Buckle up, my fellow Colorado drivers! Navigating the world of car insurance can be a daunting task, especially for us young’uns. But fear not, we’ve got your back. In this high-octane guide, we’re going to rev up your savings and help you find the best Colorado car insurance quotes that won’t leave your wallet on empty.

Understanding the Rules of the Road

Before we dive into the nitty-gritty of car insurance, let’s make sure we’re all on the same page when it comes to Colorado’s requirements. After all, you don’t want to end up in the hot seat with the authorities, do you?

Mandatory Liability Coverage: The Bare Minimum

Colorado law requires that all drivers carry a minimum level of Liability coverage. This includes:

- Bodily Injury Liability: $25,000 per person, $50,000 per accident

- Property Damage Liability: $15,000 per accident

Think of this as the insurance equivalent of a seatbelt — it’s there to protect other drivers and their vehicles if you’re the one at fault. But don’t worry, we’ll explore some extra coverage options to keep you and your ride safe too.

More Coverage for Comprehensive Protection

While the state minimums are a good starting point, many Colorado drivers opt for additional insurance to ensure they’re covered from head to toe. Let’s take a look at some of the extra goodies you can add to your policy:

- Collision Coverage: Pays for damage to your vehicle, no matter who’s to blame.

- Comprehensive Coverage: Protects your car from non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Covers you if you get into an accident with a driver who doesn’t have enough (or any) insurance.

- Medical Payments Coverage: Helps pay for your medical expenses, regardless of fault.

By weighing the pros and cons of these options, you can find the perfect balance between cost and coverage, so you can cruise with confidence.

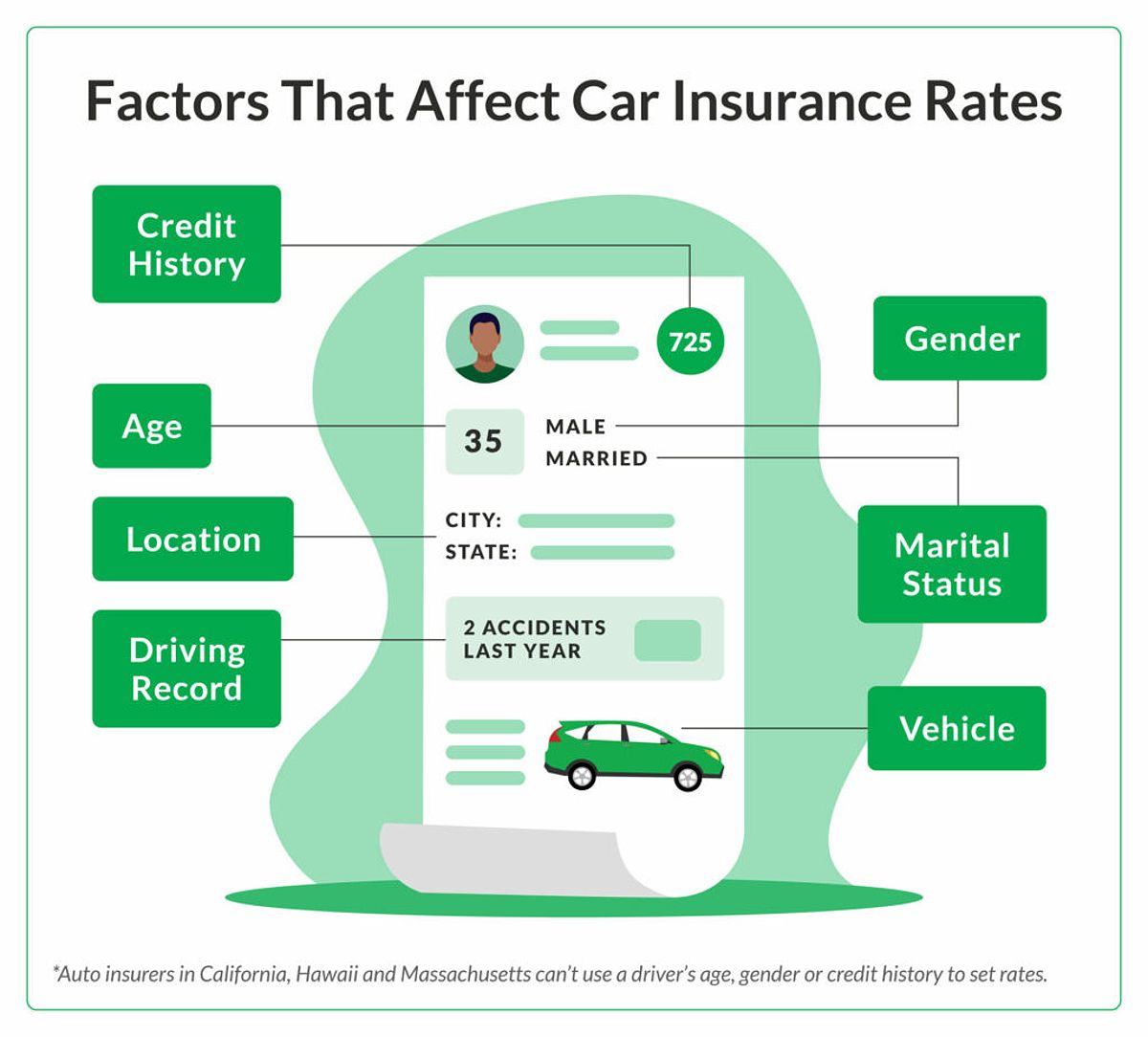

Factors That Influence Your Colorado Car Insurance Rates

Now, let’s dive into the nitty-gritty of what determines your car insurance premiums in the Centennial State. As a young Colorado driver, you’ll want to keep these key factors in mind:

Age and Inexperience: The Rookie’s Disadvantage

I hate to break it to you, but being a young driver puts you in a higher-risk category for insurers. It’s a harsh reality, but the statistics don’t lie — younger motorists are more likely to be involved in accidents, which means higher premiums for us. But don’t worry, there are ways to offset this, and we’ll get to that soon.

Driving History: The Need for Speed (or Not)

Your driving record is like your financial report card — insurers will be taking a close look. Speeding tickets, accidents, and DUI convictions can all lead to sky-high premiums. Even a single slip-up can haunt you for years to come. The key? Keep that driving record squeaky clean, and you’ll be on the fast track to savings.

Credit Score: The Surprising Sidekick

Did you know that your credit score can also impact your Colorado car insurance quotes? Yep, insurers in our state often use this as a proxy for your overall responsibility. If your credit is in tip-top shape, you could score some serious discounts. Time to get that credit game on point!

Vehicle Type: The Need for Speed (or Sensibility)

The kind of ride you’re driving can also play a role in your insurance costs. High-performance cars, for example, might come with a higher price tag due to their increased likelihood of being involved in accidents. On the flip side, vehicles loaded with safety features could qualify for discounts, helping you save some cash.

Unlocking the Secrets to Cheaper Colorado Car Insurance

Now, for the fun part — finding ways to slash your car insurance costs in Colorado! As a young driver, you’ve got some tricks up your sleeve to help you score the best deals.

Good Student Discount: The Brainiac’s Boon

If you’re crushing it in the classroom, your insurance company might just cut you a sweet deal. Many providers offer discounts to students who maintain a stellar GPA. Just make sure to keep those grades up and provide the proof — it could mean some serious savings.

Defensive Driving Course Discount: The Wise Warrior’s Windfall

Taking a defensive driving course isn’t just a smart way to hone your skills behind the wheel — it can also lead to some juicy discounts on your Colorado car insurance. Insurers recognize that drivers who complete these courses are less likely to get into accidents, so they’re happy to pass the savings on to you.

Multi-Policy Discount: The Bundle Bonanza

Who doesn’t love a good package deal? If you’re already rocking homeowners or renters insurance, you might be able to score some extra savings by bundling your car insurance with those policies. Many companies offer generous multi-policy discounts, so be sure to ask about this option when comparing quotes.

Comparing Colorado Car Insurance Quotes: The Ultimate Treasure Hunt

Alright, time to put on our detective hats and start digging for the best Colorado car insurance deals. Here’s how you can get the job done:

Online Quote Tools: The Digital Detectives

These days, you don’t even have to leave your couch to find and compare Colorado car insurance quotes. Just hop on your trusty laptop or smartphone and let the online quote tools do the heavy lifting. Input your info once, and you’ll get quotes from a variety of insurers — talk about a time-saver!

Independent Insurance Agents: The Insider Scoop

If you’re looking for a more personalized approach, teaming up with an independent insurance agent can be a game-changer. These pros have access to a wider range of products, so they can help you navigate the options and find the best coverage at a killer price. Plus, they’ll provide expert guidance every step of the way.

Tips for Saving Even More on Colorado Car Insurance

Alright, you’ve got the knowledge, now let’s put it into practice. Here are a few extra tips to help you save even more on your Colorado car insurance:

Maintain a Spotless Driving Record

It may seem obvious, but keeping your nose clean on the road is the key to keeping your rates low. Obey the traffic laws, ditch the distractions, and channel your inner defensive driving master. The longer you can avoid speeding tickets and accidents, the better.

Consider a Higher Deductible

Raising your deductible — the amount you pay out of pocket before your insurance kicks in — can be a smart way to lower your monthly premiums. Just be sure you’ve got a stash of cash set aside in case you need to file a claim.

Shop Around Regularly

The car insurance landscape is always evolving, so don’t get too comfortable with your current provider. Make it a habit to compare Colorado car insurance quotes every year or so. New discounts, policies, and rates can pop up, so staying on top of the game is key.

FAQ

What are the penalties for driving without car insurance in Colorado?

Driving without insurance in Colorado is a serious offense. You could face fines ranging from $500 to $1,000, community service, and even potential jail time. Plus, your driver’s license could be suspended. It’s just not worth the risk!

What if I have a bad driving record?

If you’ve got a few blemishes on your driving history, your insurance rates will likely be higher. But don’t worry, you can still find affordable coverage by shopping around, taking advantage of discounts, and maintaining a clean record going forward.

What are some common discounts for young drivers in Colorado?

As a young driver, you can score some sweet savings with discounts like the good student discount, defensive driving course discount, and multi-policy discount. Be sure to ask about all the available options when comparing quotes.

How do I know if I’m getting the best deal on Colorado car insurance?

The key is to shop around and compare quotes from multiple providers. Consider all the factors that affect your rates, like your age, driving history, and vehicle type. With a little digging, you can uncover the most cost-effective coverage that fits your needs.

Conclusion: Buckle Up for Savings

Alright, my fellow Colorado drivers, you’re now armed with the knowledge to navigate the world of car insurance like a pro. By understanding the requirements, exploring the available discounts, and comparing quotes, you can unlock some serious savings and hit the open road with confidence.

Remember, being a young driver doesn’t have to mean breaking the bank on car insurance. Stay vigilant, take advantage of those discounts, and you’ll be cruising with the best of them in no time. Happy driving, Colorado!