Hey there, fellow Pennsylvanian drivers! As The Insurance Whiz, I’m here to share my expertise on how you can snag the best car insurance quotes PA, especially if you’re a young driver. Navigating the world of car insurance can be a real headache, but don’t worry – I’ve got your back.

Understanding Car Insurance Quotes PA for Young Drivers

Why are Car Insurance Quotes Higher for Young Drivers?

Look, I get it – you’re just starting out on the road, and the thought of sky-high insurance premiums can be enough to make your head spin. But the truth is, insurance companies see young drivers like you as a higher risk. It’s not personal, it’s just the numbers.

Statistically speaking, drivers under 25 are more likely to be involved in accidents. That’s why insurance companies tend to charge us a bit more. But don’t despair! There are ways to keep those costs down.

You know, when I was a fresh-faced driver back in the day, I remember feeling so frustrated by the higher rates. I mean, it just didn’t seem fair, right? But once I learned a bit more about how the industry works, it all started to make a bit more sense.

Insurance companies base their rates on risk, and unfortunately, we younger folks have a bit more of that going on. It’s not that they’re singling us out or anything, it’s just that the data shows we’re more prone to accidents and claims. But hey, that’s where the discounts come in!

Minimum Coverage Requirements in Pennsylvania

In the Keystone State, all drivers are legally required to have a certain level of car insurance coverage. We’re talking bodily injury liability, property damage liability, and medical benefits. Now, these minimum requirements might seem like enough, but trust me, you’ll want to consider higher limits to keep yourself covered in case of an accident.

Think about it – the costs associated with an accident can add up quick. Those minimum limits might not cut it, leaving you on the hook for some serious cash. That’s why it’s crucial to understand your coverage options and find a policy that truly protects you.

I remember when I first got my license, my parents sat me down and walked me through all the different coverage types. At first, it was a bit overwhelming, but they really hammered home the importance of having the right protection. And boy, am I glad they did! That extra coverage has saved my bacon more times than I can count.

Finding Cheap Car Insurance Quotes PA for Young Drivers

Compare Quotes from Multiple Companies

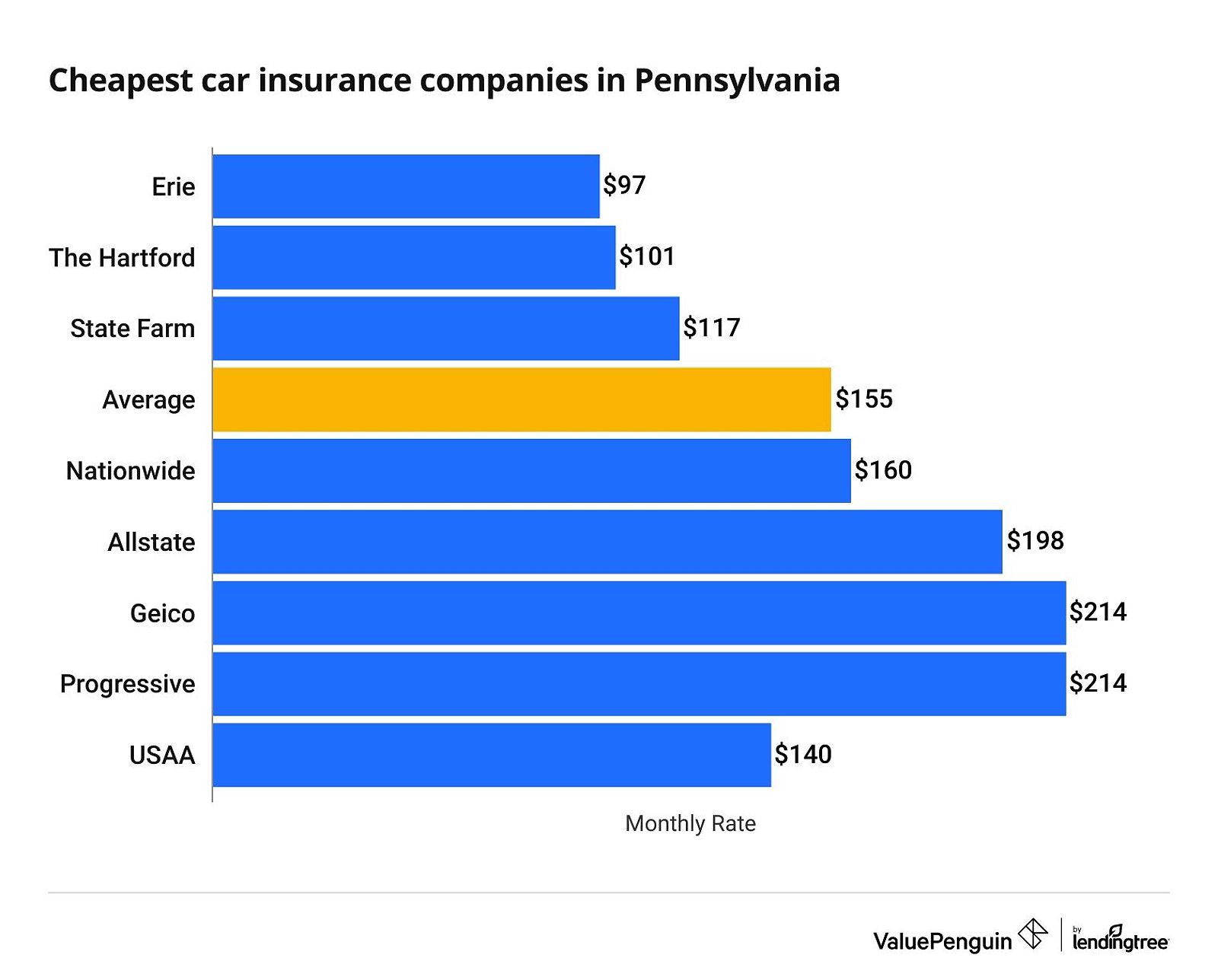

Alright, time to get down to business. The key to finding the best car insurance quotes PA is to shop around. Don’t just settle for the first offer you get – compare quotes from multiple insurers. This is where the magic happens, my friends.

Now, I know it can be tempting to just go with the cheapest option, but hold up. Make sure you’re comparing apples to apples, and that the coverage levels are similar. Some companies might offer lower premiums, but that could mean skimping on important protection.

And don’t be afraid to negotiate! If you get a better quote from one company, use that leverage to see if others can beat it. Insurance providers are often willing to match or even beat their competitors’ rates to win your business.

I’ll never forget the time I was shopping around for my policy a few years back. I got this killer quote from one company, and when I brought it to the others, they practically fell over themselves trying to give me an even better deal. It was like a full-on bidding war, and I ended up saving a ton of cash. Talk about a win-win!

Discounts for Young Drivers

Alright, let’s talk about the good news – there are actually a bunch of discounts available for young drivers in Pennsylvania. Woohoo!

For starters, you can score some serious savings if you’re a good student. Maintaining a high GPA can earn you a nice discount, because insurance companies recognize that responsible students often translate to responsible drivers.

Another biggie is the safe driver discount. If you complete a defensive driving course or keep that driving record spotless, you can save some serious cash. Insurers love to see that you’re committed to being a safe and cautious driver.

And if you’re able to share a policy with your parents, you might be eligible for a multi-car discount. Bundling your coverage can lead to substantial savings, so definitely ask your insurance provider about that one.

I remember when I first got my license, my parents were so adamant about me taking a defensive driving course. At the time, I thought they were just being overprotective, but looking back, it was one of the best decisions I ever made. Not only did it make me a safer driver, but the insurance discounts I scored were a total game-changer. Paying less for coverage and being a better driver? Sign me up!

Dealing with Speeding Tickets and Accidents

Impact of Speeding Tickets and Accidents on Car Insurance Quotes

Now, I know we all make mistakes behind the wheel, but let me tell you – those tickets and accidents can really do a number on your car insurance rates. In Pennsylvania, a single speeding ticket can hike up your premiums by a whopping 17%, and an at-fault accident? That’s a 32% increase. Ouch.

Insurance companies use your driving record as an indicator of future risk. If you’ve got a history of infractions, they see you as more likely to file a claim, and that translates to higher costs. As a young driver, this can really put a dent in your wallet.

I remember when I first got my license, I was just a little too heavy on the gas pedal. Needless to say, I ended up with a few speeding tickets under my belt, and boy, did that sting when it came time to renew my policy. But I learned my lesson, and I’ve been a model citizen on the road ever since.

Finding Affordable Insurance After a Ticket or Accident

But don’t lose hope, my friends! There are some strategies you can use to get back on track and find more affordable car insurance quotes PA, even with a blemished driving record.

First, keep shopping around. Different insurers weigh past infractions differently, so you might find one that’s a bit more forgiving. And be sure to ask about accident forgiveness programs – some providers will let that first at-fault accident slide without jacking up your rates.

Another option is to raise your deductible. This can lower your monthly premiums, but just make sure you’ve got the cash on hand to cover that higher out-of-pocket cost if you ever need to file a claim.

And here’s a tip that can really pay off: take a defensive driving course. Not only will this help you brush up on your skills, but it can also score you some sweet discounts from your insurance provider. Win-win!

I remember when I got that first speeding ticket – I thought my insurance rates were going to skyrocket, and I was so worried about how I was going to afford it. But I kept my cool, shopped around, and ended up finding a great policy that wasn’t too hard on my wallet. And that defensive driving course? Best decision I ever made!

Sharing a Policy with Parents

Benefits of Sharing a Policy with Parents

Now, let’s talk about a surefire way to save some serious cash on your car insurance – sharing a policy with your parents. As a young driver, this can be a total game-changer.

By being added to your parents’ policy, you’ll be able to take advantage of their combined driving history and experience. Insurance companies love that kind of thing, and they’ll reward it with lower premiums. Plus, you’ll get access to all sorts of family discounts and the potential for multi-car savings. Ka-ching!

I remember when I first got my license, my parents were more than happy to add me to their policy. It was a total lifesaver, to be honest. Not only did it keep my costs down, but I also learned a ton from their years of experience on the road. It was a win-win all around!

Considerations for Sharing a Policy

Of course, there are a few things to consider before jumping on the shared policy train. If your parents have a less-than-stellar driving record, it could actually end up costing you more in the long run. And you might have to deal with higher deductibles or limited coverage options.

The key is to have an open and honest conversation with your parents about the pros and cons. Make sure you’re all on the same page and understand the terms of the policy. That way, you can make the best decision for your individual needs and budget.

I remember when my parents first brought up the idea of me being on their policy. At first, I was a little hesitant, you know? I didn’t want my rates to go up just because they had a few dings on their record. But we sat down, crunched the numbers, and figured out a plan that worked for everyone. It’s all about communication and compromise!

FAQ

Q: What is the average cost of car insurance for young drivers in Pennsylvania?

A: The average cost of car insurance for young drivers in Pennsylvania can vary quite a bit, depending on factors like your age, driving history, vehicle type, and coverage levels. But you can generally expect to pay significantly more than older, more experienced drivers.

When I was a fresh-faced young driver back in the day, I remember my insurance quotes being through the roof. It was like I was practically funding the entire industry on my own! But as I gained more experience and took advantage of those discounts, my rates started to come down. These days, I’m paying a fraction of what I used to, and it’s made a huge difference in my budget.

Q: Can I get car insurance if I’m under 18?

A: Absolutely! If you’re under 18, you can get car insurance, but you’ll need a parent or legal guardian to co-sign the policy with you.

I remember when I was 17 and trying to figure out this whole insurance thing. It was a bit of a headache, to be honest, but my parents were there to guide me through the process. Having that extra support and signature made all the difference in getting me covered and on the road.

Q: What are some tips for getting a good deal on car insurance as a young driver?

A: Here are a few of my top tips:

- Shop around and compare quotes from multiple insurance companies

- Take advantage of discounts for good students and safe drivers

- Consider sharing a policy with your parents

- Maintain a clean driving record to keep your rates low

When I was starting out, I was all about finding the cheapest option possible. But I quickly learned that it’s not just about the bottom line – it’s about finding the right coverage to protect yourself. By shopping around, taking advantage of discounts, and keeping that driving record spotless, I was able to find a policy that fit my budget and gave me the peace of mind I needed.

Conclusion

Well, there you have it, folks – everything you need to know about getting the best car insurance quotes PA as a young driver. It may seem like a daunting task, but with a little elbow grease and some savvy strategy, you can totally score a great deal.

Remember, the key is to shop around, take advantage of discounts, and keep that driving record squeaky clean. And if you need a little extra help, don’t hesitate to reach out to your friendly neighborhood Insurance Whiz. I’m always here to lend a hand and make sure you’re cruising down the road with the perfect coverage.

So what are you waiting for? Start comparing those car insurance quotes PA today and let’s get you on the road to savings and confidence. Drive safe, my friends!