Hey there, fellow Texan! Are you a teen driver trying to navigate the wild world of car insurance? Well, you’re in the right place. As The Insurance Whiz, I’ve got your back with a comprehensive guide to help you find the best car insurance quote in the Lone Star State.

Understanding Texas Car Insurance Requirements for Teens

First things first, let’s talk about the legal requirements for car insurance in Texas. As a teen driver, you’re required to carry a minimum of liability coverage, which includes:

- Bodily Injury Liability: $30,000 per person and $60,000 per accident

- Property Damage Liability: $25,000 per accident

Now, I know what you’re thinking: “That’s great, but what about protecting my own ride?” Well, my friend, you might want to consider adding some extra coverage, like collision and comprehensive protection. These can help cover the cost of repairing or replacing your car if you’re in an accident or the victim of theft or natural disaster.

And let’s not forget about uninsured/underinsured motorist coverage. In Texas, there are a lot of drivers out there who don’t have enough (or any) insurance, and you don’t want to be stuck footing the bill if you get into an accident with one of them.

Factors Influencing Car Insurance Rates for Texas Teens

Now, let’s talk about what’s really going to impact your car insurance premiums as a teen driver in Texas. Here are the big ones:

-

Driving Record: You better believe your driving history is a huge factor. If you’ve got a clean record, free of speeding tickets and at-fault accidents, you’re in great shape. But if you’ve, you know, had a few mishaps, your rates could skyrocket.

-

Vehicle Type and Age: The car you drive can also affect your insurance costs. As a general rule, newer and sportier vehicles tend to be more expensive to insure. So, if you’re rocking a classic ’78 Camaro, your premiums might be a little lower than if you were driving a shiny new Corvette.

-

Location: Where you live in Texas can also play a role. Drivers in urban areas with high traffic and crime rates often pay more for coverage than those in the suburbs or rural areas.

-

Credit Score: Yep, even your credit score can impact your car insurance rates. Insurance companies use this as an indicator of risk, so if your credit is a little rough, you might end up paying more.

Finding the Best Car Insurance Quote for Texas Teen Drivers

Alright, now that you know the lay of the land, let’s talk about how to actually find the best car insurance quote in Texas. The key is to shop around and compare quotes from multiple insurers. Many companies have user-friendly online tools that make this process a breeze.

When you’re comparing quotes, don’t just look at the base price. Make sure to consider the coverage levels and any available discounts, too. As a teen driver, you might be eligible for some sweet savings, like:

-

Good Student Discount: If you’re rocking a solid GPA, you could qualify for a discount that could shave some serious cash off your premium.

-

Safe Driver Discount: Maintaining a clean driving record can also earn you a nice little discount from your insurer.

-

Multi-Car Discount: If you’re able to insure multiple vehicles with the same company, you might be able to score a multi-car discount.

Don’t be afraid to negotiate with the insurance companies, either. Ask about any additional ways you can save, and don’t be afraid to shop around every year or so to make sure you’re still getting the best deal.

Tips for Texas Teen Drivers to Save on Car Insurance

Alright, let’s wrap this up with a few extra tips to help you save on car insurance as a teen driver in Texas:

-

Keep That Record Squeaky Clean: Seriously, avoid accidents and traffic violations like the plague. It’s one of the best ways to keep your rates low.

-

Take a Defensive Driving Course: Completing an approved defensive driving class can demonstrate your commitment to safe driving and potentially earn you a discount.

-

Shop Around Regularly: Car insurance rates can fluctuate, so it’s a good idea to compare quotes from multiple providers at least once a year.

FAQ

Q: What are the best car insurance companies for teen drivers in Texas?

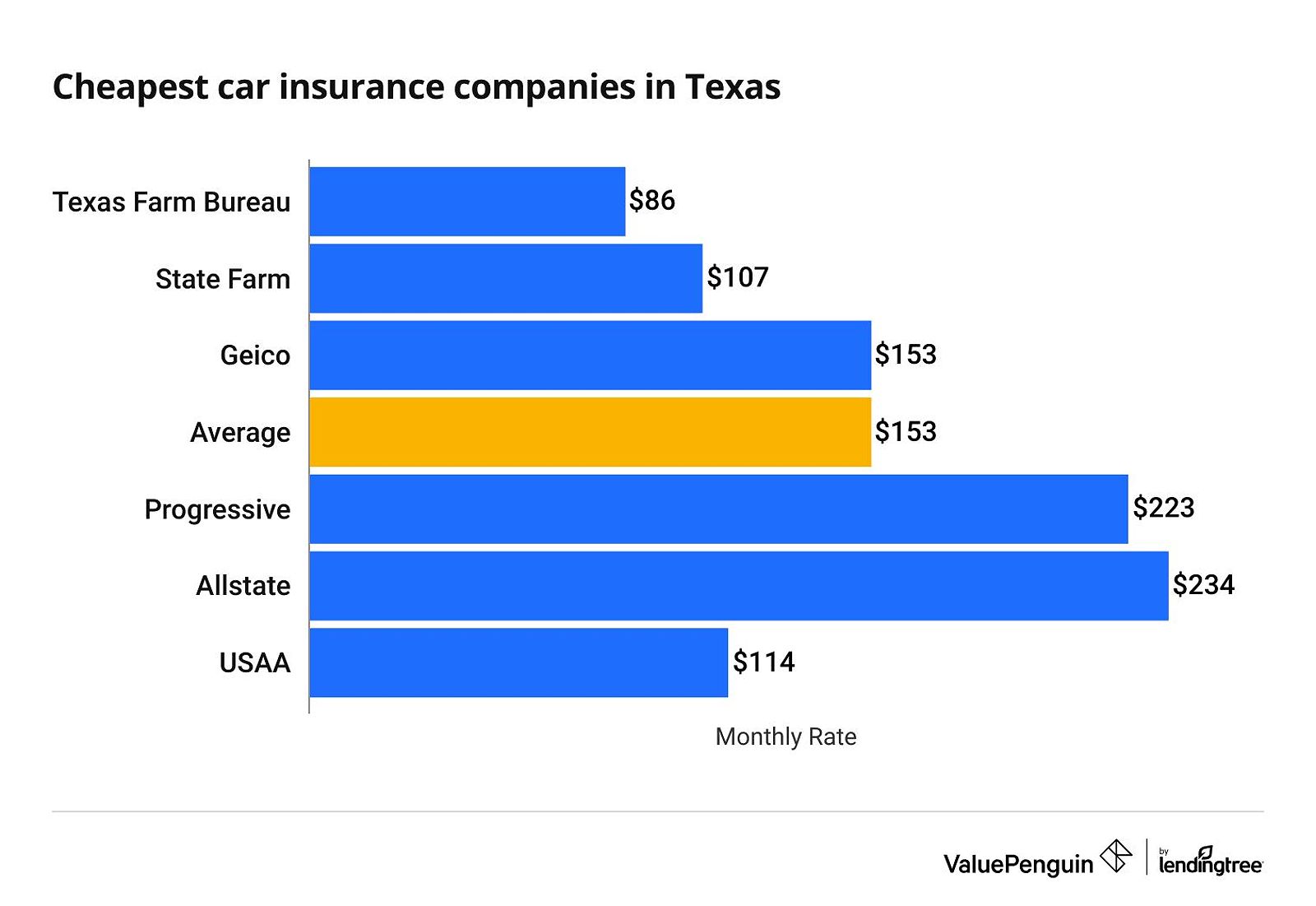

A: Some of the top-rated options for teen drivers in Texas include USAA, State Farm, and Texas Farm Bureau. USAA is known for its competitive rates and excellent customer service, but it’s only available to current and former military members and their families. State Farm and Texas Farm Bureau also offer great coverage options for young drivers in the Lone Star State.

Q: How can I get a Texas driver’s license if I’m under 18?

A: To get your driver’s license in Texas as a teen, you’ll first need to obtain a learner’s permit, which requires you to be at least 15 years old and complete a driver’s ed course. After holding the permit for at least 6 months and logging 40 hours of supervised driving, you can then apply for a provisional license. Once you turn 18, the provisional restrictions will be lifted, and you’ll have a full driver’s license.

Q: What are some tips for safe driving?

A: As a teen driver, it’s so important to keep your eyes on the road and avoid distractions like texting, using your phone, or blasting the music. Always obey traffic laws, including speed limits, and never, ever drive under the influence of alcohol or drugs. And don’t forget to buckle up – your seatbelt could be a real lifesaver.

Additional Tips for Texas Teen Drivers

Alright, I know I’ve already given you a ton of info, but let me throw in a few more tips to help you save even more on your car insurance in Texas:

-

Consider an Older, Less Expensive Vehicle: The type of car you drive can have a big impact on your premiums. In general, older and less flashy vehicles tend to be cheaper to insure. So, if you’re in the market for a new set of wheels, keep that in mind.

-

Bundle Your Policies: Many insurers offer discounts if you bundle your car insurance with other policies, like homeowner’s or renter’s insurance. It’s worth exploring your options to see if you can score some additional savings.

-

Increase Your Deductible: Raising your deductible, which is the amount you pay out-of-pocket before your insurance kicks in, can also help lower your monthly premiums. Just be sure you’ve got enough savings to cover the higher deductible if you do end up in an accident.

-

Take Advantage of Telematics: Some insurers now offer “black box” or telematics programs that track your driving behavior. If you’re a safe, low-mileage driver, this could earn you some impressive discounts.

Conclusion

Well, there you have it, my fellow Texas teen drivers! You’re now armed with the knowledge and tools to navigate the car insurance world and find the best coverage for your needs and budget. Just remember to shop around, take advantage of those sweet discounts, and always, always drive safely. With a little effort, you’ll be cruising the roads in no time without breaking the bank.

Oh, and if you ever have any other insurance-related questions, you know where to find me – right here, ready to lend a hand (or an ear). Until next time, drive safe and happy insuring!