As a Colorado resident, navigating the car insurance landscape can feel like a daunting task. With so many companies and options to choose from, it’s easy to get overwhelmed. But fear not, my friend! I’ve done the hard work for you and created this comprehensive guide to help you find the best car insurance quote in Colorado.

Understanding Colorado’s Car Insurance Requirements

Colorado operates under an “at-fault” system, which means that the driver responsible for an accident is financially liable for the other driver’s medical bills, lost wages, and other related expenses. Now, I know what you’re thinking — “Great, more rules to follow!” But don’t worry, I’ve got you covered.

All drivers in Colorado are required to carry a minimum of $25,000 per person and $50,000 per accident in Bodily Injury Liability (BIL) insurance, as well as at least $15,000 in Property Damage Liability (PDL) insurance. While it may not be mandatory, I highly recommend getting Uninsured/Underinsured Motorist (UM/UIM) coverage. This type of insurance can protect you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage to pay for the damages.

But wait, there’s more! You can also opt for additional coverages like Medical Payments and Collision/Comprehensive to provide even more protection for you and your vehicle. Just keep in mind that failing to maintain the required minimum coverage in Colorado can result in hefty fines, license suspension, and potentially even community service. So, let’s make sure you’re fully covered, shall we?

Factors Affecting Your Car Insurance Quote Colorado

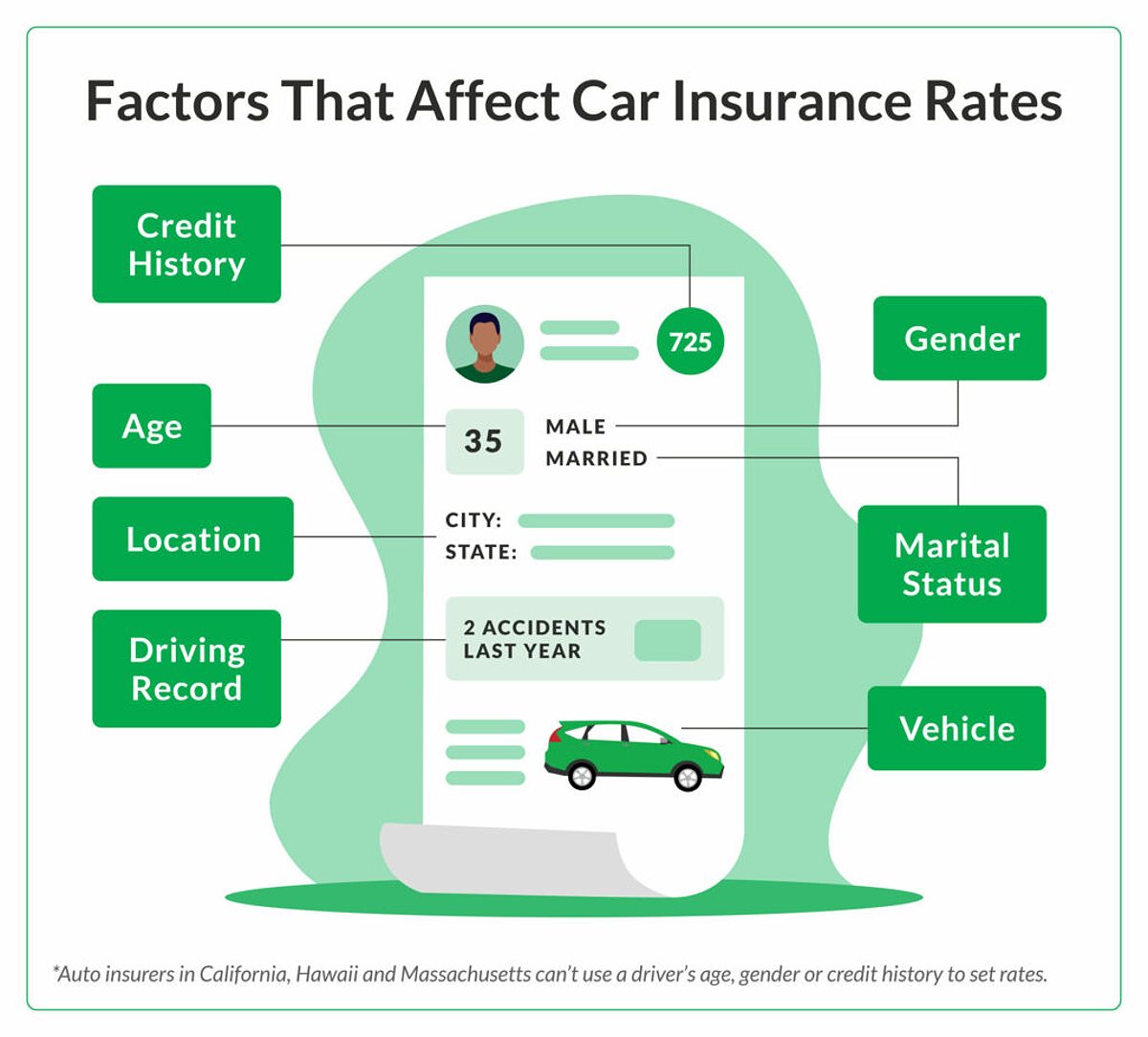

Alright, now that we’ve got the basics covered, let’s dive into the factors that can affect your car insurance rates in the Centennial State. Brace yourself, because this is where the real magic happens!

Your Driving History

Your driving record is like a crystal ball for insurance companies — they can see into the future and predict how likely you are to get into an accident. Yep, that’s right! Accidents, speeding tickets, and DUIs can all lead to higher premiums, as insurers view you as a higher-risk driver. The number of points on your license can also impact your rates, and certain offenses may even require you to obtain an SR-22 certificate from your insurer.

But don’t worry, there’s light at the end of the tunnel! A clean driving record can work in your favor, and the longer it’s been since your last incident, the better.

Your Vehicle

The make, model, year, and safety features of your vehicle can also play a significant role in your car insurance costs. Vehicles with higher repair costs or a greater risk of theft or damage tend to have higher premiums. For example, that shiny new sports car you’ve been eyeing might be a little more expensive to insure than your trusty old sedan.

But fear not, my friend! Vehicles equipped with advanced safety features like automatic braking systems, lane departure warnings, and airbags can actually qualify for lower premiums. It’s like the insurance companies are rewarding you for being a responsible driver.

Your Demographics

Believe it or not, your age, location, and credit score can also impact your car insurance rates. Generally, younger drivers and those with lower credit scores tend to pay higher premiums. It’s all about that risk assessment, you see. Insurers often use demographic data to determine how likely you are to file a claim.

Top Car Insurance Companies in Colorado

Now that you know the factors that can affect your car insurance rates, let’s take a look at some of the top companies in the Centennial State. Get ready for a wild ride!

Geico

Geico is known for its competitive rates and user-friendly digital platform. The company offers a wide range of discounts, making it a popular choice for Colorado drivers looking to save a few bucks. However, Geico’s customer service options may be a bit limited compared to some of its competitors. But hey, if you’re a tech-savvy individual who loves a good deal, Geico might just be your new best friend.

State Farm

As one of the largest insurers in the country, State Farm has a reputation for excellent customer service and a network of local agents that can’t be beat. While their rates may not always be the cheapest, State Farm’s comprehensive coverage options and claims-handling expertise make it a reliable choice for many Colorado residents. Plus, they’ve got a whole host of discounts to help you save even more.

Nationwide

Nationwide offers competitive rates, a variety of discounts, and strong customer service. The company’s coverage options are also quite extensive, making it a solid choice for Colorado drivers. However, Nationwide’s availability may be limited in certain areas of the state. But if you’re looking for a balance of affordability and quality service, Nationwide might just be the way to go.

USAA

Now, this one’s for all my military members, veterans, and their families out there. USAA is a top-notch choice for car insurance in Colorado, known for its exceptional customer service, affordable rates, and comprehensive coverage options. The catch? You have to be eligible based on your military affiliation. But if you are, you’re in for a treat!

Getting the Best Car Insurance Quote in Colorado

Alright, now that you know all about the top car insurance companies in Colorado, let’s talk about how you can get the best possible quote. Buckle up, because we’re about to go on a wild ride!

Compare Quotes

First things first, don’t settle for the first quote you receive. Take the time to compare car insurance rates from several different companies. This will ensure that you’re getting the best deal possible. You can use online comparison tools or even reach out to insurers directly to get the most competitive options.

Explore Discounts

Colorado car insurance companies love to offer discounts, and you should take full advantage of them. Some common discounts include good driver, multi-policy, safe vehicle, student, and defensive driving discounts. Be sure to ask about any discounts you may qualify for when getting quotes. And who knows, you might even stumble upon a hidden gem that can save you a ton of cash.

Negotiate

Did you know that you can actually negotiate your car insurance rate? Yep, it’s true! By bundling multiple policies, improving your driving record, or even increasing your deductible, you might be able to score a better deal. Don’t be afraid to ask your insurer if there’s any room for negotiation — you might be surprised by what they’re willing to offer.

Review Your Policy Regularly

Now, this one’s important: remember to review your car insurance policy at least once a year. Your needs and the available discounts may change over time, so regularly evaluating your coverage can help you ensure you’re getting the best possible rate. Life changes like getting married, moving to a different city, or purchasing a new vehicle can also affect your insurance needs. So, keep an eye on that policy and make sure it’s keeping up with your ever-evolving life.

Additional Resources for Colorado Car Insurance

If you’re still feeling a bit overwhelmed, don’t worry — there are plenty of resources out there to help you navigate the world of car insurance in Colorado. Check out the Colorado Division of Motor Vehicles (DMV) website for essential information about vehicle registration, licensing, and insurance requirements. You can also visit the Colorado Department of Insurance website for consumer resources, tips on shopping for insurance, and information on how to file complaints against insurers.

And if you’re the tech-savvy type, there are plenty of online car insurance comparison tools that can help you find the best rates for your coverage needs. Just remember to do your research and compare apples to apples to ensure you’re getting the best deal.

FAQ

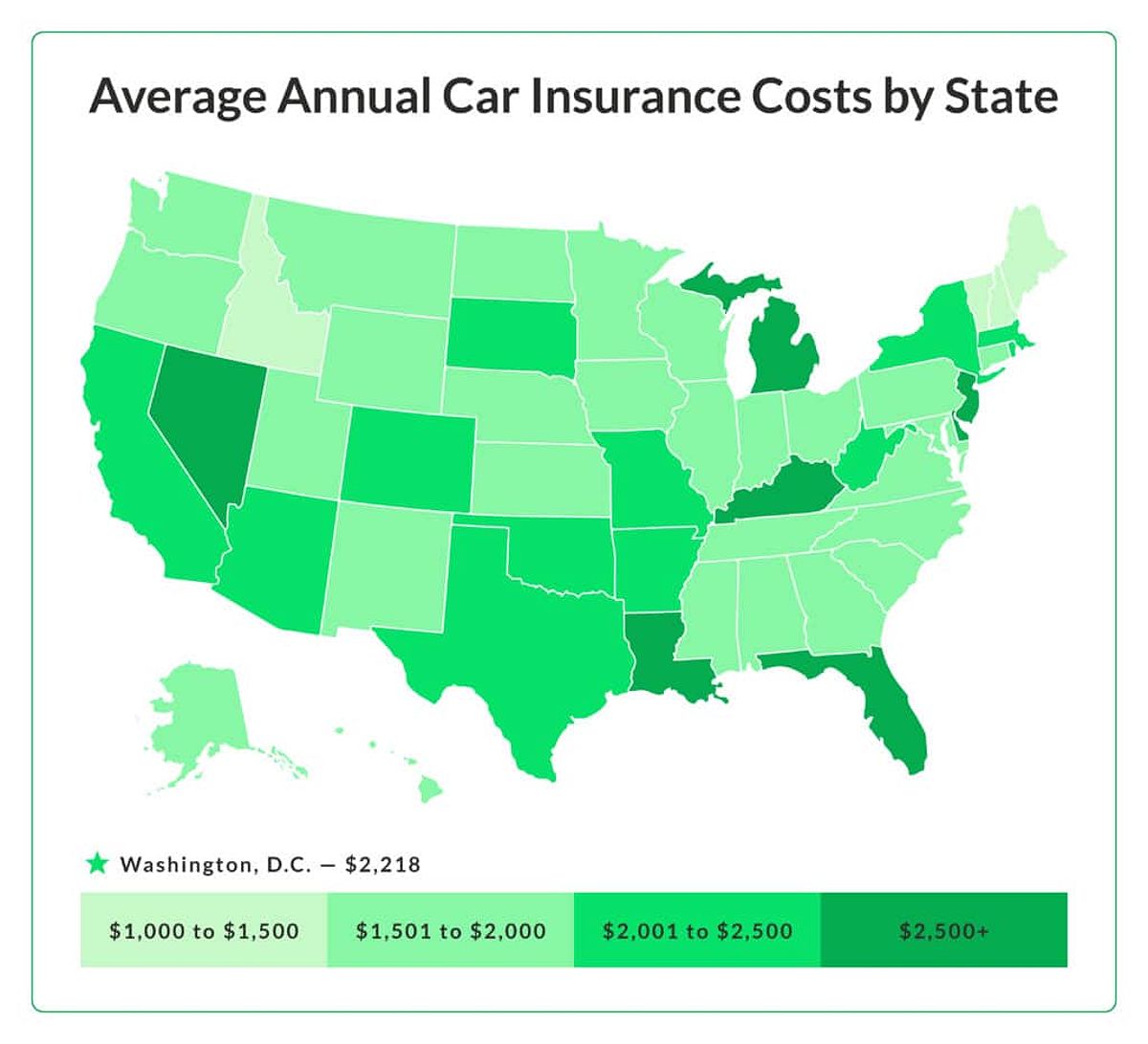

Q: What is the average cost of car insurance in Colorado?

A: The average cost of car insurance in Colorado can vary quite a bit, but it generally falls between $1,800 and $2,200 per year. Of course, your personal driving history, the type of vehicle you drive, and your demographic profile can all influence your rates.

Q: What are the best ways to save money on car insurance in Colorado?

A: Comparing quotes, exploring discounts, and negotiating your rate are all fantastic ways to save money on car insurance in Colorado. Maintaining a clean driving record can also help you secure lower premiums over time.

Q: What should I do if I get into an accident in Colorado?

A: If you’re involved in an accident in Colorado, the first thing you should do is exchange information with the other driver(s), call the police, and contact your insurance company as soon as possible. Be sure to document the scene, take photos if possible, and gather any witness information to support your claim.

Conclusion

Alright, my fellow Coloradans, I hope this guide has given you the confidence and tools you need to navigate the car insurance landscape in the Centennial State. Remember, finding the best car insurance quote is all about research, comparison, and a little bit of negotiation. So, what are you waiting for? Start comparing quotes today and see how much you can save on your Colorado car insurance!