As a young driver in Florida, navigating the world of auto insurance can feel like a daunting task. With rates often among the highest in the country, it’s understandable to feel overwhelmed. But fear not! With the right information and a little bit of savvy, you can find the most affordable coverage to protect yourself on the road.

In this comprehensive guide, we’ll take you on a journey to uncover the secrets of securing the best ‘florida auto insurance quote’ as a young Floridian. We’ll dive into the state’s insurance requirements, explore practical tips to save you money, and provide insights into the key factors that influence your rates. Whether you’re a new driver or have a few years under your belt, you’ll learn how to maximize your savings and get the coverage you need.

Understanding the Landscape of Florida Auto Insurance

Before we dive into the nitty-gritty of finding cheap car insurance, let’s start by understanding the basics of auto coverage in the Sunshine State.

Mandatory Minimum Coverage in Florida

Florida’s car insurance laws require all drivers to carry two types of coverage: Personal Injury Protection (PIP) and Property Damage Liability (PDL). PIP provides up to $10,000 in medical and disability benefits per person, regardless of who is at fault in an accident. PDL coverage, on the other hand, protects you from liability for damage you cause to another person’s vehicle or property, with limits of $10,000 per accident.

While these minimum requirements may seem straightforward, it’s crucial for young drivers to consider the potential consequences of only having the bare minimum. A serious accident could easily exceed these coverage limits, leaving you financially responsible for the remaining costs.

Why Full Coverage is a Smart Investment

Opting for full coverage, which includes collision and comprehensive insurance, can provide invaluable protection for young drivers. These additional coverages help pay for repairs to your own vehicle if you’re in an accident or if your car is damaged by events like theft, vandalism, or natural disasters.

Given the higher accident rates among young and inexperienced drivers, full coverage can be a wise investment. It may cost more upfront, but it can save you from potentially costly out-of-pocket expenses in the long run.

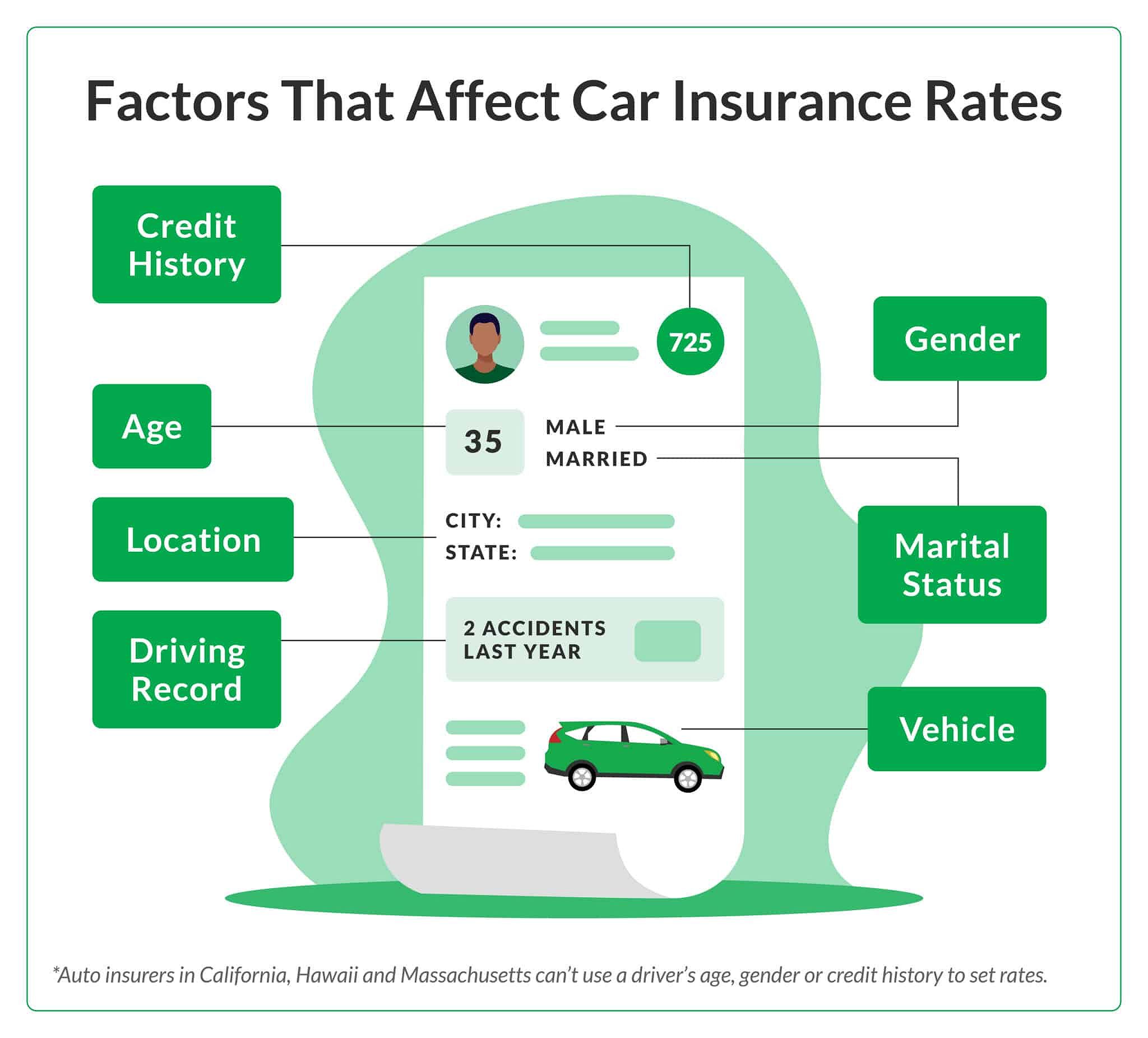

Factors Influencing Your ‘Florida Auto Insurance Quote’

Now that you understand the basic insurance requirements in Florida, let’s dive into the key factors that can impact your car insurance rates as a young driver.

Age and Driving Experience

Insurance companies view young drivers as higher-risk, as they are statistically more likely to be involved in accidents. Consequently, drivers under the age of 25 tend to pay significantly higher rates than their older counterparts. As you gain more driving experience and demonstrate a proven track record of safe driving, your rates will gradually decrease.

Driving Record and Traffic Violations

Your driving history plays a crucial role in determining your car insurance costs. Maintaining a clean record with no accidents, speeding tickets, or other violations can help you qualify for the best rates. Conversely, even a single traffic infraction can result in a substantial increase in your premiums.

Credit Score

In Florida, insurance providers are permitted to use your credit score as a factor in calculating your car insurance rates. Drivers with higher credit scores are generally viewed as more financially responsible and less likely to file claims, making them eligible for lower premiums.

Vehicle Type and Value

The make, model, and value of your vehicle can also impact your insurance costs. Newer, more expensive cars often have higher repair and replacement costs, leading to higher premiums. On the other hand, older, less valuable vehicles may be less expensive to insure.

Strategies to Find the Cheapest ‘Florida Auto Insurance Quote’

Now that you understand the key factors influencing car insurance rates for young drivers in Florida, let’s explore practical strategies to help you find the most affordable coverage.

Shop Around and Compare Quotes

One of the most effective ways to save on car insurance is to shop around and compare quotes from multiple insurance companies. Rates can vary significantly, even for drivers with similar profiles, so it’s essential to explore your options.

Take Advantage of Available Discounts

Florida insurance providers offer a variety of discounts that can help young drivers save on their premiums. Common discounts include good student discounts, driver’s education discounts, and multi-policy discounts for bundling your car insurance with other coverage, such as homeowners or renters insurance.

Consider Usage-Based Insurance Programs

Some insurance companies in Florida offer usage-based insurance programs that track your driving behavior through a mobile app or device installed in your vehicle. These programs can reward safe driving habits with lower rates, making them a potentially attractive option for young drivers.

Increase Your Deductible

Raising your deductible can lower your monthly premiums, but be sure you have the financial means to cover the higher out-of-pocket costs in the event of a claim.

Shop Around Regularly

Don’t just settle for the first quote you receive. Review your options annually to ensure you’re getting the best rate.

Maintain a Clean Driving Record

Avoiding traffic violations and accidents is crucial for keeping your rates low.

Choose a Less Expensive Vehicle

Opting for a more affordable, less valuable car can lead to lower insurance costs.

Comparing Top Insurance Providers in Florida

When it comes to finding the cheapest car insurance in Florida, not all providers are created equal. Let’s take a closer look at how some of the top insurers stack up:

-

Geico: Known for offering competitive rates and a wide range of discounts, Geico is often a top choice for young drivers in Florida. Their average full-coverage premium for a 35-year-old driver is around $2,119 per year.

-

Travelers: This insurer stands out for its affordable options for young and student drivers. Their average full-coverage rate for a 35-year-old in Florida is $2,341 per year.

-

State Farm: As one of the largest insurers in the country, State Farm provides a solid mix of coverage and customer service. Their average full-coverage premium for a 35-year-old Floridian is $2,439 per year.

-

USAA: Exclusively serving military members and their families, USAA offers some of the lowest rates in Florida, with an average full-coverage premium of $2,940 per year for a 35-year-old driver.

When comparing these providers, it’s essential to get personalized quotes and consider factors like your driving history, credit score, and vehicle type to determine which one offers the best value for your specific needs.

FAQ

Q: What are the best car insurance companies for young drivers in Florida?

A: Some of the top-rated insurance companies for young drivers in Florida include Geico, Travelers, State Farm, and USAA (for military members and their families). These providers are known for offering competitive rates and a variety of discounts.

Q: How can I get a Florida auto insurance quote online?

A: Most major insurance companies in Florida have user-friendly online quoting tools that allow you to input your personal information and receive personalized rate estimates. This is a great way to quickly compare quotes from multiple providers.

Q: What happens if I get a speeding ticket or have an accident?

A: Traffic violations and accidents can significantly impact your car insurance rates in Florida. Insurers will often view you as a higher-risk driver, leading to higher premiums. Maintaining a clean driving record is crucial for keeping your costs low.

Q: Can I get car insurance if I have bad credit?

A: Yes, you can still obtain car insurance in Florida if you have a poor credit score. However, your rates may be higher than drivers with good credit. Some insurance companies, such as USAA, may be more lenient when it comes to credit scores.

Conclusion

Finding affordable car insurance as a young driver in Florida may seem like a daunting task, but with the right strategy, it’s definitely achievable. By understanding the state’s insurance requirements, exploring available discounts, and comparing quotes from multiple providers, you can secure the coverage you need at a budget-friendly price.

Remember, car insurance is an essential investment that can protect you financially in the event of an accident or unexpected incident. Take the time to shop around, utilize all the savings opportunities available, and keep your driving record clean to maximize your savings on your ‘florida auto insurance quote’. With a little diligence, you can find a policy that fits your needs and your budget.

So, what are you waiting for? Start your search for the cheapest ‘florida auto insurance quote’ today and get the peace of mind you deserve on the road.