As a California homeowner, I know firsthand the unique challenges we face when it comes to protecting our most valuable assets. From earthquakes and wildfires to the ever-rising cost of living, securing the right insurance coverage can feel like a daunting task. But I’m here to share my tips and strategies for getting the best car and home insurance quotes in California, so you can have the peace of mind you deserve.

Whether you’re a busy mom juggling work and family or a young professional navigating the complexities of homeownership, this guide will empower you to make informed decisions about your insurance needs. With a personalized approach and a focus on women’s unique considerations, I’ll walk you through the process of comparing quotes, understanding coverage options, and discovering the discounts that can save you money.

Introduction

Before we dive into the nitty-gritty of getting the best quotes, let’s take a moment to understand the basics of homeowners insurance in our state. As a California resident, I know all too well the importance of having comprehensive coverage to protect our homes and belongings.

Understanding Homeowners Insurance in California

What’s Covered in a Homeowners Policy?

A standard homeowners insurance policy in California typically includes the following key coverages:

- Dwelling Protection: This covers the structure of your home, including the foundation, walls, and roof, in the event of damage from covered perils like fire, theft, or windstorms.

- Personal Property: Your belongings, from furniture and electronics to clothing and jewelry, are protected in the case of a covered loss.

- Liability Protection: If someone is injured on your property or you’re found legally responsible for damage to someone else’s property, this coverage can help cover the resulting expenses.

- Additional Living Expenses: If your home becomes uninhabitable due to a covered event, this coverage can help pay for temporary housing and other necessary costs.

It’s worth noting that homeowners insurance typically does not include protection against earthquakes or floods, which require separate policies. Given the high rate of property crimes in California, comprehensive coverage is crucial.

Factors Affecting Home Insurance Rates

As a California homeowner, I’ve learned that several factors can impact the cost of your homeowners insurance, including:

- Location: Homes in high-risk areas for natural disasters, like wildfires or earthquakes, may have higher premiums.

- Home Value: The more your home is worth, the more it will cost to insure it.

- Age and Construction: Newer homes with modern materials are generally less expensive to insure than older properties.

- Deductible: Choosing a higher deductible can lower your monthly premiums, but it means you’ll pay more out of pocket in the event of a claim.

According to my research, the average cost of homeowners insurance in California is around $1,584 per year. However, as a savvy shopper, I know that I can find competitive rates by understanding these factors and exploring my options.

Getting the Best Car and Home Insurance Quotes

Now, let’s dive into the process of finding the most affordable and comprehensive car and home insurance quotes in California. As a busy woman, I’ve learned that it pays to be proactive and do your homework.

Comparing Quotes from Multiple Insurers

One of the most important steps in securing the best rates is to compare quotes from multiple insurance providers. This can be done through online comparison tools or by working with an independent insurance agent who can shop the market on your behalf.

While online tools offer convenience, I’ve found that working with an agent can provide personalized guidance and help me navigate the complexities of home and auto insurance in California. They can offer valuable insights and ensure I’m getting the coverage I need at the best possible price.

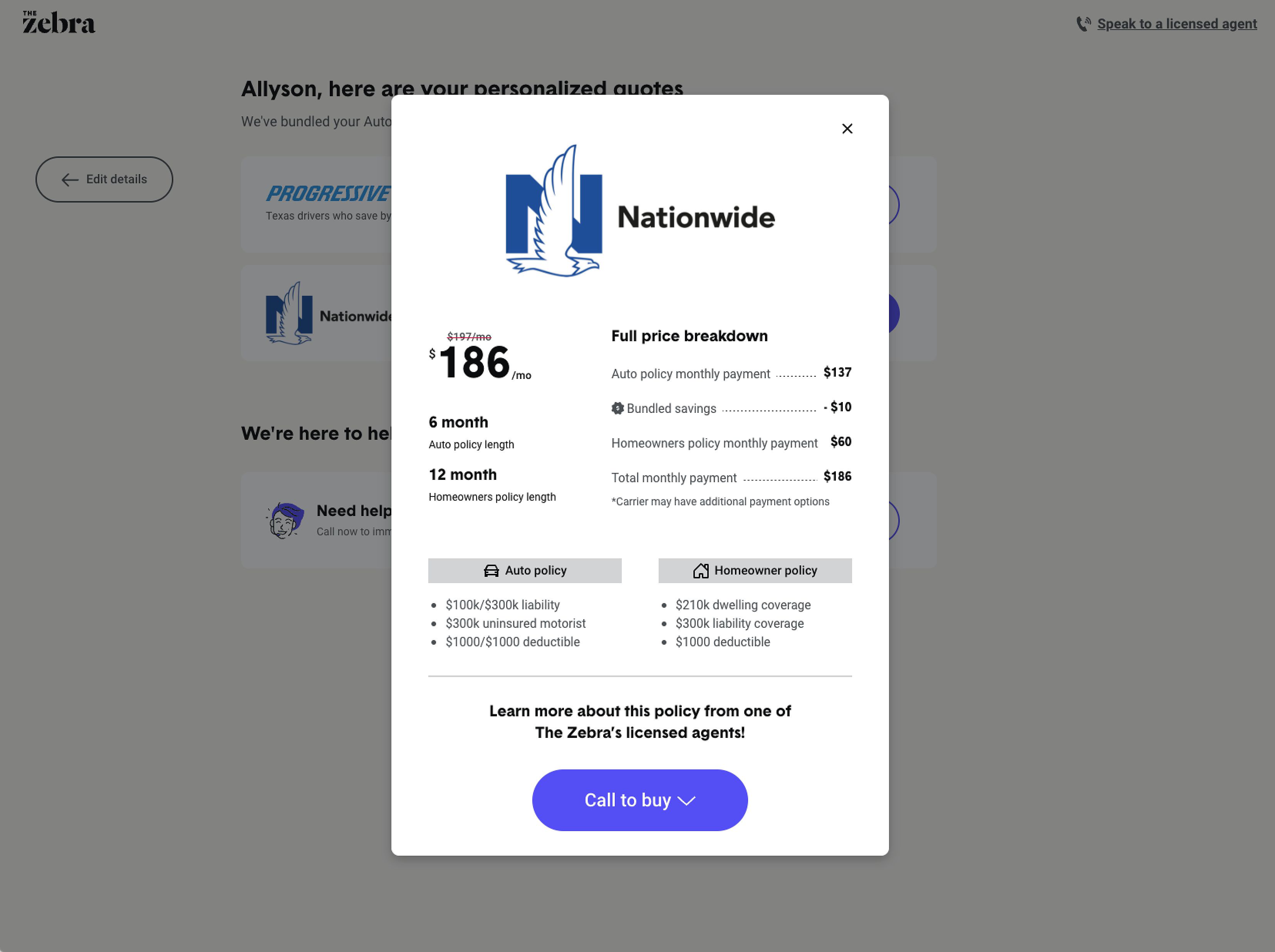

Bundling Car and Home Insurance for Savings

Another strategy I’ve employed is bundling my car and home insurance policies with the same provider. This approach can often lead to significant cost savings, with California homeowners who bundle saving an average of 10% and renters saving around 5%.

Some of the most affordable companies for bundling in California include USAA, State Farm, and GEICO. However, it’s important to compare both bundled and unbundled quotes to ensure the discount is truly worthwhile. Sometimes, mixing and matching policies from different insurers can be more cost-effective than a traditional single-carrier bundle.

Maximizing Homeowners Insurance Discounts

As a woman who’s always on the lookout for ways to save money, I’ve discovered that there are plenty of discounts available for California homeowners when it comes to insurance. Here are some of the most common ones:

- Multi-Policy Discount: Save up to 20% when you bundle your home and auto insurance policies.

- Protective Devices Discount: Install smoke alarms, burglar alarms, and other safety devices to qualify for additional savings.

- Fire-Resistant Construction Discount: If your home is built with fire-resistant materials, you may be eligible for a discount.

- Newer Home Discount: Newer homes are often less expensive to insure, so you may qualify for a discount if your home was built within the last few years.

- Gated Community Discount: Living in a gated community can sometimes lead to lower home insurance rates.

- Higher Deductible Discount: Choosing a higher deductible can lower your monthly premiums.

Be sure to contact your insurance provider and inquire about all available discounts. Providing the necessary documentation can help you qualify for even more savings.

Key Considerations for California Homeowners

As a California homeowner, there are a few additional factors I’ve had to consider when it comes to protecting my home and belongings. Let’s take a closer look at them.

Earthquake Insurance

Earthquake insurance is a separate policy from standard homeowners insurance, but it’s a crucial consideration for those of us living in the Golden State. With thousands of earthquakes occurring in California each year, some of which can cause significant damage, this coverage can provide essential protection for my family.

Flood Insurance

Similarly, flood insurance is not included in a standard homeowners policy but can be crucial in certain areas of California that are prone to flooding. While our state may not be as susceptible as others, it’s still important to assess your risk and consider purchasing a separate flood insurance policy if necessary.

Finding the Right Insurance Company for You

With so many options, choosing the right insurance company can be a daunting task. But as a savvy consumer, I’ve learned to look beyond just the price tag and consider factors like financial stability, customer service reputation, coverage flexibility, available discounts, and the accessibility of online tools and mobile apps.

After researching and comparing multiple providers, I’ve found that some of the top insurance companies for bundling car and home insurance in California include USAA, State Farm, and GEICO. Each of these insurers offers unique benefits, and I encourage you to explore their offerings to find the best fit for your individual needs and budget.

FAQ

Q: What is the average cost of homeowners insurance in California? A: According to my research, the average cost of homeowners insurance in California is around $1,584 per year, but rates can vary significantly based on location, home value, and other factors.

Q: Does California require homeowners insurance? A: No, California does not legally require homeowners insurance, but most mortgage lenders will require it as a condition of obtaining a loan.

Q: What does 100% replacement cost mean for homeowners insurance? A: 100% replacement cost means that the insurance will cover the full cost of rebuilding your home, not just its market value, in the event of a covered loss.

Q: Does homeowners insurance cover everything in a fire? A: Typically, yes, homeowners insurance covers damage from fire, but it’s important to review your specific policy for any exclusions or limitations.

Q: Does California homeowners insurance cover water damage and flood damage? A: Water damage from a sudden and accidental leak is usually covered, but flood damage requires a separate flood insurance policy.

Conclusion

As a California homeowner, I know that finding the best car and home insurance quotes is essential for protecting my family and our most valuable assets. By understanding the coverage options, exploring available discounts, and comparing quotes from multiple providers, I’ve been able to secure comprehensive protection at a price that fits my budget.

Whether you’re a busy mom, a young professional, or simply someone looking to ensure your California home is safeguarded, I hope this guide has empowered you to take control of your insurance needs. Remember, the key is to be proactive, do your research, and never settle for less than the coverage you deserve.

Start comparing quotes today, and don’t wait until it’s too late to secure the right insurance for your California home. With the right plan in place, you can have the peace of mind you need to focus on the things that matter most.