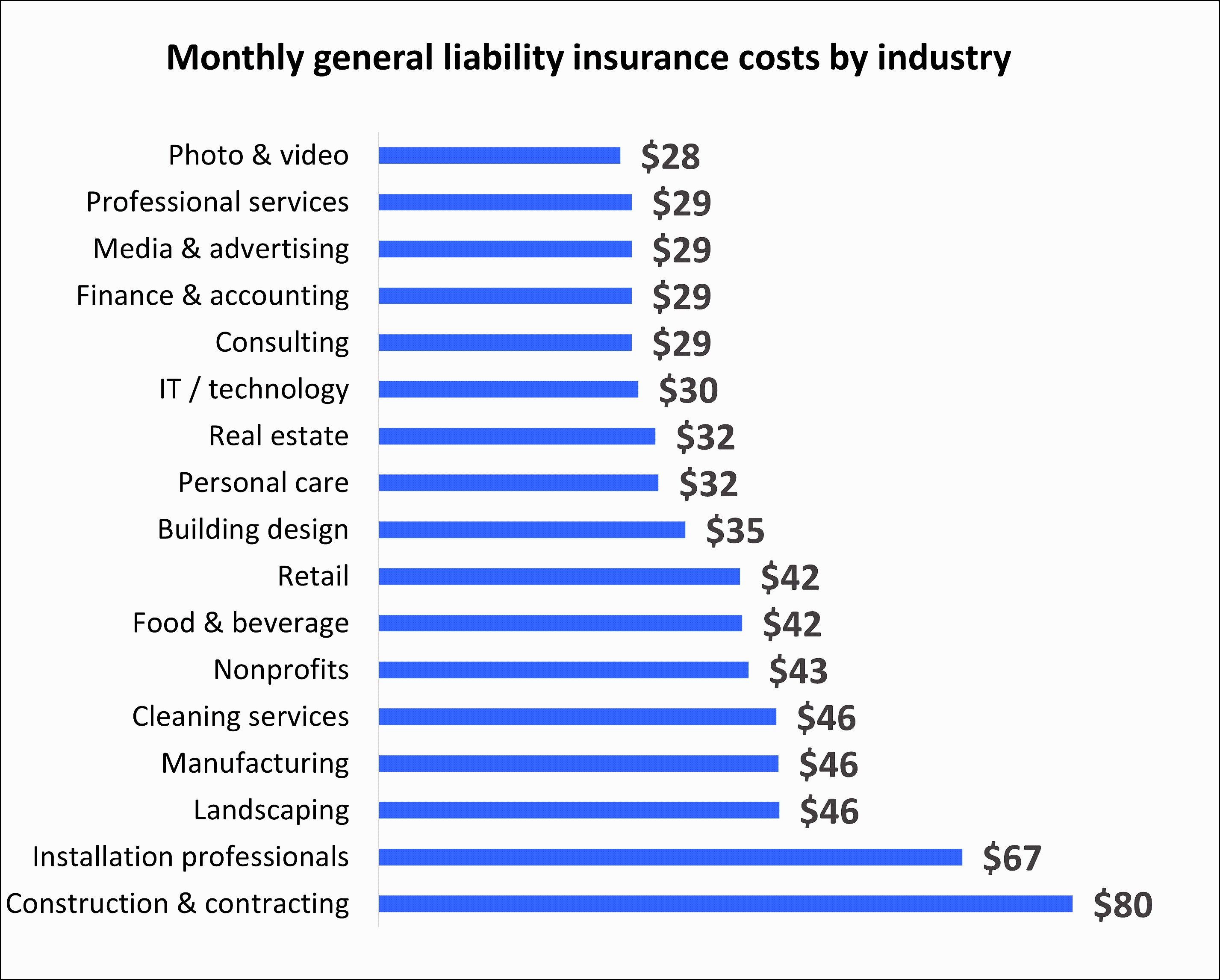

When it comes to securing the right general liability insurance for your contracting business, there are several key factors to consider. The cost of your policy can vary significantly depending on your industry, location, claims history, and the coverage limits you choose. On average, small businesses in the contracting industry pay around $42 per month, or $504 annually, for a general liability policy with $1 million per occurrence and $2 million aggregate limits.

To ensure you’re getting the most value for your money, it’s essential to shop around, compare quotes from multiple insurers, and consider bundling your general liability insurance with other policies, such as commercial property or workers’ compensation. Additionally, working with a specialist insurance broker who understands the unique needs of contractors can be invaluable in helping you identify the right coverage and customize your policy to fit your specific requirements.

Image: Average general liability insurance premium for Insureon customers by industry.

Image: Average general liability insurance premium for Insureon customers by industry.

Maintaining a Clean Claims History

Your claims history can have a significant impact on the cost and availability of your general liability insurance. Contractors with a track record of frequent or costly claims will typically pay higher premiums than those who have demonstrated a commitment to risk management and accident prevention.

Implementing comprehensive safety protocols, providing thorough employee training, and maintaining detailed records of your operations can all help to minimize the likelihood of claims and keep your insurance costs in check. By maintaining a clean claims history, you can not only secure more favorable rates, but also provide potential clients with the peace of mind that comes with working with a responsible and well-protected business partner.

The Importance of Compliance and Transparency

In addition to securing the right general liability insurance coverage, it’s crucial for contractors to stay up-to-date with the relevant state and project-specific insurance requirements. Familiarizing yourself with these regulations and ensuring you meet or exceed the necessary coverage levels can help you avoid any legal or financial penalties, while also demonstrating your commitment to responsible business practices.

Providing proof of your general liability insurance, such as a Certificate of Insurance (COI), can also be a crucial step in streamlining the contracting process. By having this documentation readily available, you can quickly and easily show potential clients that your business is properly insured, instilling confidence and opening the door to new opportunities.

Protecting Your Contracting Business in 2024

As we move into the future, the importance of general liability insurance for contractors will only continue to grow. In an increasingly litigious society, the risks you face as a contracting professional are only becoming more complex and ever-present. By investing in the right coverage today, you can safeguard your business, your assets, and your hard-earned reputation for years to come.

Don’t let the unexpected catch you off guard. Empower your contracting business with the comprehensive protection of general liability insurance, and embark on your journey with the confidence and security you deserve.

Image: General Liability Insurance

Image: General Liability Insurance

FAQ

Q: What is the difference between general liability insurance and workers’ compensation insurance?

A: General liability insurance protects your business from third-party claims, such as injuries or property damage suffered by your clients or the general public. In contrast, workers’ compensation insurance covers injuries or illnesses sustained by your employees while on the job.

Q: How much general liability insurance do I need?

A: The amount of coverage you require depends on the specific risks and potential financial impact associated with your contracting business. I recommend consulting with an experienced insurance broker who can assess your unique needs and help you determine the appropriate coverage limits.

Q: Can I get general liability insurance for a single project?

A: Yes, some insurance providers offer project-based general liability insurance, which can be a cost-effective option for contractors working on short-term projects. This type of coverage can be particularly beneficial if you’re taking on work outside of your usual scope or in a higher-risk environment.

Q: What happens if I have a claim?

A: If you experience a claim, it’s important to notify your insurance provider immediately. They will guide you through the claims process and provide the necessary legal assistance to ensure your interests are protected. Having a responsive and knowledgeable insurance team on your side can make all the difference in navigating a claim efficiently and effectively.

Conclusion

As a trusted insurance professional, I cannot stress enough the importance of general liability insurance for contractors. In today’s litigious landscape, where the unexpected can strike at any moment, this essential coverage serves as the foundation of a robust risk management strategy, shielding your business from the potentially devastating consequences of lawsuits and claims.

By understanding the unique risks you face, the key features of general liability insurance, and the strategies for securing the right coverage at an affordable price, you can empower your contracting business to thrive, even in the face of adversity. Embrace the protection that general liability insurance provides, and take the first step towards a future of financial security and growth.