Hey there, fellow Colorado driver! If you’re like me, the excitement of getting your first car can quickly be overshadowed by the headache of finding affordable car insurance. I know the feeling all too well – as a young driver in the Centennial State, the insurance rates can be downright intimidating.

But don’t worry, I’ve got your back! In this guide, I’m going to take you on a journey through the ins and outs of car insurance in Colorado, with a special focus on us young’uns. We’ll dive into the factors that affect our rates, uncover the best companies for us, and share some insider tips to help you score the best deals. By the time we’re done, you’ll be armed with the knowledge to navigate the insurance landscape like a pro, including how to get the best car insurance quotes Colorado has to offer.

Understanding Colorado’s Car Insurance Requirements

First things first, let’s talk about the mandatory coverage we need to hit the roads in Colorado. The state requires all drivers to have a minimum of $25,000 in bodily injury liability per person, $50,000 in bodily injury liability per accident, and $15,000 in property damage liability. While that might sound like a lot, trust me, it’s barely enough to keep you covered in the event of an accident.

That’s why it’s crucial to consider adding some extra protection, like collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage. These optional policies can provide a safety net for everything from vehicle damage to medical expenses. Sure, they’ll cost a bit more, but trust me, it’s worth it for the peace of mind.

Factors Affecting Car Insurance Rates for Young Drivers in Colorado

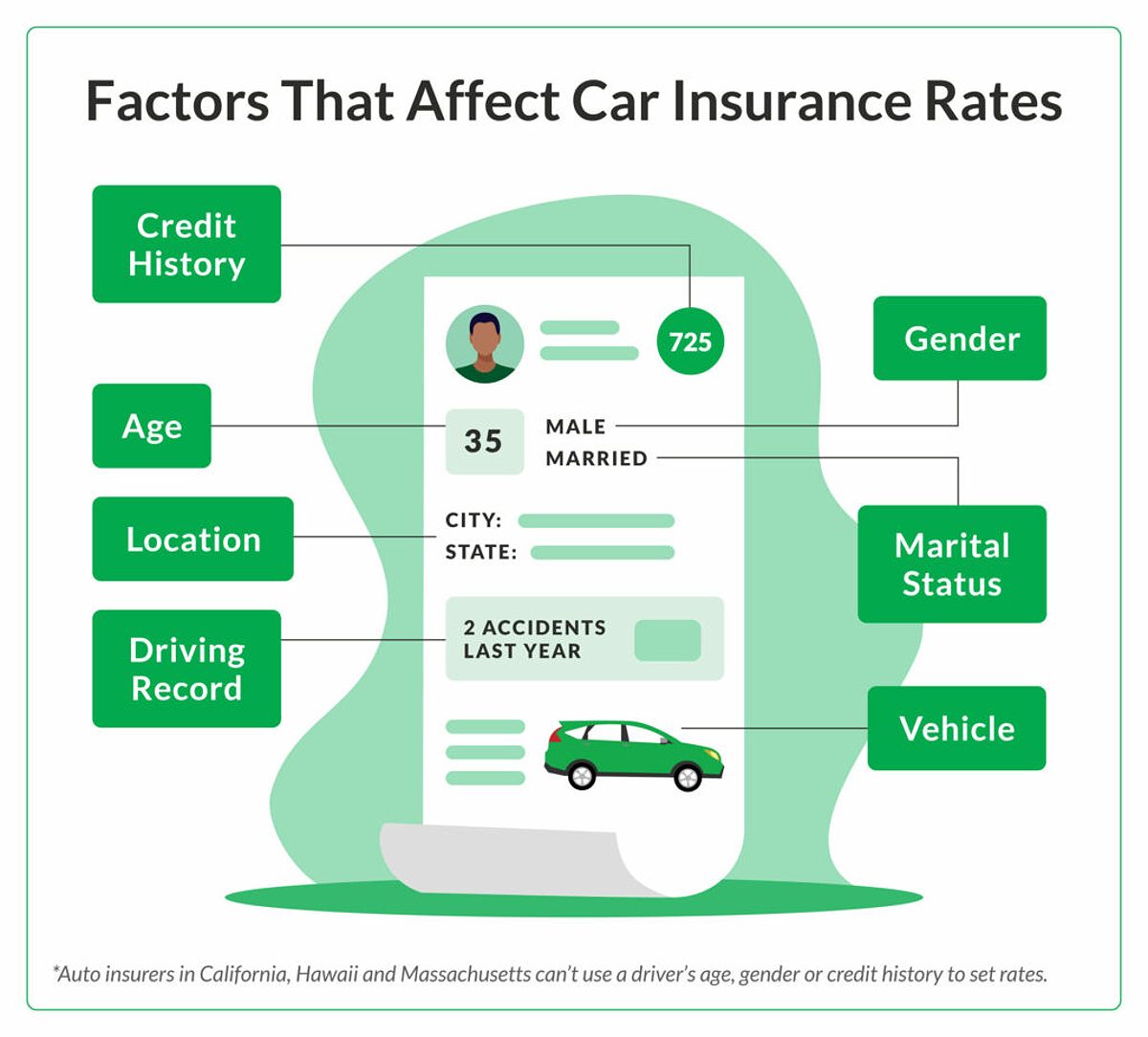

Now, let’s dive into the nitty-gritty of what’s driving up our insurance costs as young drivers in Colorado. It’s all about that dreaded R-word: risk. Insurance companies see us as a higher risk, which means higher premiums.

Age and Driving Experience

Yep, the fewer years we have under our belts, the more we pay. But don’t worry, as we rack up those driving miles and keep our records clean, our rates will start to come down.

Driving Record

Speaking of keeping it clean, that squeaky-clean driving record is gold when it comes to insurance. Speeding tickets, accidents, and DUIs can all send our premiums skyrocketing. So, let’s keep our hands off those distractions and eyes on the road, my friends.

Vehicle Type

The car we choose can also play a big role in our insurance costs. Factors like the vehicle’s safety features, repair costs, and theft risk all factor into the equation. I’d suggest doing some research on the insurance implications of the cars we’re considering before making a purchase.

Geographic Location

Where we live in Colorado can also impact our rates. Drivers in bustling areas like Denver or Colorado Springs may pay more than those in rural communities. It’s all about that traffic congestion and accident risk.

Credit Score

Surprise, surprise, our credit score can also influence our insurance rates. Insurers see a lower credit score as a sign of higher risk, so keeping that score in tip-top shape can help us secure better deals.

Finding the Best Car Insurance Quotes for Young Drivers in Colorado

Alright, now that we know what’s behind those sky-high insurance rates, let’s talk about how to find the most affordable coverage. The key is to shop around and compare quotes from multiple insurers. Trust me, it’s the only way to ensure you’re getting the best deal.

Based on my research, some of the top insurance companies that offer competitive rates for young drivers in Colorado include Geico, Southern Farm Bureau, State Farm, Nationwide, and USAA (for those of us with military connections). These guys often have special discounts and programs tailored just for us young’uns, like good student discounts, defensive driving course credits, and multi-car/multi-policy savings.

So, how do we get those quotes? Well, it’s all about using those online tools, contacting local agents, and being prepared to provide accurate info about our driving history, vehicles, and personal details. By comparing quotes side-by-side, we can identify the most cost-effective option that meets our coverage needs.

Saving Money on Car Insurance as a Young Driver in Colorado

Now, let’s talk about some practical ways we can lower those insurance premiums. Because let’s be real, we’ve got better things to do with our money than overpay for car insurance, am I right?

First and foremost, keeping that driving record squeaky clean is key. Avoiding traffic violations, speeding tickets, and at-fault accidents shows insurers that we’re responsible behind the wheel. And hey, even taking a defensive driving course can earn us some sweet discounts!

Another tip? Bundling our insurance policies. If we have other insurance needs, like renters or homeowners coverage, combining them with our car insurance can lead to some major savings through those multi-policy discounts.

Oh, and don’t forget about that deductible. Opting for a higher deductible can lower our monthly payments, but just make sure it’s an amount we can comfortably afford if we ever need to file a claim.

Understanding SR-22 Insurance in Colorado

Now, let’s quickly touch on a not-so-fun topic: SR-22 insurance. If we find ourselves in a situation where our license has been suspended or we’ve had a DUI conviction, we may be required to file an SR-22 form with the Colorado DMV.

An SR-22 isn’t a type of insurance, but rather a certificate of financial responsibility that our insurance provider has to file on our behalf. The key is to maintain continuous coverage and keep that SR-22 active for the required period, usually three years. Fail to do so, and we could be looking at an immediate license suspension. Yikes!

Wrapping it Up

Well, there you have it, my fellow young Colorado drivers! We’ve covered a lot of ground, from understanding the insurance requirements to finding the best deals and even navigating the dreaded SR-22 situation.

Remember, the key to securing affordable car insurance in Colorado is to shop around, take advantage of discounts, and keep that driving record sparkling clean. With a little know-how and some strategic shopping, you’ll be cruising the roads of the Centennial State with confidence and peace of mind.

Now, go forth and conquer those insurance quotes, my friend! And if you have any other questions, don’t hesitate to reach out. I’m always happy to lend a hand (or an insurance tip) to my fellow Colorado youngins.

FAQ

Q: What are the best car insurance companies for young drivers in Colorado? A: Based on my research, some of the top insurance companies that offer competitive rates for young drivers in Colorado include Geico, Southern Farm Bureau, State Farm, Nationwide, and USAA (for eligible military members and their families).

Q: How can I get a discount on my car insurance as a young driver? A: There are several ways to save on car insurance as a young driver in Colorado, such as maintaining a clean driving record, taking a defensive driving course, bundling insurance policies, increasing your deductible, and taking advantage of discounts like good student and safe driver programs.

Q: What happens if I get a speeding ticket or have an accident? A: Getting a speeding ticket or being involved in an at-fault accident can significantly increase your car insurance rates in Colorado. These incidents are seen as red flags by insurers, as they indicate a higher risk profile. It’s crucial to drive safely and avoid any violations to keep your premiums as low as possible.

Q: How can I register my car in Colorado? A: To register your car in Colorado, you’ll need to visit your local DMV office and provide the required documentation, such as the vehicle’s title, proof of insurance, and payment for the registration fees. The DMV website has all the detailed information you’ll need to complete the process smoothly.

Q: What is SR-22 insurance and when do I need it? A: SR-22 insurance is not a type of coverage, but rather a certificate of financial responsibility that your insurance provider must file with the Colorado DMV. You may be required to have an SR-22 if your license has been suspended or you’ve had a DUI conviction. Maintaining continuous coverage and keeping the SR-22 active for the specified period is crucial to avoid further license suspension.