As an experienced insurance advisor, I understand the unique challenges teen drivers face when it comes to securing affordable car coverage in Florida. Whether you’re a parent navigating the insurance landscape for your young driver or a teen taking on this responsibility yourself, I’m here to guide you through the process and help you find the best FL car insurance quotes.

Understanding Florida’s Car Insurance Requirements for Teen Drivers

Let’s start by addressing the essential requirements in the Sunshine State. Florida has a graduated driver licensing system, designed to gradually introduce teens to the responsibilities of driving. At age 15, your teen can apply for a learner’s permit, which initially limits them to daytime driving with a licensed adult passenger. After 90 days, they can drive until 10 PM, and once they’ve held the permit for a year and completed 50 hours of practice driving (10 at night), they can apply for a driver’s license.

Complying with these restrictions is crucial not only for your teen’s safety but also to maintain a clean driving record and avoid penalties that could impact their insurance rates. Violations can lead to extended permit durations or increased premiums, so it’s essential to ensure your young driver understands and follows the rules.

In addition to the graduated licensing system, all Florida drivers, including teens, must carry at least $10,000 in personal injury protection (PIP) and $10,000 in property damage liability (PDL) insurance. While these minimums may seem low, I highly recommend considering higher coverage limits to protect yourself and your teen driver in the event of an accident. Opting for full coverage, which includes collision and comprehensive insurance, can provide better financial protection.

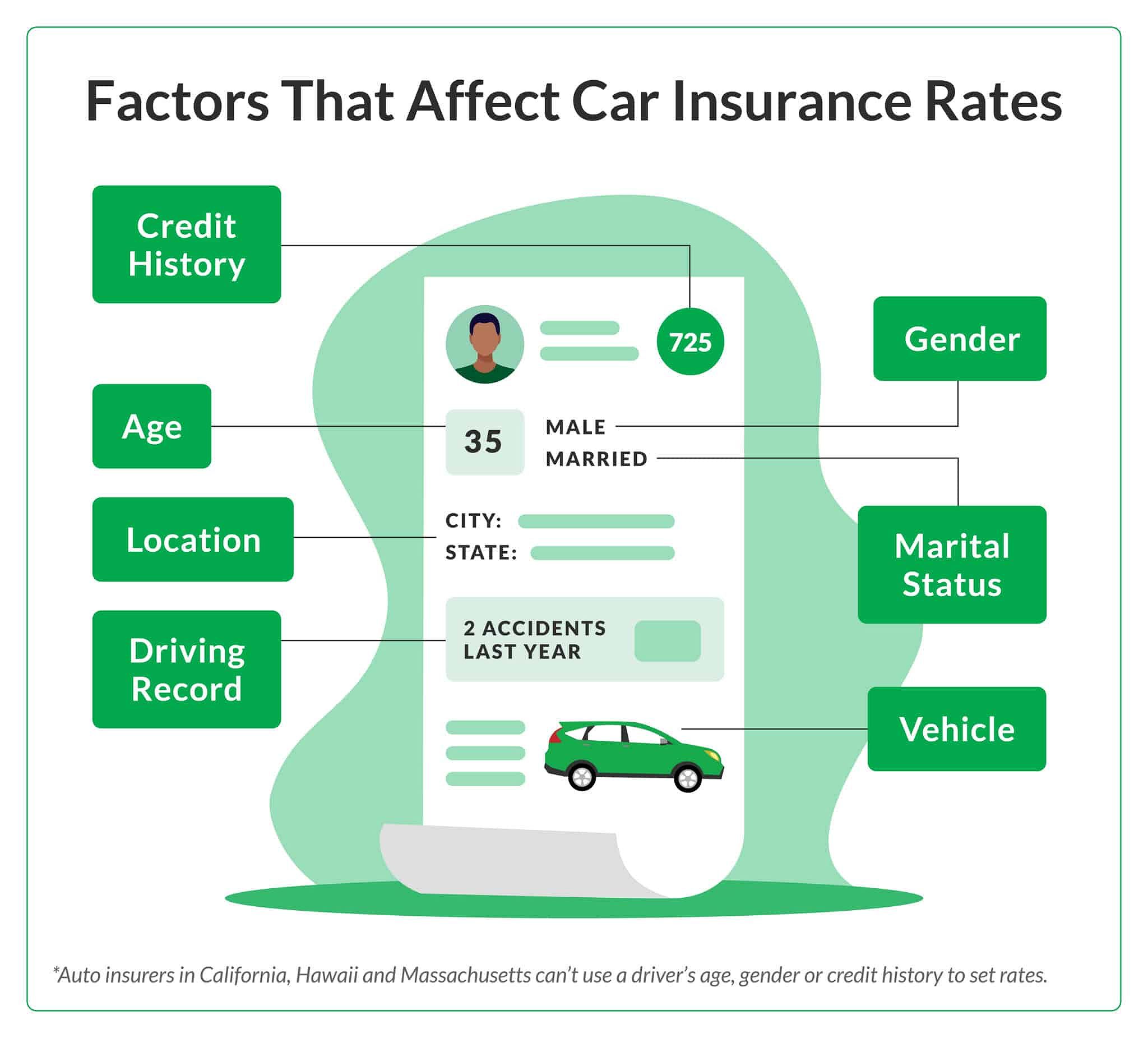

When it comes to factors influencing teen driver insurance rates, age, driving experience, driving record, and vehicle type all play a significant role. Younger, less experienced drivers are generally perceived as higher-risk, leading to higher premiums. Additionally, the type of vehicle your teen drives can impact the cost, with sports cars or high-performance vehicles typically costing more to insure.

Strategies for Finding Affordable FL Car Insurance Quotes for Teen Drivers

Now that we’ve covered the essential requirements, let’s explore ways to find the most affordable car insurance quotes for your teen driver.

Shop Around and Compare Quotes

The key to securing the best deal is to shop around and compare quotes from multiple insurance providers. Utilize online comparison tools or work directly with insurance agents to gather and compare rates from a variety of companies. This approach can reveal significant differences in premium costs, as insurers often have varying pricing models and criteria for determining rates.

When comparing quotes, be sure to look at the coverage options being offered, not just the price. A policy with a slightly higher premium but better coverage can ultimately save you more in the long run if an accident occurs.

Take Advantage of Discounts

Fortunately, there are several discounts available to teen drivers in Florida that can help lower their insurance costs. Look for opportunities such as:

- Good student discount: Maintaining a certain GPA (often a B average or higher) can earn your teen a discount, sometimes up to 15-25% off their premium.

- Driver’s education discount: Completing an approved driver’s education course can also lead to savings, as it not only helps secure a discount but also equips your teen with essential driving skills.

- Multi-policy discount: Bundling your teen’s car insurance with your home or other policies can result in additional discounts, making it an excellent way to save if you already have coverage with a provider.

Be sure to ask insurance companies about any available discounts and how your teen can qualify. In some cases, insurers may even offer loyalty discounts for customers who stay with the same company for an extended period.

Explore Usage-Based Insurance Programs

Some insurers in Florida offer usage-based insurance programs that track driving behavior and reward safe habits with lower premiums. These programs, such as Snapshot from Progressive or Drive Safe & Save from State Farm, use telematics devices or mobile apps to monitor factors like speed, braking, and mileage. Encouraging your teen to participate in these programs can help them earn discounts and develop responsible driving skills.

These usage-based insurance options can be particularly beneficial for teen drivers, who often face higher rates due to their lack of experience. By demonstrating safe driving practices through these programs, your young driver can potentially lower their insurance costs significantly.

Negotiate with Your Insurance Company

If you’ve found a lower quote from a competitor, don’t be afraid to negotiate with your current insurance provider. Explain the more affordable options you’ve found and ask if they can match or beat the competing offer. Insurance companies often want to retain loyal customers, so they may be willing to work with you to keep your business.

When negotiating, be prepared to discuss your teen’s driving record, any completed driver education courses, and any discounts you may qualify for. Highlighting your teen’s clean driving history or their participation in a driver’s ed program can strengthen your position and potentially lead to a better deal.

Tips for Teen Drivers and Their Parents

As an insurance advisor, I strongly encourage both teen drivers and their parents to prioritize safe driving practices and maintain a clean driving record. Here are some essential tips:

- Avoid distractions: Texting, talking on the phone, or adjusting the radio while driving can significantly increase the risk of accidents. Establish clear rules about phone usage and other potential distractions.

- Obey all traffic laws: Following speed limits, traffic signals, and other traffic laws is crucial for maintaining safety and avoiding fines that could affect insurance rates.

- Wear a seatbelt: Seatbelt usage is not only a legal requirement but also a critical safety measure. Ensure your teen and all passengers buckle up every time.

- Refrain from driving under the influence: Emphasize the severe consequences of impaired driving, including legal penalties and insurance ramifications.

Open communication between teens and parents about driving responsibilities, insurance coverage, and the consequences of risky behavior is essential. Regular discussions about safe driving practices and the importance of maintaining a good driving record can foster a culture of responsibility.

Resources for Teen Drivers and Their Parents

For additional information and support, I recommend exploring the following resources:

- Florida Department of Highway Safety and Motor Vehicles (FLHSMV): This website provides essential details about licensing, registration, and traffic laws in Florida.

- Florida Automobile Insurance Plan Service Office: This office can assist you in finding insurance options if you encounter difficulties obtaining coverage.

- National Highway Traffic Safety Administration (NHTSA) Teen Driving: This resource offers valuable tips and information on safe driving practices for teens.

Additionally, consider reaching out to local insurance agents who specialize in working with teen drivers. They can provide personalized guidance and help you navigate the available options in your area.

FAQ

Q: What are the best car insurance companies for teen drivers in Florida?

A: Some of the top insurers for teen drivers in Florida include Geico, Travelers, State Farm, and USAA. These companies are known for offering competitive rates and a variety of discounts for young drivers.

Q: How can I get the best car insurance deal for my teen driver?

A: To secure the best car insurance deal for your teen driver in Florida, I recommend shopping around and comparing quotes from multiple providers, taking advantage of available discounts, exploring usage-based insurance programs, and negotiating with your current insurer. Maintaining a clean driving record and encouraging safe driving habits can also help keep rates down.

Q: What happens if my teen driver gets into an accident?

A: If your teen driver is involved in an accident, it’s crucial to have adequate insurance coverage. Florida’s no-fault laws mean that your own insurance policy will cover your teen’s medical expenses, regardless of who was at fault. However, liability coverage can protect you from potential lawsuits if your teen is found responsible for the accident. Be sure to review your policy and understand your coverage limits.

Conclusion

As an experienced insurance advisor, I understand the importance of finding affordable car insurance for teen drivers in Florida. By navigating the state’s requirements, exploring available discounts, and encouraging safe driving habits, you can secure the best coverage at the most competitive prices.

Remember, the key to success is to shop around, compare quotes, and take advantage of every opportunity to save. Utilize online tools, work with insurance agents, and don’t be afraid to negotiate with your current provider. With the right strategies and a proactive approach, you can help your teen driver stay protected on the roads while keeping insurance costs manageable.

Start your search for the best FL car insurance quotes today. I’m here to provide guidance and support every step of the way. Let’s work together to find the perfect policy for your young driver and give them the coverage they need to stay safe on the road.