As a young driver in Texas, navigating the world of car insurance can feel daunting. With so many options and requirements to consider, it’s crucial to find the right coverage that fits your needs and budget. In this comprehensive guide, I’ll walk you through the essential steps to getting the best car insurance quotes in Texas, helping you save money and ensuring you have the protection you need on the road.

Texas is known for its vast network of roads and highways, which means teen drivers face unique challenges when it comes to auto insurance. Whether you’re just starting the process of obtaining your driver’s license or looking to update your existing policy, this article will provide you with the information and tools to make informed decisions.

Texas Car Insurance Requirements for Teen Drivers

In Texas, all drivers, including teenagers, are required to carry a minimum amount of liability insurance. This coverage protects others if you’re involved in an accident and found to be at fault. The minimum liability insurance requirements in Texas are:

- $30,000 per person and $60,000 per accident for bodily injury liability

- $25,000 per accident for property damage liability

While these are the legal minimums, it’s crucial to consider additional coverage options, such as collision and comprehensive insurance. As a teen driver, you’re statistically more likely to be involved in an accident, and these extra protections can provide valuable financial safeguards.

According to the Texas Department of Transportation, a reportable car accident occurred in the state every 57 seconds in 2022. This underscores the importance of having comprehensive car insurance coverage to protect myself and my vehicle.

Getting Your Texas Drivers License and Insurance

The process of obtaining a driver’s license in Texas for teens typically involves a learner’s permit and a provisional license. To get your learner’s permit, you’ll need to be at least 15 years old and complete a driver’s education course. Once you hold a learner’s permit for at least 6 months, you can then apply for a provisional license at age 16.

During this process, it’s essential to start researching car insurance options. You’ll need to provide proof of insurance when registering your vehicle and obtaining your license. Be sure to compare quotes from multiple insurance providers to find the best coverage and rates for your needs.

Finding the Best Car Insurance Quotes Texas for Teen Drivers

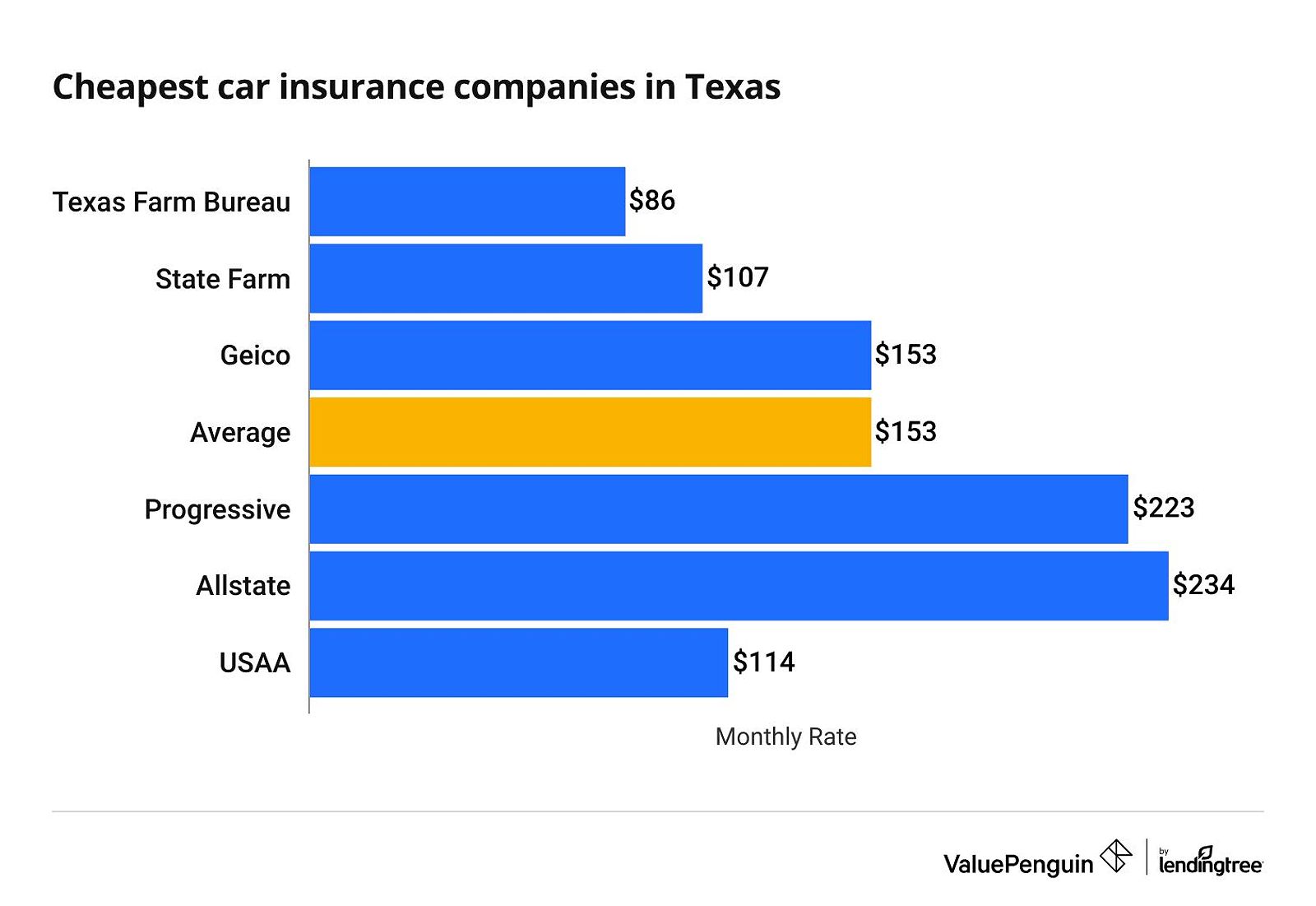

When it comes to finding the most affordable car insurance in Texas as a teen driver, it’s crucial to compare quotes from multiple providers. Some of the top insurance companies serving Texas include Texas Farm Bureau, State Farm, Geico, Allstate, Progressive, and USAA (available only to military members and their families).

Compare Quotes from Multiple Companies

Take the time to gather quotes from at least three different insurance providers. This will ensure I get the best deal and the coverage that fits my budget. I won’t just go for the cheapest option, as the cheapest rate may not always provide the level of protection I need.

Explore Discounts and Savings

There are several discounts available for teen drivers in Texas that can help lower my insurance premiums. These include:

- Good student discount: Maintain a B average or 3.0 GPA to qualify for this discount.

- Safe driver discount: Avoid accidents and traffic violations to earn this discount.

- Multi-car discount: Insure multiple vehicles on the same policy to save.

- Defensive driving course discount: Complete an approved defensive driving course to receive a premium reduction.

I’ll be sure to ask each insurance company about the discounts they offer and how to qualify for them.

Factors Affecting Insurance Premiums

As a teen driver, several factors can influence my car insurance rates, including:

- Driving history: Accidents, traffic violations, and claims can increase my premiums.

- Vehicle type: The make, model, and safety features of my car can affect my costs.

- Location: Insurance rates can vary based on my city or zip code.

- Credit score: In Texas, insurance companies may consider my credit score when determining my rates.

Understanding these factors can help me make informed decisions and take steps to minimize the impact on my insurance costs.

Tips for Teen Drivers and Their Parents

Communicate with Your Parents

I’ll involve my parents in the car insurance process. I’ll discuss my coverage options, the expected costs, and any financial responsibilities I may have. This open communication can help ensure everyone is on the same page and reduce potential misunderstandings.

Maintain a Safe Driving Record

My driving behavior has a significant impact on my car insurance rates. I’ll prioritize safe driving habits, such as obeying traffic laws, avoiding distractions, and keeping my eyes on the road. Maintaining a clean driving record can help me secure lower premiums and avoid costly premium increases due to accidents or violations.

Consider a Defensive Driving Course

Completing an approved defensive driving course in Texas can not only improve my driving skills but also potentially earn me a discount on my car insurance. These courses teach advanced techniques for hazard recognition, risk management, and accident avoidance, making me a more confident and responsible driver.

Additional Considerations for Teen Drivers in Texas

Understanding Texas Teen Driving Laws

In addition to the minimum insurance requirements, it’s essential for teen drivers in Texas to be aware of the specific laws and regulations that apply to them. This includes restrictions on the number of passengers, nighttime driving, and the use of electronic devices while behind the wheel. Familiarizing myself with these rules can help me stay compliant and avoid penalties that could impact my insurance rates.

Preparing for the Transition to Full Licensing

As a teen driver in Texas, I’ll progress through the learner’s permit and provisional license stages before eventually obtaining a full driver’s license. Each of these stages comes with its own set of requirements and limitations. By understanding the timeline and planning ahead, I can ensure a smooth transition and maintain continuous insurance coverage.

Considering Usage-Based Insurance Options

Some insurance providers in Texas offer usage-based insurance programs, which can be particularly beneficial for teen drivers. These programs use telematics devices or mobile apps to track your driving behavior, such as speed, acceleration, and braking. If I demonstrate safe driving habits, I may be eligible for discounts on my premiums. Exploring these options can help me save money while reinforcing responsible driving practices.

FAQ

Q: What is the average cost of car insurance for teen drivers in Texas?

A: The average cost of car insurance for teen drivers in Texas can vary significantly based on several factors, such as the driver’s age, location, vehicle, and driving history. However, according to industry data, teen drivers in Texas can expect to pay higher premiums compared to more experienced drivers. The average cost for a full coverage policy for a 16-year-old driver in Texas is around $418 per month, while the average for a 30-year-old driver is approximately $153 per month.

Q: What are the best car insurance companies for teen drivers in Texas?

A: When it comes to finding the best car insurance companies for teen drivers in Texas, several providers stand out. Texas Farm Bureau often offers competitive rates for young drivers, with an average full coverage premium of $143 per month for an 18-year-old. Other top options include State Farm, Geico, and USAA (for military members and their families). However, it’s crucial to compare quotes from multiple insurers to ensure I get the best deal based on my specific needs and driving profile.

Q: Can I get car insurance if I’m a new driver in Texas?

A: Yes, you can get car insurance as a new driver in Texas. Most major insurance companies offer coverage options for teen and young adult drivers. When applying for a policy, you may need to provide additional information, such as proof of enrollment in a driver’s education course or a clean driving record. The insurance company will use this information to determine your rates and coverage options.

Conclusion

Getting the best car insurance quotes in Texas as a teen driver requires careful research, comparison, and understanding of my needs and options. By exploring the minimum insurance requirements, taking advantage of available discounts, and comparing quotes from multiple providers, I can find a policy that offers the right coverage at an affordable price.

Remember, maintaining safe driving habits is crucial not only for keeping my insurance premiums low but also for protecting myself and others on the road. Start your car insurance search today and take the first step towards securing the coverage you need as a young driver in Texas.