As The Insurance Guru, I’m here to share my expertise and guide you through the complex world of car and home insurance quotes. Owning a home and a car are significant investments, and ensuring adequate coverage is crucial. Whether you’re a first-time homeowner or a seasoned driver, I’m here to help you navigate the ins and outs of insurance and unlock the secrets to saving big.

The Power of Bundling: Your Insurance Superpower

One of the most effective ways to save on your car and home insurance is through the magic of bundling. Bundling refers to the act of purchasing multiple insurance policies, like car and home, from a single provider. This approach often comes with a host of benefits that can put a smile on your face and some extra cash in your pocket.

Let’s dive into the juicy details, shall we? The cost savings are where it’s at. Insurance companies love to reward loyal customers who are willing to bundle up. These discounts can range from a modest 5% all the way up to a whopping 20% or more, depending on the insurer and your unique situation. Trust me, that’s a lot of dough you can save each year on your premiums.

But the benefits don’t stop there. Bundling also brings a sense of convenience that’ll make your life a whole lot easier. Imagine having a single point of contact, one monthly payment, and streamlined processes for policy updates, claims, and billing. No more juggling multiple providers and getting tangled in red tape.

And get this — bundling your car and home insurance may even unlock additional coverage options or features that you wouldn’t have access to otherwise. Enhanced liability protection or waived deductibles? Yes, please!

Factors That Influence Your Car and Home Insurance Quotes

Now, before you start jumping for joy at the thought of bundling, let’s take a look at the factors that can affect your car and home insurance quotes. Understanding these elements can help you make more informed decisions and potentially lower your premiums.

For your vehicle, the make, model, age, and safety features are all taken into account. Newer, safer, and less expensive cars typically come with lower insurance rates. After all, the insurer wants to know that your ride won’t be a liability on the road.

When it comes to your home, the location, age, construction, and features of your abode can greatly impact your homeowners insurance rates. Factors like the risk of natural disasters, proximity to fire stations, and the presence of security systems can all play a role. Homes in areas with lower crime rates and fewer natural disaster risks may qualify for those sweet, sweet discounts.

But it’s not just your wheels and your castle that matter — your personal characteristics also come into the equation. Your driving history, claims record, and credit score can all influence the insurance rates you’re offered. Maintaining a clean driving record and good credit can help you secure lower premiums, as insurers view these as signs of responsible behavior.

Navigating the Insurance Landscape

Now, I know navigating the insurance market can feel like a daunting task, but fear not, my friends. With the right approach, you can find the best car and home insurance quotes that fit your needs like a glove.

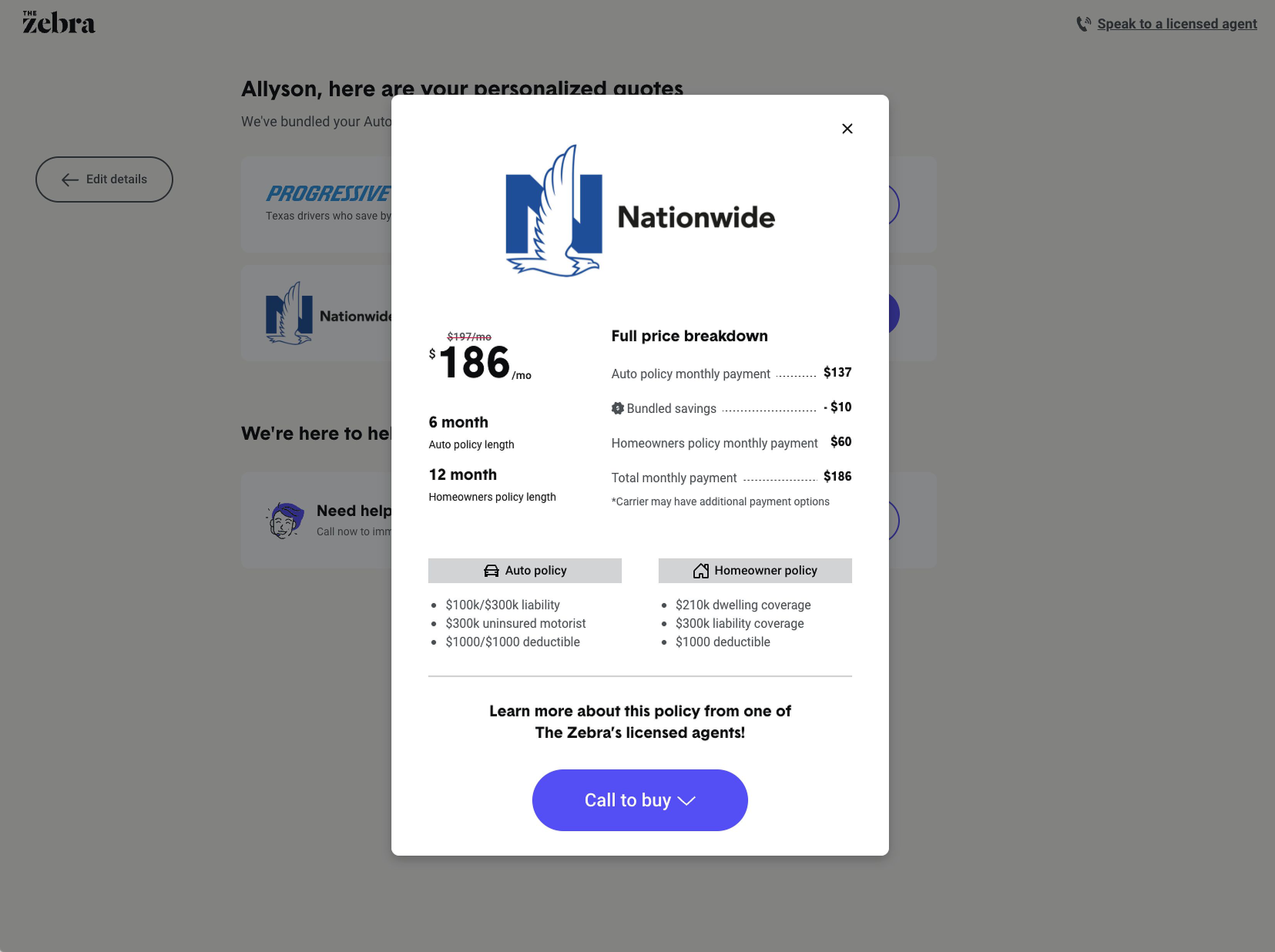

First things first, invest some time in researching and comparing quotes from multiple insurance providers. This ensures you’re getting the most competitive rates and coverage options. Online comparison tools, like the one I use called The Zebra, can make this process a breeze by allowing you to input your info and get quotes from a variety of insurers in a snap.

And don’t forget to leverage those bundling discounts! When you’re requesting quotes, be sure to inquire about any deals the insurance companies offer for bundling your car and home policies. This can lead to some serious savings, potentially hundreds of dollars off your annual insurance costs.

But the fun doesn’t stop there. Take a good, hard look at your specific needs and consider customizing your coverage. Adjusting your deductibles or coverage limits can help you find the perfect balance between protection and cost. Just make sure you have enough savings to cover any potential out-of-pocket expenses in case of a claim.

Oh, and one more thing — stay up-to-date on your policies! As your circumstances change, like buying a new car or renovating your home, your insurance needs may evolve too. Regularly reviewing your policies can help you identify any opportunities to save even more.

The Cream of the Crop: Top Insurers for Bundling

When it comes to bundling car and home insurance, certain insurance providers stand out from the rest. Let me give you the scoop on the crème de la crème.

First up, we’ve got USAA. This insurer is known for its exceptional customer service and consistently tops the charts for the most affordable bundled rates. However, their policies are only available to active military members, veterans, and their families. So, if you’re part of that exclusive club, you’re in for a real treat!

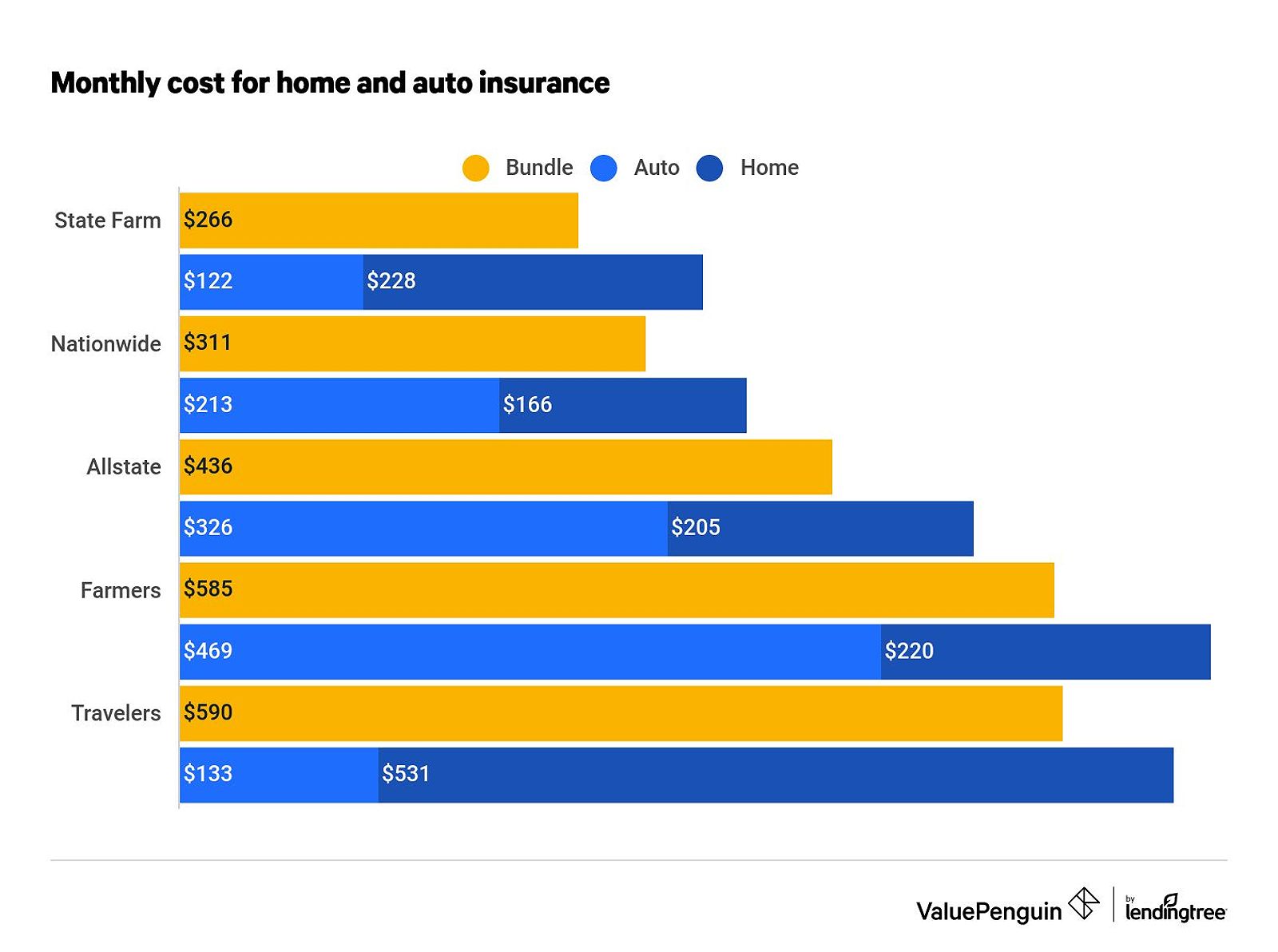

Next on the list is State Farm. This widespread and highly-rated insurer offers impressive bundling discounts, with an average savings of 24% for customers who combine their car and home policies. With their large network of agents and comprehensive coverage options, State Farm is a popular choice for bundling.

And let’s not forget about Nationwide. This insurer sets itself apart with a wide array of add-on options, like smart home discounts, home renovation credits, and roadside assistance coverage. Basically, they’re the Swiss Army knife of insurance providers. Their bundling discounts can provide significant savings, especially for all you homeowners out there.

Turbocharging Your Savings: Tips and Tricks

But wait, there’s more! Beyond the power of bundling, I’ve got a few other tricks up my sleeve to help you maximize your car and home insurance savings.

First up, let’s talk about deductibles. Raising your deductibles, the amount you pay out-of-pocket before your insurance coverage kicks in, can significantly lower your premiums. Just make sure you maintain a deductible level that won’t leave you in a bind if you need to file a claim.

And speaking of credit, keeping your credit score in tip-top shape can also work wonders for your insurance costs. Insurance providers often use credit-based scores to determine rates, so staying on top of your credit report and addressing any issues can pay big dividends.

Don’t forget about enhancing your home security either! Installing security systems, smoke detectors, and other safety features can qualify you for additional discounts on your homeowners insurance. It’s a win-win — you get to protect your castle, and the insurers get to sleep a little better at night.

And if you happen to own more than one car or property, insuring them all with the same provider can often result in even more bundling discounts. Just make sure the overall bundle price is lower than what you’d pay by insuring each asset separately. It’s all about that sweet, sweet savings!

Frequently Asked Questions

Is it always cheaper to bundle car and home insurance?

Not necessarily. While bundling can often lead to significant savings, it’s essential to compare both bundled and unbundled quotes from multiple insurers to ensure you’re getting the best deal. Sometimes, mixing and matching policies from different providers can result in a lower overall cost.

Can I bundle insurance policies from different providers?

Absolutely, it’s possible to mix and match insurance policies from different providers. However, it’s generally more convenient and potentially more cost-effective to bundle with a single insurer. Dealing with a single point of contact can simplify policy management and claims processing.

How often should I review and update my insurance policies?

As a rule of thumb, I recommend reviewing your car and home insurance policies annually or whenever your circumstances change, like a move, a new vehicle, or a home renovation. This helps ensure you’re still getting the best coverage and rates, and that your policies are keeping up with your evolving needs.

What’s the difference between actual cash value and replacement cost coverage?

Actual cash value coverage pays the depreciated value of your belongings, while replacement cost coverage pays the full cost to replace them. Replacement cost coverage is generally more expensive, but can provide more comprehensive protection, ensuring you can fully restore your property in the event of a loss.

Does bundling insurance policies affect my coverage limits?

Bundling your car and home insurance policies doesn’t necessarily impact your coverage limits. However, it’s essential to review the details of each policy to ensure you have the appropriate level of protection for your needs. Some insurers may adjust certain limits when you bundle, so it’s important to understand the implications.

Conclusion: Unlock Your Insurance Savings Superpowers

There you have it, my friends — the inside scoop on maximizing your car and home insurance savings. By harnessing the power of bundling, understanding the factors that influence your rates, and employing a few strategic tactics, you can ensure your assets are protected while keeping your insurance costs under control.

As The Insurance Guru, I’m here to tell you that navigating the world of insurance doesn’t have to be a daunting task. With the right knowledge and a little bit of research, you can achieve the perfect balance of comprehensive coverage and cost-effective premiums. So, what are you waiting for? Start comparing quotes, leveraging those bundling discounts, and unleash your insurance savings superpowers today!