As a young driver in Colorado, navigating the world of auto insurance can feel like a daunting task. With higher premiums and a myriad of factors influencing your rates, it’s crucial to approach the process with a strategic plan. In this comprehensive guide, we’ll walk you through the key steps to securing the best Colorado auto insurance quote tailored to your needs and budget.

Understanding Colorado’s Auto Insurance Requirements

Before you start comparing quotes, it’s essential to familiarize yourself with the minimum insurance coverage required by the state of Colorado. All drivers must carry the following liability insurance:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident. This coverage helps pay for medical expenses if you’re at fault in an accident and injure someone.

- Property Damage Liability: $15,000 per accident. This pays for the cost of repairing or replacing the other driver’s vehicle or property.

While these are the legal minimums, it’s generally a good idea to consider additional coverage, such as uninsured/underinsured motorist protection. This can provide financial protection if you’re involved in an accident with a driver who doesn’t have adequate insurance.

Factors That Influence Your Colorado Auto Insurance Rates

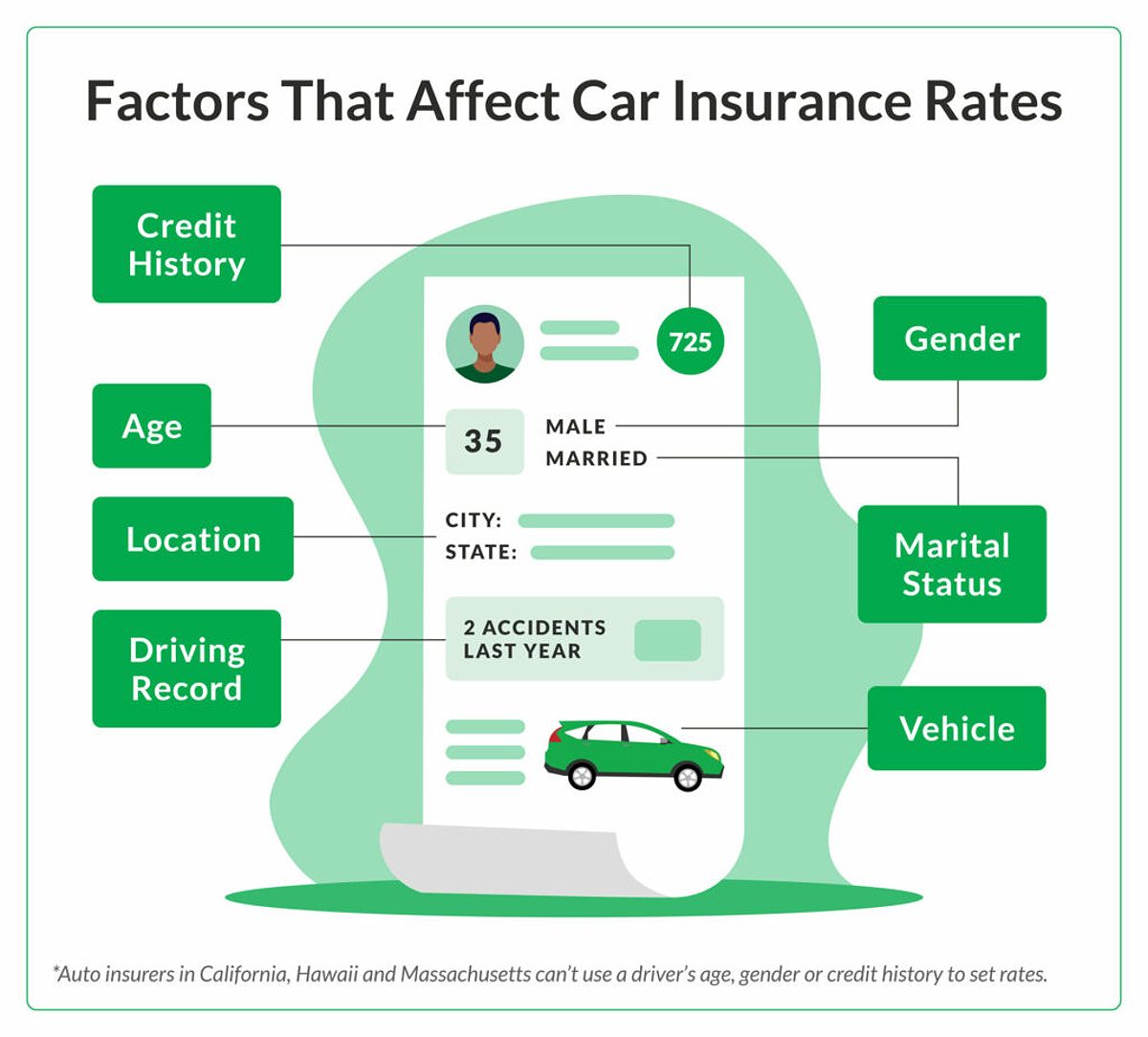

As a young driver, several key factors will come into play when insurance providers determine your rates. Understanding these elements can help you make informed decisions and potentially save money on your Colorado auto insurance.

-

Age and Driving Experience: Insurance companies often view younger drivers as higher-risk, as statistics show they are more likely to be involved in accidents. Your age and the length of your driving history can significantly impact your premiums.

-

Driving History: Your driving record is a crucial factor. Speeding tickets, at-fault accidents, and other infractions can cause your rates to skyrocket. Maintaining a clean driving record, on the other hand, can help you qualify for discounts.

-

Vehicle Type: The car you drive can also influence your insurance costs. Vehicles with higher repair expenses, such as luxury or high-performance models, tend to have higher premiums.

-

Location: Where you live in Colorado can make a difference. Urban areas with more traffic and a higher frequency of accidents typically have higher insurance rates compared to rural regions.

-

Credit Score: Believe it or not, your credit score is another factor insurers consider when determining your Colorado auto insurance rates. Maintaining a healthy credit history can help you secure better rates.

5 Steps to Finding the Cheapest Colorado Auto Insurance Quote

Now that you understand the key factors affecting your rates, let’s dive into the steps to help you find the most affordable Colorado auto insurance quote as a young driver.

-

Shop Around: The first and most crucial step is to compare quotes from multiple insurance providers. Don’t just stick with the first company you find — take the time to gather quotes from at least three to five different insurers to ensure you’re getting the best deal.

-

Maximize Discounts: Insurance companies often offer a variety of discounts that can help lower your rates as a young driver. Be sure to ask about opportunities such as good student, safe driver, and multi-car discounts. Providing proof of your academic achievements or clean driving record can help you qualify for these money-saving benefits.

-

Consider Raising Your Deductible: Increasing your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can significantly reduce your monthly premiums. Just make sure you have the financial means to cover the higher deductible if needed.

-

Maintain a Clean Driving Record: Driving safely and avoiding risky behaviors, such as speeding and distracted driving, is essential. Keeping your driving record clean can help you maintain lower insurance rates and potentially earn additional discounts.

-

Review and Reevaluate Regularly: Don’t set and forget your Colorado auto insurance policy. Review your coverage annually and compare quotes to ensure you’re still getting the best deal. Your needs and the insurance market can change over time, so staying proactive is key.

The Benefits of Usage-Based Insurance for Young Colorado Drivers

In the ever-evolving world of auto insurance, a new trend is gaining traction: usage-based insurance (UBI). As a young driver in Colorado, this type of policy could provide you with significant advantages.

-

Personalized Pricing: UBI policies use telematics technology to track your driving behavior, such as speed, braking, and mileage. This allows insurers to offer you a rate that’s tailored to your actual driving habits, rather than relying solely on demographic factors.

-

Potential for Savings: By demonstrating safe and responsible driving, you can earn substantial discounts on your Colorado auto insurance premiums. Some UBI programs offer savings of up to 30% or more.

-

Improved Driving Habits: The real-time feedback provided by UBI apps and devices can help you identify and correct risky driving behaviors, making you a safer driver and reducing the likelihood of accidents.

-

Flexibility: Many UBI programs offer the ability to adjust your coverage and deductibles based on your driving patterns and needs, allowing you to optimize your policy as your life and driving habits evolve.

As you explore your Colorado auto insurance options, be sure to consider the benefits of usage-based insurance. It could be the key to unlocking the most affordable and personalized coverage for you as a young driver.

Comparing Traditional vs- Usage-Based Insurance

While usage-based insurance offers several advantages, it’s important to weigh the pros and cons compared to traditional auto insurance policies. Here’s a quick comparison:

Traditional Auto Insurance:

- Rates based on demographic factors like age, location, and vehicle type

- Less personalized, one-size-fits-all approach

- Typically higher monthly premiums

- Less flexibility to adjust coverage and deductibles

Usage-Based Insurance (UBI):

- Rates based on your actual driving behavior

- Highly personalized and tailored to your driving habits

- Potential for significant savings (up to 30% or more)

- Provides real-time feedback to improve your driving

- Flexible adjustments to coverage and deductibles

Ultimately, the choice between traditional and usage-based insurance will depend on your individual needs, driving habits, and financial situation. It’s worth exploring both options to determine the best fit for you as a young driver in Colorado.

FAQ

Q: What are the average costs for young drivers in Colorado?

A: As a young driver in Colorado, you can expect to pay higher premiums compared to more experienced drivers. Exact costs can vary widely based on factors like your age, location, vehicle, and driving history, but you’re generally looking at $150-$300 or more per month.

Q: How can I qualify for a good student discount on my Colorado auto insurance?

A: Most insurers offer a good student discount if you maintain a GPA of 3.0 or higher. Make sure to check with your provider and provide a recent report card or transcript as proof of your academic performance.

Q: What should I do if I get a speeding ticket in Colorado?

A: Getting a speeding ticket is never fun, but the best thing to do is pay it off quickly and avoid any further infractions. While it may temporarily increase your rates, maintaining a clean record over time can help mitigate the impact on your Colorado auto insurance costs.

Conclusion

As a young driver in Colorado, navigating the world of auto insurance can be a complex task, but with the right approach, you can find the most affordable coverage that meets your needs. By understanding the state’s requirements, identifying the key factors that influence your rates, and following the steps outlined in this guide, you’ll be well on your way to securing the best Colorado auto insurance quote.

Remember, staying proactive, taking advantage of discounts, and maintaining a safe driving record are all crucial to saving money on your auto insurance. With a little research and diligence, you can get the coverage you need at a price that fits your budget. Whether you opt for a traditional or usage-based policy, the key is to explore all your options and find the solution that works best for you as a young driver in Colorado.