Navigating the world of car insurance in Colorado can be challenging, especially if you have a history of speeding tickets or a less-than-perfect credit score. Finding affordable car insurance colorado quotes might feel like an impossible task, but there are strategies and insurers that can help you get the coverage you need without breaking the bank.

Unraveling the Car Insurance Puzzle for Colorado High-Risk Drivers

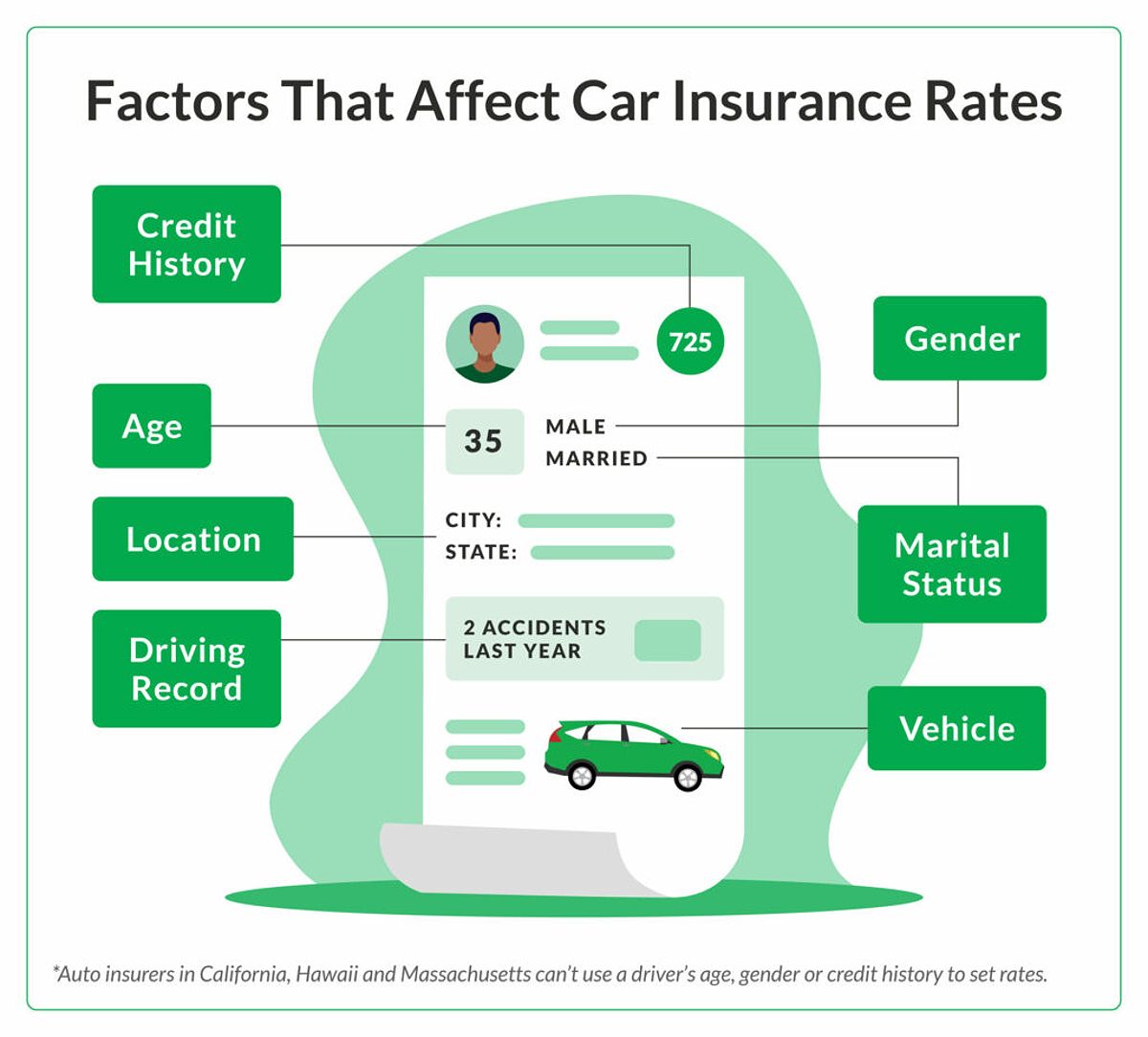

Let’s face it, insurance companies don’t exactly roll out the red carpet for drivers with a few blemishes on their records. When it comes to setting your rates, they weigh factors like your driving history, credit score, and other personal characteristics quite heavily. For instance, a single speeding ticket in Colorado can hike up your premiums by 20-30%, while poor credit can add an extra 10-15% to your bill.

The good news is, not all insurers view these high-risk factors the same way. While one provider might see a minor offense as a major red flag, another might be more forgiving. That’s why it’s crucial to shop around and compare quotes from multiple companies. By doing so, you can uncover the hidden gems offering the most competitive rates for drivers in your unique situation.

Discovering Affordable Car Insurance Colorado Quotes for High-Risk Drivers

As you navigate the car insurance landscape, a few standout providers deserve your attention:

State Farm: A Trusted Name in Colorado’s High-Risk Market

As one of the largest and most well-known insurers in the nation, State Farm has a reputation for working wonders with drivers who have a few skeletons in their closets. Their personalized risk assessment approach often translates to lower-than-average rates for Colorado residents dealing with accidents, speeding tickets, or even DUIs.

Beyond their competitive pricing, State Farm’s comprehensive coverage options, ranging from liability to collision and comprehensive, can provide the peace of mind high-risk drivers crave. And with a wide array of discounts – from good student to safe driver and multi-policy – they make it easier to offset those pesky premium hikes.

What’s more, State Farm’s commitment to customer service is second to none. With 24/7 support and a user-friendly mobile app, managing your policy and filing claims has never been easier. It’s no wonder they continue to be a top choice for Colorado’s high-risk drivers.

Geico: The Credit-Conscious Choice for Colorado

If your credit score is less than stellar, Geico might just be the insurer for you. Their credit-based pricing model means that drivers with less-than-perfect credit can often secure lower rates compared to other providers.

But Geico’s appeal goes beyond their credit-conscious approach. Their user-friendly online platform makes it a breeze to compare coverage options, get quotes, and manage your policy from anywhere. And with 24/7 customer service and a network of local agents, you can always count on getting the support you need, whether you prefer to handle things digitally or face-to-face.

What’s more, Geico’s resources for high-risk drivers, including tips on improving your driving record, can be invaluable as you strive to lower your premiums over time. It’s no wonder this national powerhouse continues to be a top pick for Colorado’s discerning drivers.

Honorable Mentions: Other Insurers Making Waves in Colorado

While State Farm and Geico may be the standouts, they’re not the only insurers worth considering if you’re a high-risk driver in Colorado. Keep an eye out for these other noteworthy providers:

-

Southern Farm Bureau: This regional insurer has a reputation for delivering affordable coverage, especially for drivers with a history of accidents or tickets. Their personalized service and community-oriented approach often resonate with Colorado drivers.

-

USAA: Exclusively catering to military members, veterans, and their families, USAA consistently earns high customer satisfaction ratings and offers competitive rates for eligible drivers.

-

Nationwide: As a national provider, Nationwide has the resources to tailor policies for high-risk drivers, with a focus on personalized service and flexible coverage options. Their extensive range of discounts can also help mitigate costs for those with a less-than-perfect driving history.

Strategies to Rev Up Your Savings on Colorado Car Insurance

Navigating the car insurance landscape as a high-risk driver in Colorado can feel like a daunting task, but there are several strategies you can employ to keep your premiums as low as possible:

Polish Up Your Driving Record

One of the most effective ways to lower your car insurance rates in Colorado is to improve your driving record over time. By avoiding tickets, accidents, and other infractions, you can demonstrate to insurers that you’re a lower-risk driver, potentially leading to significant premium reductions.

Consider enrolling in a defensive driving course – not only will it help you become a safer driver, but it may also qualify you for additional discounts from your insurance provider. Many companies recognize the value of defensive driving and offer incentives for completing such courses. Additionally, maintaining a clean record for several years can go a long way in helping you secure more affordable coverage.

Boost Your Credit Score: The Key to Unlocking Lower Rates

In Colorado, insurance companies often rely on credit-based scoring models to determine your rates, with drivers who have poor credit paying significantly more for coverage. By taking steps to improve your credit score, you can potentially unlock lower premiums from providers like Geico.

Strategies to boost your credit score include paying bills on time, reducing outstanding debt, and disputing any errors on your credit report. Regularly monitoring your credit and addressing any issues can pay dividends when it comes to your car insurance costs. And don’t forget to set up automatic payments to avoid late fees, which can further drag down your credit score.

Negotiate, Negotiate, Negotiate

When it comes to high-risk drivers, insurance companies may be more willing to negotiate on rates and discounts than you might think. By regularly comparing quotes, identifying potential savings, and advocating for yourself, you can often secure a better deal on your car insurance.

Be sure to ask about all available discounts, such as those for good students, safe drivers, or multi-policy holders. You can also inquire about any loyalty or renewal discounts that may be available. If you’ve maintained coverage with your current insurer for several years, they may be more inclined to work with you to keep your business. Don’t hesitate to shop around and leverage quotes from other companies as a bargaining tool.

Embrace Usage-Based Insurance: The Personalized Approach

For some high-risk drivers in Colorado, usage-based insurance can be a game-changer. This type of insurance bases your premiums on your actual driving behavior, rather than just historical data. If you’re a safe driver despite your past, usage-based insurance can reward you with lower rates.

Many insurance companies offer telematics programs that track your driving habits through a mobile app or device installed in your vehicle. By demonstrating safe driving practices, such as obeying speed limits and avoiding hard braking, you may qualify for significant discounts over time. It’s a personalized approach that can help high-risk drivers in Colorado take control of their car insurance costs.

FQAs: Navigating Car Insurance for High-Risk Drivers in Colorado

Q: Can I get car insurance in Colorado if I have a DUI on my record?

A: Yes, you can still obtain car insurance in Colorado if you have a DUI conviction, but you’ll likely face higher premiums. Insurance providers like State Farm and Geico may offer more competitive rates for drivers with a DUI history compared to other insurers.

Q: What is SR-22 insurance, and do I need it?

A: SR-22 insurance is a certificate of financial responsibility that you may be required to carry in Colorado if your driver’s license has been suspended due to certain traffic offenses, such as a DUI or repeated moving violations. The SR-22 requirement mandates that your insurance provider file this certificate with the state, demonstrating that you’re carrying the minimum required coverage.

Q: How often should I compare car insurance quotes?

A: As a high-risk driver in Colorado, it’s a good idea to compare car insurance quotes at least once a year, or whenever there is a significant change in your driving record or credit score. The car insurance landscape is constantly evolving, and regular comparison shopping can help you ensure you’re getting the best possible rates.

Q: Are there specific discounts available for high-risk drivers?

A: Yes, many insurance companies offer discounts specifically designed for high-risk drivers. These can include discounts for completing defensive driving courses, maintaining a clean driving record over time, or bundling multiple policies with the same provider. It’s important to ask your insurer about all available discounts that may apply to your situation.

Revving Up Your Colorado Car Insurance Savings

Finding affordable car insurance in Colorado can be a challenge for drivers with blemished records, but it’s not an impossible task. By understanding the factors that influence high-risk rates, exploring the top insurance providers for your situation, and employing smart cost-saving strategies, you can secure the coverage you need without breaking the bank.

Remember, the key to success is to shop around, compare quotes, and stay proactive in maintaining a clean driving history and good credit score. With a little diligence and the right approach, you can find car insurance in Colorado that fits your budget and provides the protection you deserve. So, rev up your savings and hit the road with confidence — your dream of affordable coverage is within reach!