Navigating the world of car insurance as a young driver in Colorado can be overwhelming. This guide provides essential information to help you find the best auto insurance quotes Colorado has to offer, tailored to your specific needs. We’ll cover Colorado’s car insurance requirements and offer practical tips to lower your premiums.

Understanding Colorado’s Car Insurance Essentials

In the Centennial State, drivers are required to carry a minimum of $25,000 per person and $50,000 per accident in Bodily Injury Liability (BIL) insurance, as well as at least $15,000 in Property Damage Liability (PDL) coverage. This coverage, often referred to as 25/50/15, is the bare minimum to legally operate a vehicle in Colorado.

While these requirements may seem straightforward, it’s crucial to recognize their limitations. Imagine a scenario where you’re involved in a serious accident that results in significant medical expenses and vehicle damage. In such a case, the minimum liability coverage may not be enough to fully protect you from financial liability, potentially leaving you responsible for the remaining costs out of your own pocket.

According to our research, the average driver in Colorado pays $2,173 per year for a full-coverage auto insurance policy, which is about 8% higher than the national average. As a young driver, you may face even steeper rates due to your lack of experience behind the wheel.

Your Driving Record: The Key to Affordable Auto Insurance Quotes Colorado

As a young driver, your driving record plays a pivotal role in determining your car insurance rates. Insurance companies closely scrutinize factors like speeding tickets, at-fault accidents, and DUI convictions when calculating your premiums. A clean driving record can earn you substantial discounts, while even a single violation can lead to a significant increase in your rates.

Our data shows that a young driver in Colorado with a speeding ticket can expect to pay around $145 per month on average for a full-coverage policy, compared to just $122 per month for a driver with a clean record. The impact of an at-fault accident can be even more severe, with average rates jumping to $154 per month. And a DUI conviction can result in a staggering $185 per month premium, nearly 80% higher than the state average.

The clear takeaway is that maintaining safe driving habits and avoiding violations can go a long way in keeping your car insurance costs low as a young driver in Colorado.

Strategies to Find the Best Auto Insurance Quotes

Navigating the car insurance landscape as a young driver can be challenging, but there are several effective strategies you can employ to secure the most competitive quotes:

Shop Around and Compare Offers

One of the most crucial steps is to shop around and compare quotes from multiple insurers. Don’t settle for the first quote you receive — take the time to explore options from different providers. Online comparison tools and websites can be a great starting point, but don’t hesitate to contact insurance companies directly for personalized quotes as well. Be sure to compare not just the prices, but also the coverage levels and available discounts to ensure you’re getting the best value.

Maximize Discount Opportunities

As a young driver, you may be eligible for a variety of discounts that can significantly lower your insurance costs. Look for opportunities such as good student discounts, safe driver discounts, and driver training discounts. Additionally, consider bundling your auto insurance with other policies, like homeowners or renters insurance, to take advantage of multi-policy savings.

Customize Your Coverage Levels

When selecting your auto insurance policy, it’s essential to strike a balance between adequate coverage and affordable premiums. While the state minimum requirements provide a starting point, you may want to consider adding additional coverage, such as collision, comprehensive, and medical payments, to better protect yourself and your vehicle. Weigh the potential risks and your budget to determine the right coverage levels for your needs.

By implementing these strategies, young drivers in Colorado can navigate the auto insurance landscape with confidence and secure the most competitive rates. According to our data, a 16-year-old driver with a clean record can expect to pay around $303 per month on average for a full-coverage policy, while a 21-year-old with a clean record can find rates as low as $122 per month.

Factors That Influence Young Driver Insurance Rates in Colorado

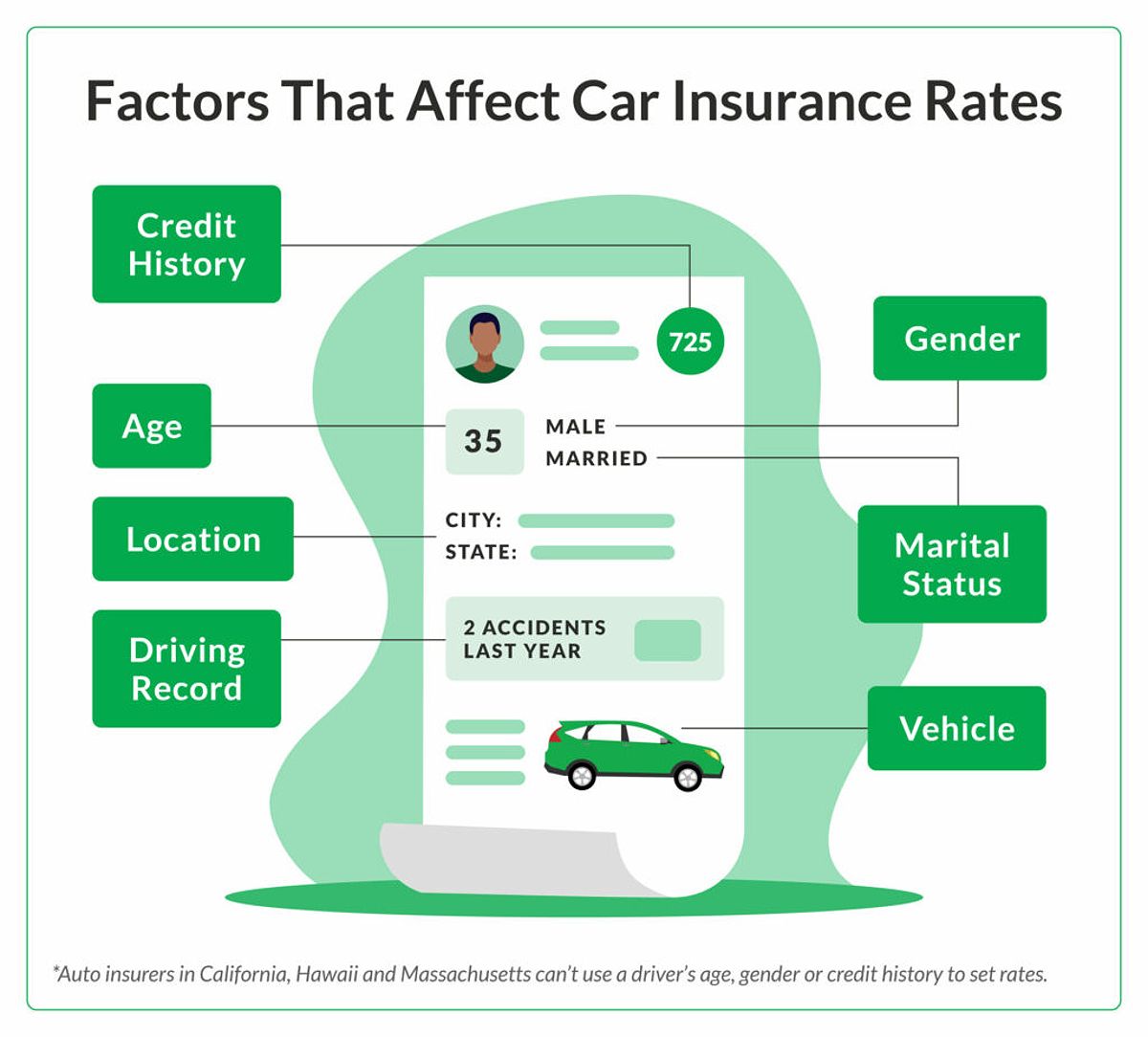

In addition to your driving record, several other factors can impact the auto insurance rates you’re quoted as a young driver in Colorado:

Age and Experience

Younger drivers, especially those under 25, are generally considered higher-risk by insurance companies. As you gain more experience behind the wheel, your rates will typically decrease.

Vehicle Type

The make, model, and year of the vehicle you drive can affect your insurance costs. Newer, more expensive, and high-performance vehicles tend to have higher premiums.

Credit Score

Insurance providers often use credit-based insurance scores to help determine rates. Maintaining a good credit score can help you secure lower auto insurance premiums.

Garaging Location

Where you park your vehicle can also play a role in your insurance costs. Vehicles garaged in urban areas or high-traffic neighborhoods may have higher rates than those in quieter, suburban locations.

Usage and Mileage

If you only use your car for occasional driving or have a short commute, you may qualify for lower rates than someone who drives long distances or logs high annual mileage.

By understanding these factors and how they can affect your insurance costs, you can make more informed decisions about the coverage you choose and the vehicle you drive.

Additional Considerations for Young Drivers in Colorado

As a young driver, there are a few additional factors you should keep in mind when navigating the auto insurance landscape in Colorado:

Maintain a Clean Driving Record

One of the most effective ways to keep your insurance costs low is to maintain a clean driving record. Avoid speeding tickets, accidents, and other violations, as these can significantly increase your premiums. If you do receive a ticket or get into an accident, work on improving your driving habits and consider taking a defensive driving course to mitigate the impact on your rates.

Choose Your Vehicle Wisely

The type of vehicle you drive can also have a significant impact on your insurance costs. Opt for a more budget-friendly, lower-profile model, as these tend to have lower premiums than newer, high-performance vehicles. Additionally, consider the safety features of the car, as vehicles with advanced safety technology may qualify for additional discounts.

Review Your Policy Regularly

As your circumstances change over time, it’s essential to review your auto insurance policy regularly to ensure you’re still getting the best value. Compare quotes from various insurers every year or two to see if you can find better rates elsewhere. Remember, your needs and the market may evolve, so staying vigilant can lead to substantial long-term savings.

FAQ

Q: What are the best car insurance companies for young drivers in Colorado? A: Some of the top-rated insurers for young drivers in Colorado include Geico, State Farm, and USAA (for military members and their families). These companies are known for offering competitive rates and good customer service.

Q: How can I get a car insurance quote online? A: You can easily obtain online car insurance quotes by visiting the websites of major insurers or using comparison tools like Geco, Insurify, or The Zebra. These platforms allow you to input your personal details and get quotes from multiple providers at once.

Q: What happens if I get a speeding ticket? A: If you receive a speeding ticket in Colorado, you can expect to see a significant increase in your car insurance rates. On average, a young driver with a speeding violation will pay around $145 per month for full coverage, compared to $122 per month for a driver with a clean record. To avoid this, it’s crucial to maintain safe driving habits and obey all traffic laws.

Conclusion

As a young driver in Colorado, navigating the auto insurance landscape can be a daunting task, but with the right strategies and knowledge, you can secure the most competitive coverage for your needs. By understanding the state’s insurance requirements, how your driving record impacts your rates, and leveraging available discounts and savings, you can make informed decisions and find the best value for your money.

Remember, taking the time to shop around, compare quotes, and optimize your policy can lead to substantial long-term savings. Maintaining a clean driving record and exploring all available discounts are also key to keeping your car insurance costs in check. With this comprehensive guide, you’ll be well-equipped to tackle the Colorado auto insurance market and get the coverage that best fits your budget and protection needs.