As a young driver in Colorado, the world of car insurance can feel like a daunting maze. With limited driving experience and the inherent risks associated with your age group, you’re likely facing higher premiums. But fear not, my fellow adventurous driver! I’m here to guide you through this journey and help you find the most affordable Colorado car insurance quotes tailored just for you.

Why Car Insurance Costs More for Young Drivers

Let’s dive into the reasons why car insurance tends to be more expensive for young drivers like us. It all boils down to two key factors: our lack of driving experience and the increased risk of accidents.

Navigating the Roads with Less Experience

When it comes to car insurance, the number of years behind the wheel plays a significant role. As a new driver, I haven’t had the time to develop the necessary skills and reflexes to handle various road conditions and traffic situations with ease. This lack of experience makes us more prone to making mistakes, which in turn increases the likelihood of being involved in an accident.

The Higher Risk Factor

Statistics show that young drivers, especially those between the ages of 16 and 25, are more likely to be involved in accidents, both minor and severe. According to the Centers for Disease Control and Prevention (CDC), car crashes are the leading cause of death for teenagers in the United States. In 2020, young drivers aged 16-19 were nearly three times more likely to be involved in a fatal crash compared to drivers aged 20 and older.

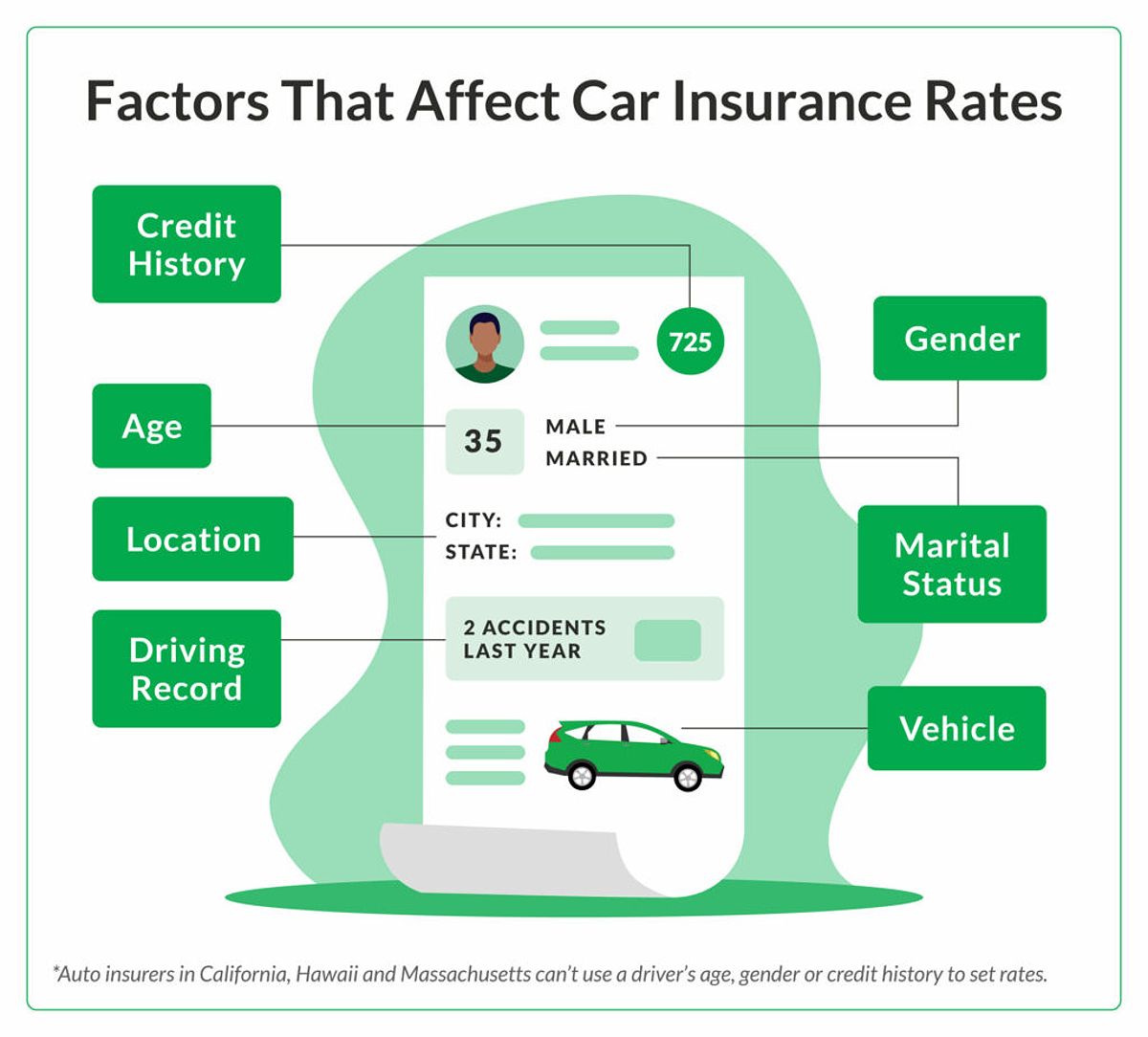

Other Factors That Influence Rates

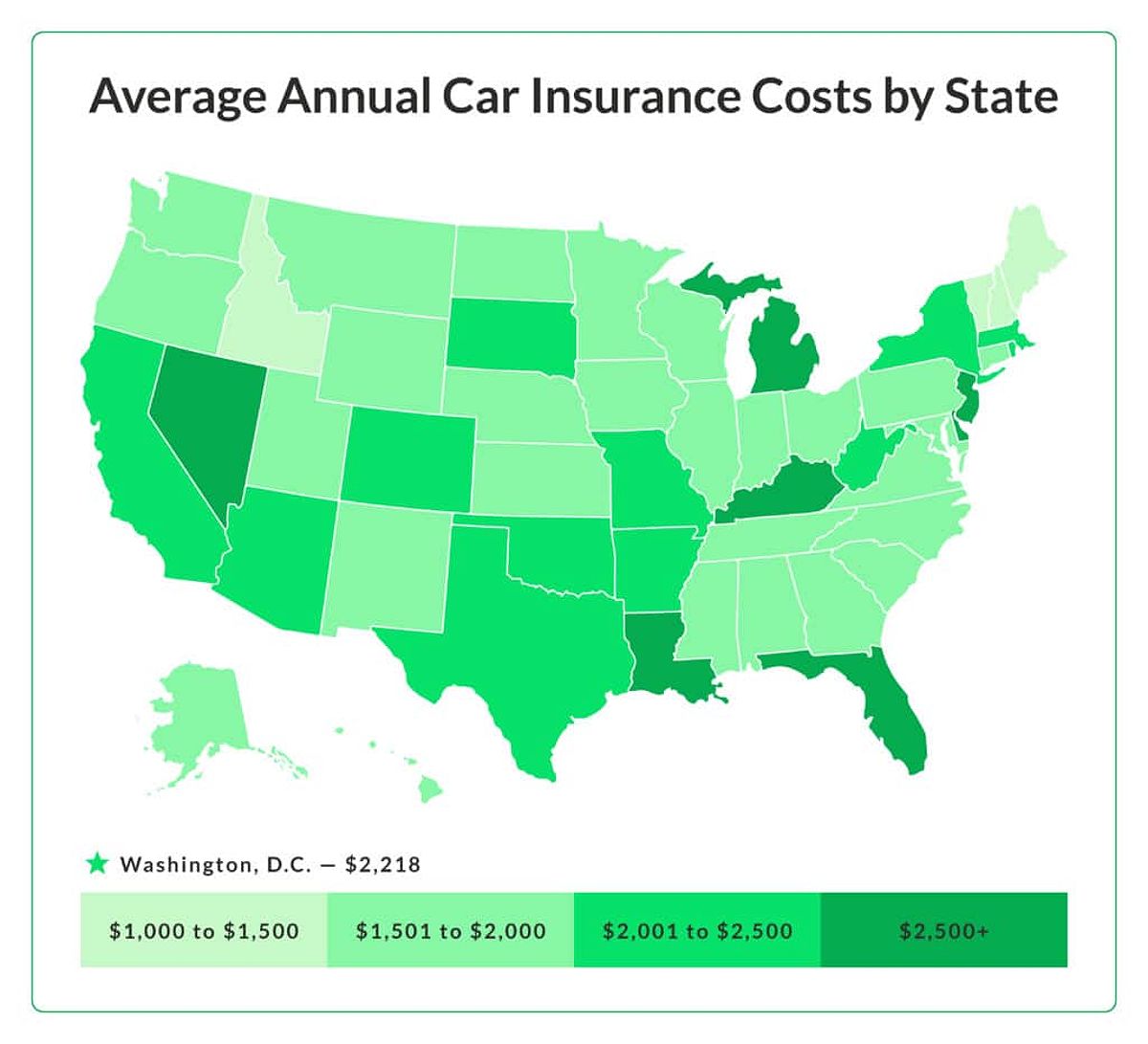

In addition to age and driving experience, insurers also consider other factors when determining our Colorado car insurance premiums. These include our driving record, the type of vehicle we drive, our location within the state, and even our credit score. Drivers with a clean record, a safer vehicle, and a higher credit score tend to enjoy lower rates. It’s important to keep these factors in mind as we shop around for the best deal.

Finding the Most Affordable Colorado Car Insurance Quotes

Now, let’s dive into the strategies that will help us secure the cheapest Colorado car insurance quotes as young drivers.

Compare, Compare, Compare

The key to finding the best deal is to compare quotes from multiple insurance providers. This may seem like a daunting task, but trust me, it’s worth the effort. Each insurer weighs the various factors differently, so the lowest quote may not always come from the same company. By taking the time to research and gather quotes from a variety of sources, I can ensure I’m getting the most cost-effective solution.

Explore Companies Specializing in Young Drivers

Some insurance companies, like Geico and State Farm, have a strong focus on serving young drivers. These providers often offer tailored coverage options and discounts specifically designed to cater to our needs. Be sure to explore their offerings as you compare quotes. They may just have the perfect plan to fit your budget and driving profile.

Utilize Online Comparison Tools

To streamline the quote-gathering process, I recommend taking advantage of online comparison tools like Policygenius or Insurance.com. These platforms allow me to input my information and receive multiple quotes from various insurers in Colorado, making it easier to find the most affordable option. It’s like having a personal insurance assistant at my fingertips!

Discounts for Young Drivers: Your Key to Savings

As a young driver, I’m eligible for several discounts that can significantly lower my Colorado car insurance premiums. Let’s explore these money-saving opportunities.

Good Student Discounts

Maintaining a solid academic record can really pay off when it comes to car insurance. Many insurers offer substantial discounts, up to 15-20%, for young drivers who maintain a B average or higher. It’s a win-win — I get to save on my insurance and show off my smarts!

Defensive Driving Course Discounts

Taking a defensive driving course is not only a smart move for my safety, but it can also earn me a discount on my car insurance. These courses cover important topics like hazard recognition, accident avoidance, and proper driving techniques, all of which demonstrate my commitment to being a responsible driver.

Multi-Car Discounts

If I have the opportunity to insure multiple vehicles under the same policy, I may be eligible for a multi-car discount. This can be particularly beneficial if I have siblings or parents who also need car insurance coverage. Combining our policies can lead to some serious savings.

USAA: A Trusted Choice for Military Families

For young drivers with a military background, USAA is an excellent option to consider for your Colorado car insurance needs. USAA has a long-standing reputation for providing exceptional service and competitive rates to active-duty military members, veterans, and their families.

USAA’s deep understanding of the unique challenges and circumstances that come with the military lifestyle means they can offer tailored discounts and coverage options to help me save money on my car insurance. As a young driver from a military family, USAA is definitely worth exploring.

Tips for Keeping Your Car Insurance Rates Low

Maintaining affordable car insurance rates as a young driver in Colorado requires a proactive approach. Here are some tips to help me keep my premiums low.

Prioritize a Clean Driving Record

One of the most important factors in determining my car insurance rates is my driving record. By avoiding accidents, speeding tickets, and other traffic violations, I can demonstrate my commitment to safe driving and help keep my premiums low.

Choose a Safe, Low-Profile Vehicle

The type of vehicle I drive can also impact my car insurance rates. Opting for a safer, more practical car that is less expensive to repair or replace can lead to lower premiums. Vehicles with advanced safety features, such as airbags and anti-lock brakes, may also qualify for additional discounts.

Consider Increasing My Deductible

Raising my deductible, the amount I pay out-of-pocket before my insurance coverage kicks in, can result in lower monthly premiums. However, it’s crucial to choose a deductible that I can comfortably afford in the event of an accident.

Staying Up-to-Date on Colorado Car Insurance Regulations

As a young driver in Colorado, it’s important to stay informed about the state’s car insurance requirements and regulations. Regularly reviewing the latest updates can help you ensure you’re maintaining the necessary coverage and avoiding any penalties.

Minimum Liability Coverage Requirements

Colorado requires all drivers to carry a minimum of $25,000 per person and $50,000 per accident in Bodily Injury Liability (BIL) coverage, as well as at least $15,000 in Property Damage Liability (PDL) coverage. These are the state’s minimum requirements, but it’s often wise to consider higher limits to protect your financial assets in the event of a serious accident.

Uninsured/Underinsured Motorist Coverage

While not mandatory, Colorado strongly recommends that drivers purchase Uninsured/Underinsured Motorist (UM/UIM) coverage. This type of insurance protects you if you’re involved in an accident with a driver who doesn’t have adequate coverage or is completely uninsured.

Maintaining Proof of Insurance

In Colorado, you must be able to provide proof of insurance if stopped by a law enforcement officer or involved in an accident. Failure to have valid coverage can result in fines, license suspension, and other penalties.

FAQ (Optional)

Q: What are the minimum car insurance requirements in Colorado?

A: Colorado requires drivers to have liability insurance with minimum coverage limits of $25,000 per person and $50,000 per accident for bodily injury, and $15,000 for property damage.

Q: What are some common mistakes young drivers make when getting car insurance?

A: Common mistakes include not comparing quotes, not taking advantage of available discounts, and choosing the wrong deductible.

Q: How can I get my car insurance rates lowered after a speeding ticket?

A: You can take a defensive driving course, maintain a clean driving record for a few years, and consider raising your deductible to help lower your rates after a speeding ticket.

Conclusion

As a young driver in Colorado, finding affordable car insurance is definitely achievable. By comparing quotes, taking advantage of available discounts, and maintaining a safe driving record, I can secure the best deal on my car insurance coverage. Remember, driving responsibly is the key to keeping my rates low and staying protected on the road.

So, let’s embark on this exciting journey together! Start your search for the most affordable Colorado car insurance quote today. Utilize the tips and strategies outlined in this article to find the coverage that fits your needs and your budget. With the right approach, I can hit the road with confidence, knowing I’ve found the best car insurance solution for my unique situation.