As a new driver, navigating the world of car insurance can feel like a daunting task. But fear not, we’re here to guide you through the process and help you find the best car home insurance quotes tailored to your unique needs.

Securing the right coverage is crucial, not only to meet legal requirements but also to protect yourself and your assets on the road and at home. In this comprehensive guide, we’ll explore the essential car insurance coverages, uncover the factors that can influence your rates, and reveal the powerful benefits of bundling your car and home (or renters) insurance policies.

Understanding the Essentials of Car Insurance for New Drivers

Let’s start by diving into the core components of car insurance that every new driver should know.

Mandatory Liability Coverage

The most fundamental car insurance coverage for new drivers is liability insurance. This coverage protects you if you’re found legally responsible for an accident that causes injury or damage to others. It’s required by law in most states, so it’s crucial to have at least the state-mandated liability limits.

Collision and Comprehensive Protection

While liability insurance is a necessity, you may also want to consider adding collision and comprehensive coverage to your policy. Collision coverage pays for repairs to your vehicle if you’re involved in an accident, while comprehensive coverage protects against non-collision events like theft, vandalism, or weather-related damage.

It’s important to note that the average cost of a car accident can be over $10,000. Without proper insurance, this financial burden could quickly become overwhelming for new drivers, making these additional coverages well worth the investment.

Factors Influencing New Driver Rates

Several factors can impact your car insurance rates as a new driver, including:

- Age: Younger drivers, especially those under 25, typically pay higher premiums due to their relative lack of experience behind the wheel.

- Driving Record: A clean driving record with no accidents or traffic violations will help keep your rates low. Conversely, any infractions can lead to significant rate increases.

- Vehicle Type: The make, model, and age of your car can also play a role, as newer, more powerful vehicles often cost more to insure.

- Location: Where you live can influence your insurance costs, as rates can vary significantly by state and even by city.

By understanding these factors, you can take proactive steps to minimize your car insurance costs as a new driver. For example, choosing a safe and fuel-efficient vehicle, maintaining a clean driving record, and taking a defensive driving course can all help you secure more affordable rates.

Finding the Best Car Home Insurance Quotes

Now that you understand the essentials of car insurance for new drivers, let’s explore the best ways to find the most competitive quotes.

Online Comparison Websites

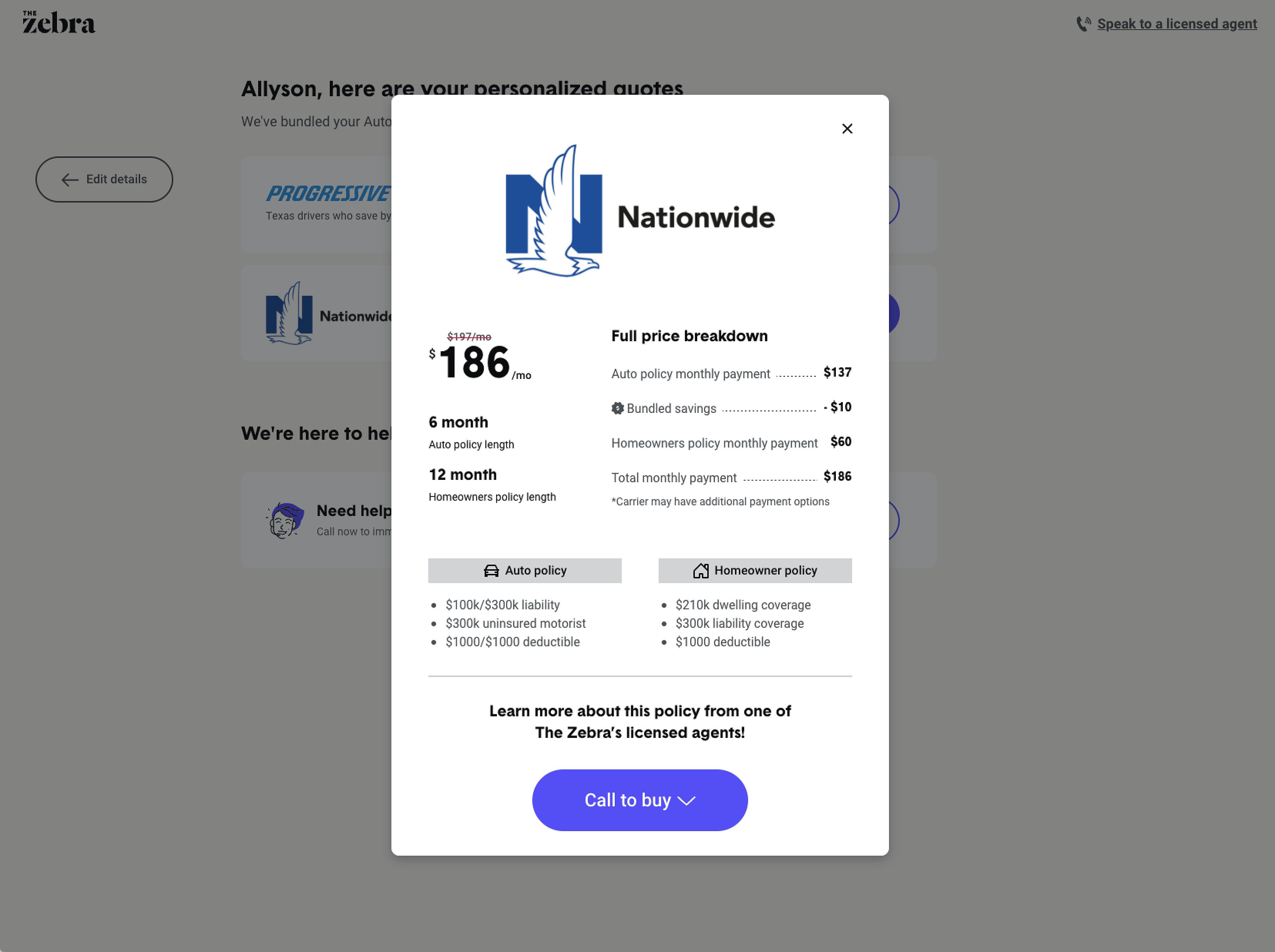

Using online comparison websites, such as The Zebra or Policygenius, is an excellent way to quickly and easily gather multiple car home insurance quotes. These platforms allow you to input your information and receive side-by-side comparisons from a variety of insurance providers, making it easier to find the best coverage at the right price.

The beauty of these comparison tools is that they do the research for you, saving you valuable time and ensuring you have the information needed to make an informed decision. Simply enter your details, compare the available options, and choose the policy that best meets your needs and budget.

Direct Insurance Companies

Another option is to obtain quotes directly from insurance companies. This approach can provide a more personalized experience, as you’ll have the opportunity to speak with an agent who can tailor a policy to your specific requirements.

When reaching out to insurance companies, be sure to compare quotes from multiple providers. Don’t be afraid to negotiate, as some insurers may be willing to match or even beat a competitor’s rate to earn your business.

The Power of Bundling Car and Home Insurance

One of the most effective ways to save money on your insurance as a new driver is to bundle your car and home (or renters) policies together. Bundling, also known as a multi-policy discount, can provide significant savings, often up to 25% or more on your combined premiums.

The benefits of bundling car and home insurance go beyond just cost savings. It also offers added convenience, as you can manage both policies in one place, streamlining processes like billing, policy updates, and claims filing.

However, it’s important to note that the potential savings from bundling may not always outweigh the cost of choosing a less competitive insurer for one of your policies. Be sure to use comparison websites or speak with agents to ensure the bundling discount provides the best overall value for your specific needs.

Strategies to Secure Affordable Car Insurance as a New Driver

In addition to bundling, there are several other strategies new drivers can use to minimize their car insurance costs:

- Maintain a Clean Driving Record: Avoid accidents, traffic violations, and other infractions, as these can significantly increase your premiums.

- Choose a Safe and Fuel-Efficient Vehicle: Insurers often offer lower rates for vehicles with good safety ratings and high fuel efficiency.

- Take a Defensive Driving Course: Many insurers offer discounts to drivers who complete approved defensive driving programs.

- Explore Discounts: Ask your insurance provider about potential discounts for good students, safe drivers, military personnel, or multi-car households.

- Shop Around Regularly: Don’t settle for the first quote you receive. Compare offers from multiple insurers to ensure you’re getting the best deal.

By implementing these tips and strategies, new drivers can take control of their car insurance costs and enjoy the freedom of the open road with the peace of mind that comes from proper coverage.

Unlocking Savings: A Personal Story

As a recent college graduate, Emily was excited to finally have her driver’s license and the independence that came with it. However, she was apprehensive about the cost of car insurance, having heard horror stories from her friends about their high premiums.

Determined to find the best possible coverage, Emily decided to explore her options. She started by checking her state’s minimum liability requirements and then researched the additional coverages that would provide the most protection for her budget.

Next, Emily turned to online comparison websites, where she was able to quickly gather quotes from a variety of insurance providers. She was surprised to see how much the rates could vary, and she made sure to compare apples to apples, ensuring the coverage levels were consistent across the quotes.

During her research, Emily also learned about the benefits of bundling her car and renters insurance. After crunching the numbers, she found that by combining her policies, she could save over 20% on her total insurance costs. The added convenience of managing both policies in one place was an added bonus.

With her newfound knowledge and the help of the comparison tools, Emily was able to find an insurance package that provided the coverage she needed at a price she could afford. As a new driver, she felt empowered and confident in her decision, knowing she had taken the necessary steps to protect herself and her assets.

Emily’s story is a testament to the importance of research and the power of leveraging tools and strategies to secure the best car home insurance quotes. By following a similar approach, new drivers can unlock significant savings and enjoy the open road with the peace of mind that comes from proper coverage.

FAQ

Q: What is a good credit score for car insurance?

A: While credit score isn’t a factor in all states, it can significantly impact your rates in some areas. Aim for a score of 700 or above to get the best car insurance rates.

Q: Do I need to list my parents on my car insurance policy?

A: This depends on your state’s laws and your insurance company’s policies. It’s best to discuss this with your insurer and understand your options.

Q: Can I get car insurance without a driving record?

A: Yes, but you’ll likely pay higher premiums. Your insurance company will assess your risk based on other factors like your age, location, and vehicle type.

Conclusion

As a new driver, securing the right car and home insurance coverage is essential to protect both you and your assets on the road and at home. By understanding the key factors that influence your rates, exploring the benefits of bundling, and implementing cost-saving strategies, you can find the best possible insurance solutions to fit your needs and budget.

Remember, the key to unlocking significant savings on your auto and home insurance is to shop around, compare quotes, and take advantage of available discounts. With the right coverage in place, you can have the confidence to embrace the open road and the comfort of knowing your home and belongings are protected.

Start your search for the best car home insurance quotes today, and take the first step towards a safer and more financially secure future.