As a Colorado resident, having reliable car insurance coverage is crucial not just for your own protection, but for the safety of your loved ones on the road. With the state’s diverse driving conditions, from snowy mountain passes to bustling city streets, finding the right auto insurance policy can be a complex task.

In this empowering guide, we’ll explore the key factors that influence Colorado auto insurance quotes, discuss the top insurance providers in the state, and share practical tips to help you secure the best coverage at the most affordable price. Whether you’re a seasoned Colorado driver or new to the state, this article will equip you with the knowledge and confidence to make informed decisions about your car insurance needs.

Understanding Colorado’s Car Insurance Requirements

Colorado is an at-fault state when it comes to auto insurance, which means the driver responsible for an accident is financially liable for the other party’s medical expenses, lost wages, and property damage. The state requires all drivers to carry a minimum of $25,000 per person and $50,000 per accident in Bodily Injury Liability (BIL) coverage, as well as at least $15,000 in Property Damage Liability (PDL) coverage.

While these minimum requirements provide basic protection, it’s generally recommended for Colorado women and families to purchase higher levels of coverage to safeguard their financial well-being. Colorado also allows drivers to opt for $5,000 in Medical Payments coverage, which can help pay for medical bills regardless of fault. Additionally, uninsured/underinsured motorist coverage is not mandated but can be a wise investment in case of an accident with a driver who lacks adequate insurance.

Failing to maintain the required auto insurance in Colorado can result in significant penalties, including fines, license suspension, and even community service. It’s crucial for Colorado residents to understand and comply with the state’s insurance laws to avoid these consequences.

Factors Affecting Colorado Auto Insurance Quotes

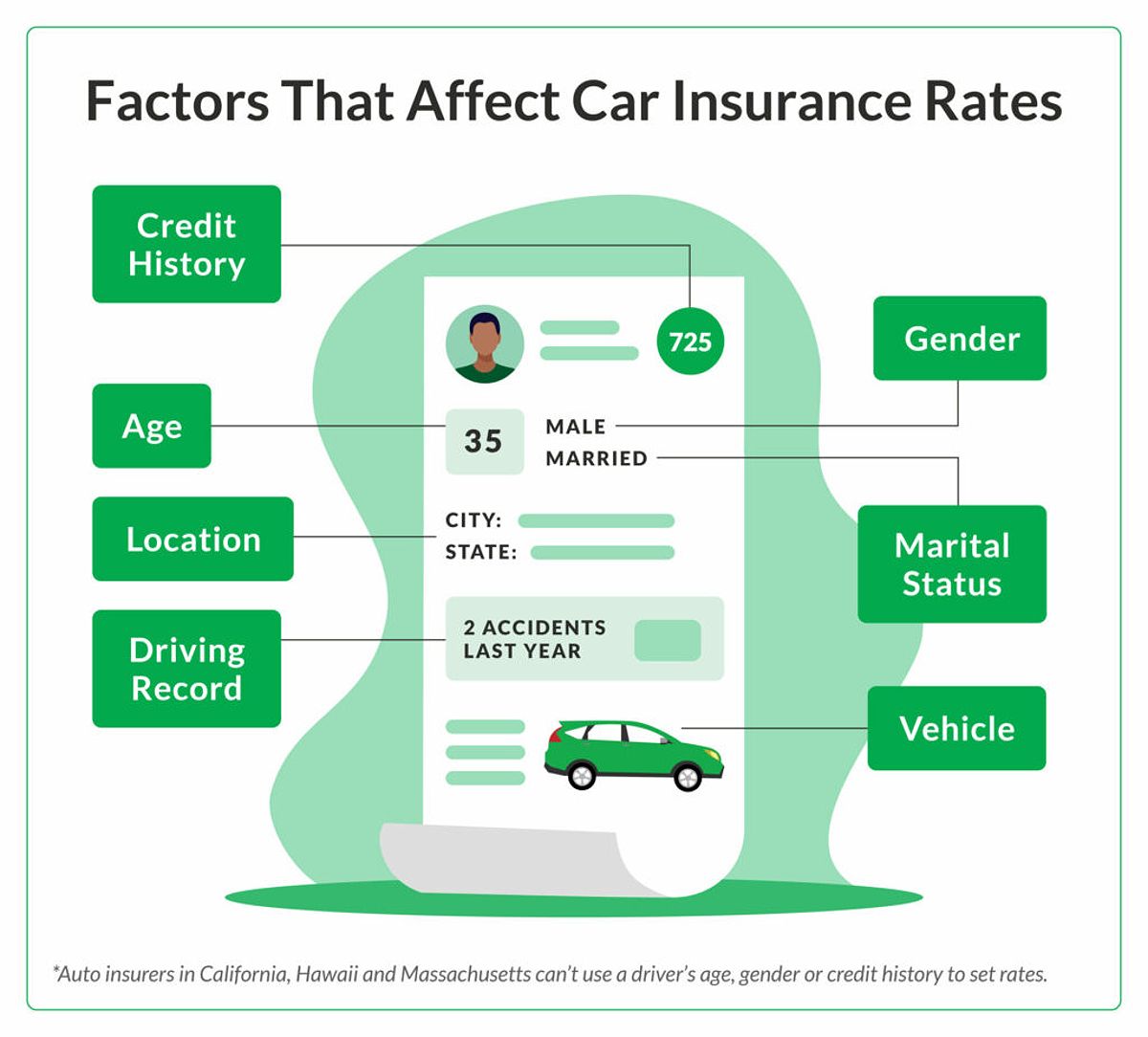

When it comes to determining your car insurance rates in Colorado, insurers consider a variety of factors, including:

Driving History

Your driving record plays a crucial role in your auto insurance costs. Accidents, speeding tickets, and DUIs can all lead to higher premiums, as insurers view these incidents as indicators of increased risk. As a Colorado woman or family, maintaining a clean driving record is essential for securing the best possible rates.

Image: A driving profile that shows details car insurance companies use to set premiums

Image: A driving profile that shows details car insurance companies use to set premiums

Age and Experience

Younger, less experienced drivers typically pay more for car insurance, as they are statistically more likely to be involved in accidents. Conversely, senior drivers may qualify for discounts based on their years of safe driving. If you’re a young or mature Colorado driver, be sure to explore available discounts to offset the higher costs.

Vehicle Type

The make, model, and year of your vehicle can also impact your insurance rates. Factors such as the vehicle’s safety features, repair costs, and theft risk are all considered by insurers. Consider choosing a car that balances your needs and budget when it comes to Colorado auto insurance.

Geographic Location

Where you live in Colorado can significantly influence your auto insurance quotes. Drivers in urban areas, particularly those with higher accident and crime rates, often pay more than their counterparts in rural regions. As a Colorado woman or family, be mindful of how your location may affect your insurance costs.

Credit Score

Many insurers use credit-based insurance scores to determine rates, as studies have shown a correlation between credit history and the likelihood of filing a claim. Drivers with poor credit may face higher premiums, so it’s essential to maintain a healthy credit score to get the best Colorado auto insurance rates.

Coverage Levels

The level of coverage you choose, from basic liability to comprehensive plans, will directly affect the cost of your Colorado auto insurance. Higher levels of protection generally come with a higher price tag, so it’s important to strike a balance between your coverage needs and budget.

By understanding these key factors, you can better anticipate how your personal and vehicle-related characteristics may impact your insurance costs in Colorado.

Top Car Insurance Companies in Colorado

When it comes to finding the cheapest car insurance in Colorado, several providers stand out for their competitive rates and comprehensive coverage options. Based on our research, some of the top insurers in the state include:

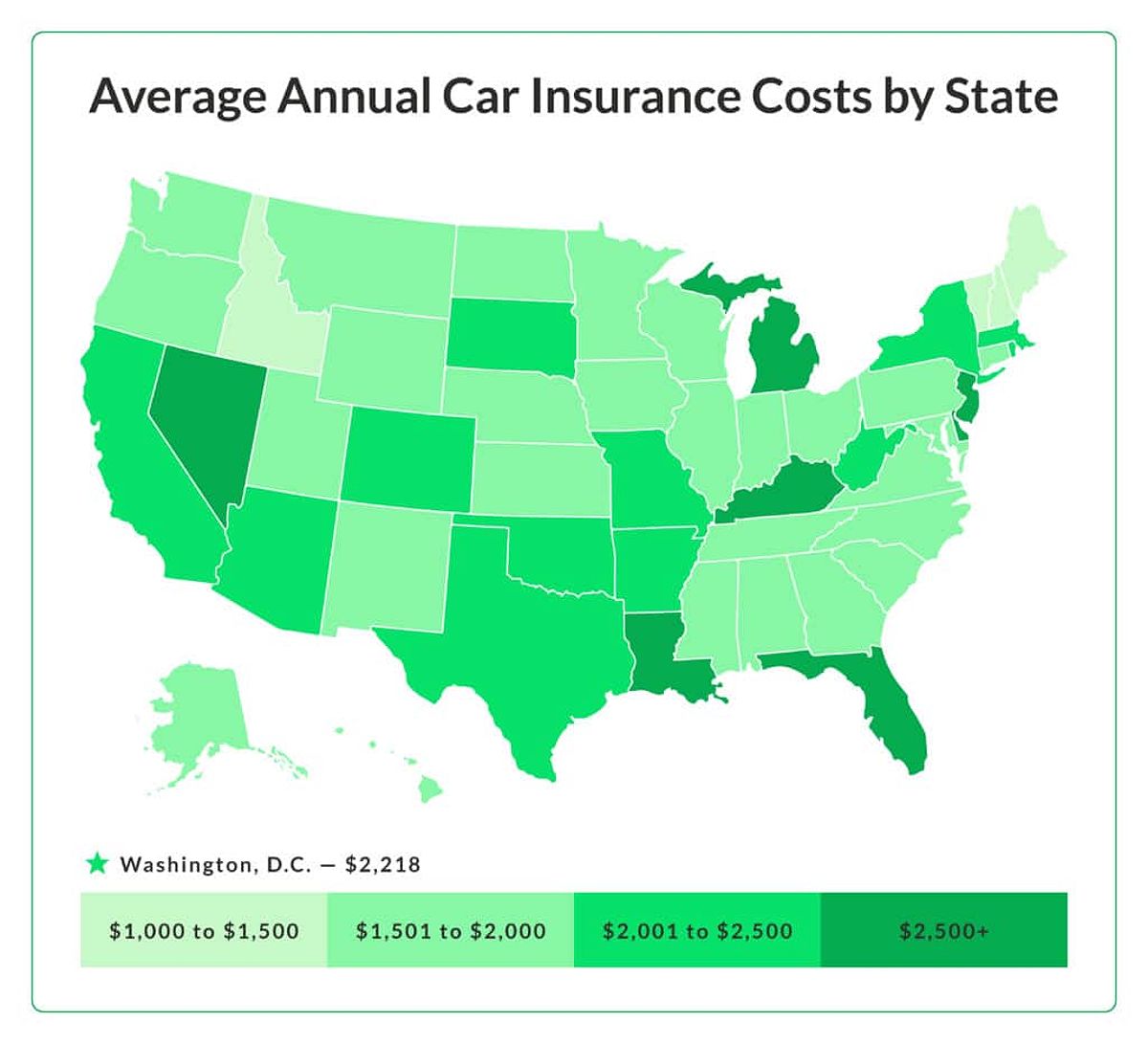

Image: A U.S. map showing the average annual cost of full-coverage car insurance in each state

Image: A U.S. map showing the average annual cost of full-coverage car insurance in each state

Geico

Geico is known for offering affordable auto insurance rates, with an average annual premium of $1,306 for full coverage policies. The company’s user-friendly mobile app and wide range of discounts make it a popular choice for Colorado women and families.

State Farm

As one of the largest insurance providers in the country, State Farm offers competitive rates and a strong reputation for customer service. Their average annual full coverage premium in Colorado is $1,623, making them a solid option for Colorado residents.

Nationwide

Nationwide provides a variety of coverage options, including standard liability, collision, and comprehensive plans. With an average annual full coverage cost of $1,695, Nationwide is a reliable choice for Colorado drivers.

USAA

While USAA’s car insurance is only available to military members, veterans, and their families, the company consistently offers some of the most affordable rates in Colorado, with an average annual full coverage premium of $1,640. If you or a family member qualify, USAA is worth considering.

Southern Farm Bureau

For Colorado women and families seeking minimum liability coverage, Southern Farm Bureau stands out with an average annual rate of $275, making it one of the cheapest options in the state.

It’s important to note that individual rates can vary significantly based on your specific circumstances, so it’s always recommended to compare quotes from multiple insurers to find the best deal.

Saving Money on Colorado Auto Insurance Quotes

Securing the most affordable car insurance in Colorado doesn’t have to be a daunting task. Here are some tips to help Colorado women and families save money on their auto insurance premiums:

Shop Around

One of the most effective ways to find cheap car insurance in Colorado is to compare quotes from multiple providers. Take the time to request and compare quotes from at least three to five insurers to ensure you’re getting the best deal.

Take Advantage of Discounts

Colorado insurers offer a variety of discounts that can help lower your auto insurance costs. These may include discounts for good drivers, good students, military members, safe vehicles, and bundling your policies (e.g., auto and homeowner’s insurance).

Review Your Coverage Needs

Carefully evaluate your coverage requirements and consider adjusting your policy to find the right balance between protection and cost. For example, if your vehicle is older, you may be able to drop comprehensive and collision coverage without significantly increasing your risk.

Pay in Full

Many insurers offer a discount for customers who pay their annual premium in full, rather than opting for monthly installments. This can result in substantial savings over the course of the year.

Maintain a Clean Driving Record

Avoiding accidents, speeding tickets, and other traffic violations can go a long way in keeping your Colorado auto insurance rates low. By demonstrating responsible driving behavior, you’ll be eligible for the best possible rates.

By implementing these strategies, Colorado women and families can confidently navigate the car insurance landscape and find the coverage they need at a price that fits their budget.

Getting Online Colorado Auto Insurance Quotes

In today’s digital age, obtaining car insurance quotes has never been easier. Many insurers offer user-friendly online platforms that allow you to input your information and receive personalized quotes within minutes. Some popular websites for comparing Colorado auto insurance rates include:

- Geico.com

- StateFarm.com

- Nationwide.com

- USAA.com

- RootInsurance.com

When requesting online quotes, be sure to have the following information readily available:

- Your personal details (name, age, address, etc.)

- Information about your vehicle (make, model, year, mileage, etc.)

- Your driving history (accidents, tickets, claims, etc.)

- Your desired coverage levels

By providing accurate information, you can ensure that the quotes you receive accurately reflect your specific insurance needs and preferences as a Colorado woman or family.

Understanding Colorado Car Insurance Coverage Options

Colorado drivers have several car insurance coverage options to consider, each offering different levels of protection:

Liability Coverage

Liability insurance is the minimum required coverage in Colorado, paying for damages and injuries you cause to other drivers and their vehicles in an at-fault accident. This coverage is essential for protecting your financial well-being in the event of an accident.

Collision Coverage

Collision coverage protects your vehicle if you are involved in a collision with another car or object, regardless of fault. This is particularly important for Colorado women and families who rely on their vehicles for everyday transportation.

Comprehensive Coverage

Comprehensive insurance covers non-collision damages to your vehicle, such as theft, vandalism, or weather-related events. This coverage can provide valuable protection in Colorado, where extreme weather conditions can pose a significant risk.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you are involved in an accident with a driver who has no insurance or inadequate coverage to pay for your losses. As a Colorado woman or family, this coverage can offer crucial protection in an unexpected situation.

Medical Payments Coverage

Medical payments coverage helps pay for medical expenses for you and your passengers, regardless of who is at fault in an accident. This can be particularly useful for Colorado families with children or elderly relatives riding in the vehicle.

Carefully evaluating these coverage options and selecting the right combination can provide you with the best protection for your needs and budget as a Colorado woman or family.

FAQ

Q: What is the average cost of car insurance in Colorado?

A: According to our research, the average cost of car insurance in Colorado is $2,173 per year for a full-coverage policy. However, individual rates can vary significantly based on factors such as age, driving history, location, and coverage levels.

Q: How do I find the cheapest car insurance in Colorado?

A: To find the cheapest car insurance in Colorado, we recommend the following:

- Shop around and compare quotes from multiple insurers, including Geico, State Farm, Nationwide, and USAA (for military members and their families).

- Take advantage of available discounts, such as those for good drivers, good students, military members, and bundling policies.

- Review your coverage needs and adjust your policy to find the right balance between protection and cost.

- Maintain a clean driving record to qualify for the best possible rates.

Q: What are the penalties for driving without car insurance in Colorado?

A: Driving without the minimum required car insurance in Colorado can result in significant penalties, including:

- Fines of at least $500 for the first offense and $1,000 for the second offense

- License suspension until proof of insurance is provided

- Up to 40 hours of community service

- Points added to your driving record

It’s essential for Colorado women and families to maintain the required coverage to avoid these consequences and protect their financial well-being in the event of an accident.

Conclusion

Navigating the car insurance landscape in Colorado can be a complex endeavor, but with the right knowledge and strategies, you can find affordable coverage that meets your unique needs as a Colorado woman or family. By understanding the state’s insurance requirements, key factors that influence rates, and the top providers in the market, you can make informed decisions and secure the protection you need at a reasonable cost.

Remember to shop around, take advantage of available discounts, and regularly review your coverage to ensure you’re getting the best value for your money. With a little research and diligence, you can confidently find the perfect Colorado auto insurance solution for your driving needs and budget.