Hey there, it’s The Insurance Whiz here! As someone who’s been navigating the car insurance world for young drivers in Pennsylvania for years, I’m excited to share my insider tips and tricks with you. Getting affordable coverage doesn’t have to be a headache – with the right approach, you can find the perfect policy that fits your budget and your needs. This article will guide you through the process of getting car insurance quotes in PA, ensuring you get the best deal possible.

Understanding PAs Car Insurance Requirements

First things first, let’s talk about the basics. In the Keystone State, all drivers are required to have a minimum of $15,000 in bodily injury liability per person, $30,000 in bodily injury liability per accident, and $5,000 in property damage liability. On top of that, you’ll need $5,000 in medical benefits coverage. These are the bare minimums, but I always recommend exploring higher liability limits and additional coverage options to make sure you’re fully protected.

Liability Coverage: The Backbone of Your Policy

Liability coverage is the foundation of your car insurance, folks. It helps pay for the damages and injuries you might cause to others if you’re found at-fault in an accident. While the minimum requirements are designed to cover the basics, they may not be enough if things go really wrong. Imagine causing a serious crash that results in sky-high medical bills or major property damage – the minimum coverage could leave you on the hook for the rest. That’s why it’s important to consider upgrading to higher liability limits.

Full Coverage for Extra Peace of Mind

As a young driver, you might also want to look into full coverage insurance, which includes collision and comprehensive coverage. Collision coverage has got your back when your car gets dinged up, no matter who’s to blame. Comprehensive coverage, on the other hand, shields you from non-collision incidents like theft, vandalism, or weather-related mishaps. Sure, full coverage comes with a higher price tag, but it can be a wise investment, especially if you’ve got a newer or more valuable vehicle. It’s all about weighing the potential risks and costs.

Factors That Affect Your Rates

Now, let’s talk about what’s really going to impact your car insurance premiums as a young driver in PA. Your age and driving experience are big ones – statistically, us youngsters are more likely to get into accidents, so insurers tend to charge us higher rates. The type of car you drive and where you live in the state can also play a role, with urban areas generally seeing higher prices due to increased accident risks. But don’t worry, there are ways to offset these factors and keep your costs down.

Finding Affordable Car Insurance Quotes in PA

Alright, time to put on your savvy shopper hat! The key to getting cheap car insurance quotes in PA is to compare, compare, compare. Don’t just settle for the first offer you get – shop around with multiple insurers to find the best deal. Many handy websites let you input your info once and instantly get quotes from all the top providers. Just make sure you give them accurate details about your driving history, vehicle, and desired coverage levels.

Unlock Those Discounts, Young Padawan

As a young driver, you’ve got some discounts working in your favor. Good student discounts, safe driver discounts, and multi-car discounts (if you can tag along on your parents’ policy) can all help lower your premiums. Just be sure to ask your insurance company about every possible discount – you never know what kind of savings you might uncover.

Stay Safe and Keep Those Rates Low

You know what they say – practice makes perfect. The more experience you rack up behind the wheel, the better. And by keeping your driving record squeaky clean, you’ll show insurers that you’re a responsible, low-risk driver. Avoiding things like speeding tickets and at-fault accidents is key to keeping your rates down. You can also consider taking a defensive driving course, which not only sharpens your skills but may even score you an additional discount.

Going the Extra Mile for Your Car Insurance

Alright, now that we’ve covered the basics, let’s dive into a few more tips to help you really maximize your savings.

Piggyback on Your Parents’ Policy

One of the best ways for young drivers to save on car insurance in PA is to join your parents’ policy. This allows you to take advantage of multi-car and multi-policy discounts, plus you’ll get the same great coverage as your folks. Just make sure to discuss the option with them and see if it makes sense for your situation.

Find the Right Deductible for You

When choosing your car insurance coverage, the deductible you select can have a big impact on your premiums. Generally, the higher your deductible, the lower your monthly payments will be. But that also means you’ll have to pay more out of pocket if you ever need to file a claim. It’s all about finding the sweet spot that fits your budget and your comfort level with risk.

Understand Your Policy Inside and Out

As a young driver, it’s crucial that you really understand the ins and outs of your car insurance policy. Don’t be afraid to ask your agent or the insurance company all the questions you’ve got – the more you know, the better equipped you’ll be to make informed decisions. Reviewing your coverage annually or after any major life changes can also help you stay on top of things and ensure you’re getting the best deal.

The Importance of Regularly Reviewing Your Coverage

Speaking of reviewing your coverage, that’s something I can’t stress enough. As a young driver, your needs and circumstances can change a lot over time. Maybe you get a new car, move to a different area, or even just gain more experience on the road. That’s why it’s so important to take a fresh look at your car insurance policy at least once a year, or whenever you hit a major life milestone.

By keeping tabs on your coverage, you can make sure you’re still getting the protection you need at the best possible price. Who knows, maybe there’s a new discount or a lower rate that you’re eligible for but didn’t know about before. Plus, regularly reviewing your policy can help you catch any errors or gaps in your coverage before they become a big problem.

FQAs

Q: What are the best car insurance companies for young drivers in PA?

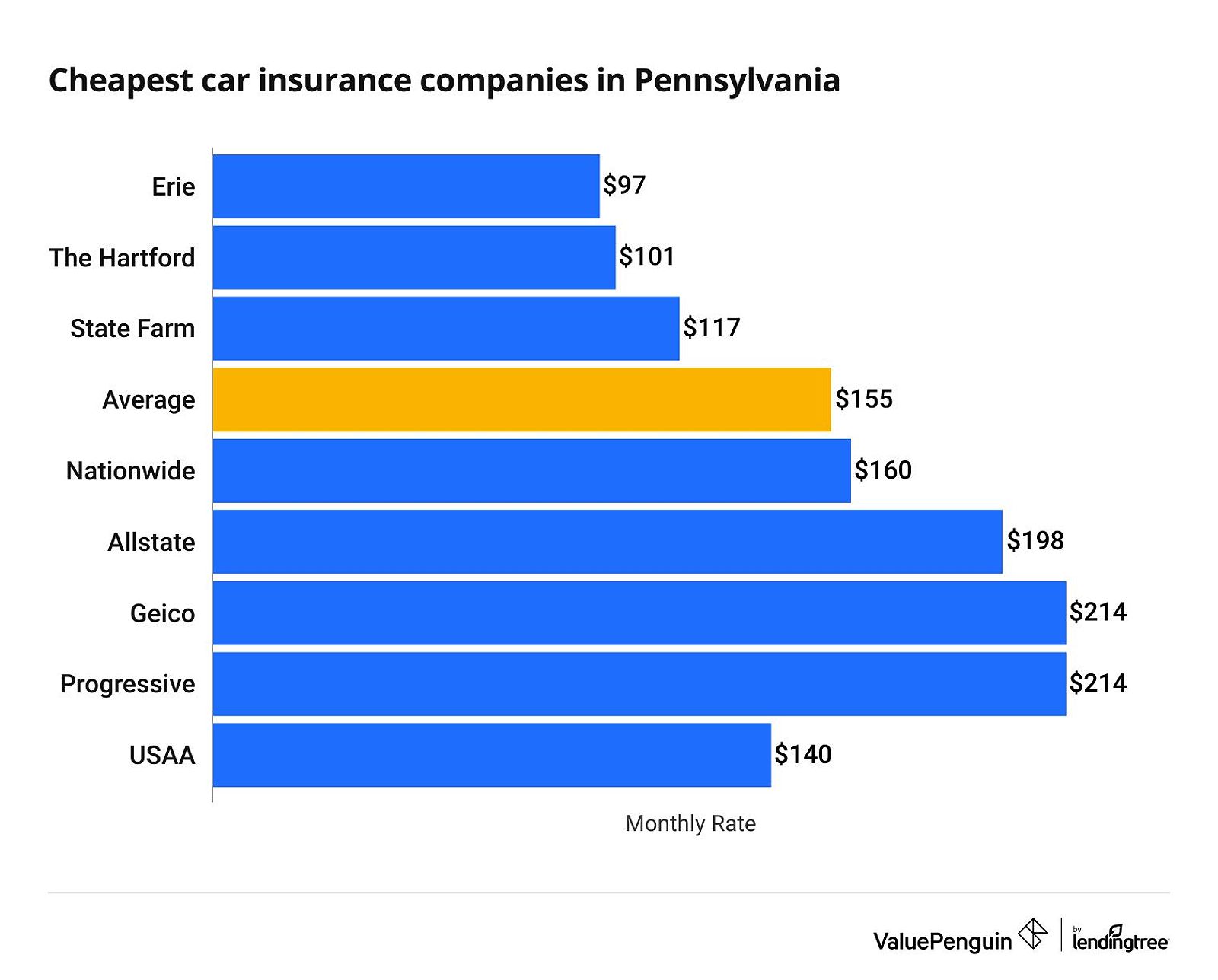

A: Some of the top options for young drivers in Pennsylvania include Erie, The Hartford, and USAA (for eligible military members and their families). These insurers often offer competitive rates and a variety of discounts tailored to our age group.

Q: How can I lower my car insurance premiums after getting a ticket?

A: If you’ve received a traffic violation, your rates may go up. But don’t worry, there are ways to counteract that. Taking a defensive driving course can earn you a nice discount, and continuing to drive safely after the ticket will help your premiums come back down over time.

Q: What should I do if I’m involved in an accident?

A: First and foremost, call the police and exchange info with any other drivers involved. Then, report the accident to your insurance company as soon as possible, providing them with all the details. They’ll guide you through the claims process and make sure you get the coverage you need to get your car fixed and cover any medical expenses.

Conclusion

Whew, that’s a lot of information to digest, but I promise it’s worth it! As a young driver in PA, finding affordable car insurance doesn’t have to be a constant headache. By understanding the state’s requirements, comparing quotes, taking advantage of discounts, and driving safely, you can get the coverage you need at a price that won’t break the bank. Just remember to stay proactive, ask lots of questions, and don’t be afraid to shop around. With a little due diligence, you’ll be cruising the roads of the Keystone State with the perfect car insurance policy in no time. Happy driving, my friends!

In July 2024, I decided to take a fresh look at my car insurance policy. As a young driver in Pennsylvania, I knew that finding affordable coverage was crucial, especially with the higher premiums we often face. But with the right strategies, I was determined to secure the protection I needed without blowing my budget.

First, I made sure I had a solid understanding of the state’s minimum car insurance requirements. In PA, drivers need at least $15,000 in bodily injury liability per person, $30,000 in bodily injury liability per accident, and $5,000 in property damage liability. On top of that, we need $5,000 in medical benefits coverage. While these are the legal minimums, I decided to explore higher liability limits to really safeguard my assets in case of a serious accident.

Liability coverage is the backbone of any car insurance policy, so I knew it was crucial to get that part right. The minimum levels might cover basic scenarios, but they could leave me on the hook for major expenses if I caused a wreck with significant damage or injuries. I didn’t want to take that risk, so I made sure to carefully consider my options and select the right liability limits for my needs.

In addition to liability coverage, I also looked into full coverage insurance, which includes collision and comprehensive protection. Collision coverage has your back when your car gets dinged up, no matter who’s at fault. Comprehensive coverage shields you from non-collision incidents like theft, vandalism, or weather-related mishaps. While the extra coverage comes at a higher cost, I felt it was worth the investment, especially since I had a newer, more valuable vehicle.

Of course, as a young driver, I knew my rates would be on the higher side. Factors like my age, driving experience, and vehicle type all play a big role in how much insurers charge. Living in a more urban area of PA also contributed to my premiums being a bit steeper. But I was determined to find ways to offset those costs and get the best deal possible.

The key, I learned, was to shop around and compare quotes from multiple insurance providers. I used handy online tools to get personalized estimates, making sure to input accurate details about my driving history, car, and desired coverage levels. This allowed me to easily compare options and find the most affordable policy that still gave me the protection I needed.

As I dug into the quote-gathering process, I also made sure to ask about any discounts I might be eligible for. Being a good student, maintaining a clean driving record, and even sharing a policy with my parents all helped me unlock significant savings. I made sure to explore every possible discount to maximize my car insurance budget.

Of course, keeping my driving record spotless was crucial too. The more experience I gained and the safer I drove, the better my rates would be. I even enrolled in a defensive driving course, which not only sharpened my skills but also scored me an extra discount from my insurer.

In the end, taking the time to understand Pennsylvania’s car insurance requirements, compare quotes, and take advantage of every available discount paid off big time. I was able to find a comprehensive policy that gave me the peace of mind I needed, all while fitting comfortably within my budget as a young driver.

As I look ahead, I know it’s important to regularly review my coverage to ensure I’m still getting the best deal. My needs and circumstances can change, so I’ll be sure to revisit my policy at least once a year, or any time I hit a major life milestone. That way, I can stay on top of things and make sure I’m always maximizing my savings.

So, if you’re a young driver navigating the car insurance landscape in PA, take it from me – with the right approach, you can absolutely find affordable coverage that meets your needs. Just stay informed, shop around, and don’t be afraid to ask lots of questions. Your wallet (and your peace of mind) will thank you. Happy driving, fellow Pennsylvanians!