As a renter, I know how important it is to protect your belongings and financial well-being. That’s why I’m here to share my insider tips on getting the best car and house insurance quotes – without breaking the bank!

You see, I used to be in your shoes, wondering if renters insurance was really worth the investment. But after a close call with a kitchen fire that nearly wiped out my entire apartment, I realized just how crucial it is to have the right coverage. Let me tell you, that experience was enough to make me a lifelong advocate for renters insurance.

Why Renters Need Car and House Insurance Quotes

As a renter, your landlord’s insurance policy typically only covers the building itself, not your personal possessions. That means if your apartment gets burglarized or there’s a flood that damages your belongings, you’d be on the hook for the replacement costs – yikes!

But renters insurance is an absolute game-changer. For as little as $15 to $30 per month, you can get coverage that protects your electronics, furniture, clothing, and more. Plus, it provides liability protection in case someone gets injured on your rented property. Trust me, that peace of mind is priceless.

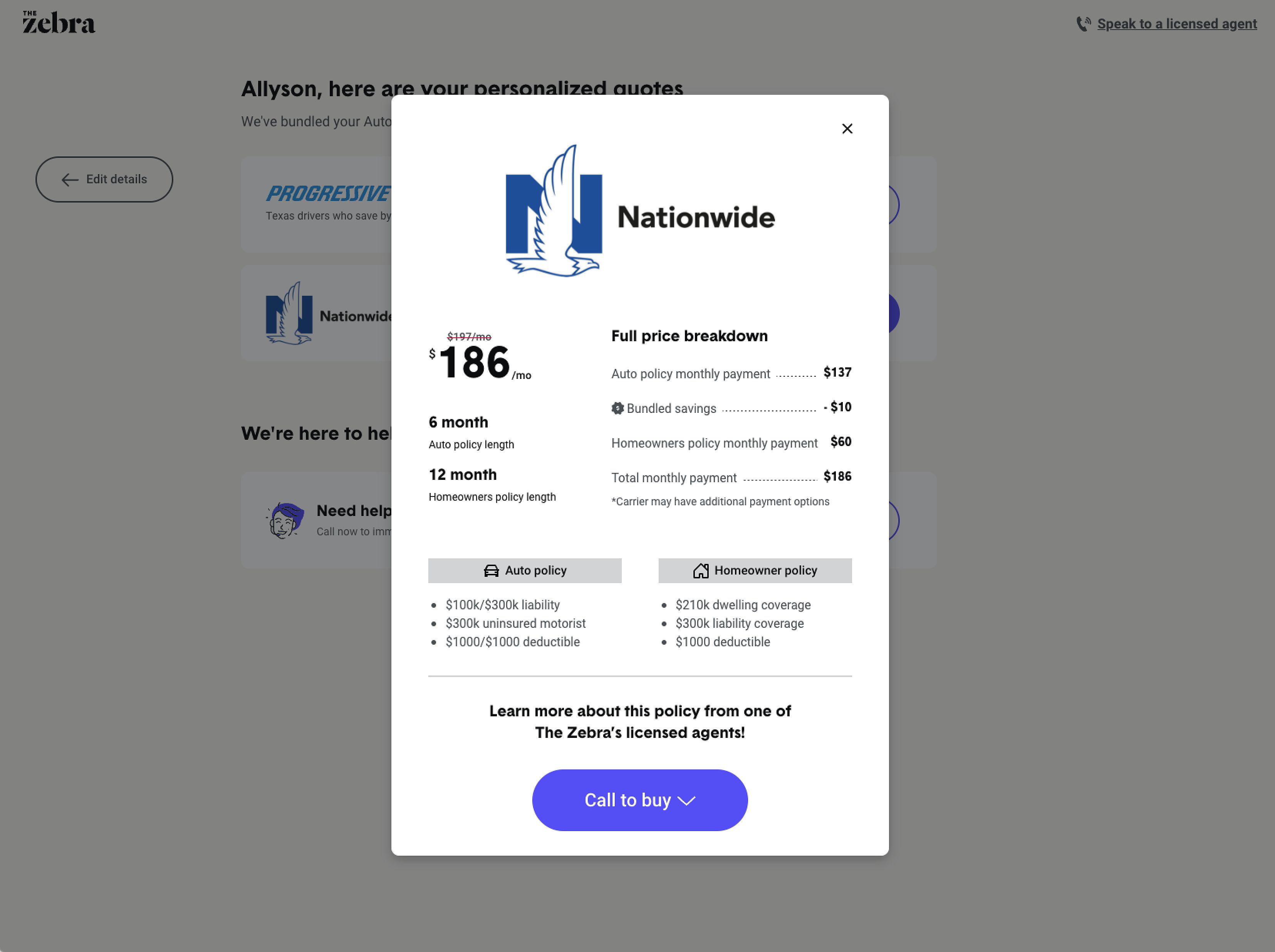

And when it comes to car insurance, even if you don’t own a vehicle, it’s still essential to have liability coverage. After all, you never know when you might need to borrow a friend’s or family member’s car. Bundling your renters and car insurance is a surefire way to score major savings – we’re talking potentially hundreds of dollars per year!

Understanding Renters Insurance Coverage

Alright, let’s dive into the nitty-gritty of renters insurance. A standard policy typically includes three main types of coverage:

- Personal Property Coverage: This protects all your personal belongings, from your beloved gaming setup to your favorite designer threads, in the event of a covered incident like fire, theft, or water damage.

- Liability Coverage: If someone gets hurt on your rented property, this coverage can help pay for their medical expenses and any legal fees you may incur. Trust me, you don’t want to be stuck with those bills!

- Additional Living Expenses: If your rental becomes uninhabitable due to a covered event, this coverage can help pay for temporary housing and other related costs. That means you won’t be left scrambling to find a place to crash.

And the best part? You can even add optional coverage for high-value items like jewelry, art, or musical instruments. It’s like the ultimate insurance safety net for your stuff!

Bundling Renters and Car Insurance: Save Money and Simplify

Now, let me let you in on a little secret: bundling your renters and car insurance policies can be a total game-changer. Not only does it make managing both policies a breeze, but it can also lead to some serious savings.

Many insurers offer multi-policy discounts, which can translate to hundreds of dollars in annual savings. And let’s be real, who doesn’t love a good deal? Plus, with everything under one roof, you can say goodbye to the hassle of juggling multiple payments and claims. It’s a win-win!

To find the best bundled quotes, I recommend using online comparison tools to get quotes from a variety of providers. That way, you can easily see how the bundled rates stack up against the individual, unbundled prices. And don’t be afraid to reach out to insurance agents for personalized assistance — they’re there to help you find the perfect coverage at the most competitive rate.

Tips for Getting Affordable Car and House Insurance Quotes

Now, I know insurance can be a real headache, but trust me when I say there are ways to keep those premiums in check. Let’s start with the factors that can impact your costs:

- Location: Where you live can play a big role in your insurance rates, so be sure to shop around for the best deals in your area.

- Driving History: Maintaining a clean driving record with no accidents or violations can score you some sweet discounts.

- Credit Score: Believe it or not, your credit score can also influence your insurance premiums, so keep that puppy in tip-top shape.

- Coverage Limits: The more coverage you want, the higher your rates will be. But that doesn’t mean you have to break the bank — there are ways to save.

And speaking of saving, let’s talk about those all-important discounts:

- Multi-Policy Discounts: I already mentioned the magic of bundling, but don’t forget about other multi-policy perks, like insuring your car and motorcycle with the same provider.

- Good Driver Discounts: If you’ve been accident-free for a while, make sure to let your insurer know. They love rewarding responsible drivers!

- Safety Features Discounts: Things like anti-theft devices and advanced safety tech in your car can score you some serious savings.

- Home Security Discounts: Equipping your rental with security systems and other protective measures can help lower your renters insurance costs.

But the savings don’t stop there! You can also try increasing your deductibles, shopping around regularly, and maintaining a top-notch driving record to keep those premiums in check. It’s all about finding that sweet spot between coverage and cost.

Maximizing Your Savings: Additional Tips

Now, let’s dive a little deeper into some more ways you can save on your car and house insurance quotes. After all, who doesn’t love a good deal?

One of the best things you can do is review your coverage limits regularly. Sure, it’s tempting to max out your protection, but that can also mean sky-high premiums. Take a close look at your needs and see if you can get by with slightly lower limits — you might be surprised at how much you can save.

Another great tip? Consider raising your deductibles. I know, it might sound counterintuitive, but hear me out. By opting for a higher deductible, you can often score lower monthly or annual premiums. Just make sure you have enough savings set aside to cover the higher out-of-pocket costs in the event of a claim.

And let’s not forget about those pesky discounts! Beyond the multi-policy and safety feature perks, you might be eligible for all sorts of other savings. For example, some insurers offer discounts for students, military members, or even certain professional associations. Do a little digging and see what you might qualify for.

FAQ

Q: How much renters insurance do I need? A: The amount of coverage you need depends on the value of your belongings. Take a good look at your possessions and choose a policy limit that will adequately protect them. You can even create a detailed inventory to make sure you’re fully covered.

Q: Is renters insurance required? A: While renters insurance isn’t usually mandated by law, your landlord may require you to have it as part of your lease agreement. Even if it’s not required, it’s still a smart investment to protect yourself and your stuff.

Q: What are some common exclusions in renters insurance? A: Every policy is a little different, but common exclusions often include damage from earthquakes, floods, and acts of war. Be sure to review your policy carefully so you know exactly what’s covered.

Q: How do I file a claim with renters insurance? A: If you ever need to make a claim, just reach out to your insurance provider as soon as possible. They’ll guide you through the process and help you get the coverage you need to get back on your feet.

Conclusion

As a fellow renter, I get it – insurance can seem like a total hassle. But trust me, finding the right car and house insurance quotes is so worth it. With the right coverage, you can rest easy knowing your belongings, liability, and financial security are protected, no matter what life throws your way.

So, what are you waiting for? Start exploring your options and get those quotes flowing. Before you know it, you’ll be saving money and simplifying your insurance game – all while enjoying the peace of mind that comes with being a savvy, covered renter. Happy quoting, my friends!