In today’s dynamic insurance landscape, savvy consumers are constantly on the lookout for ways to optimize their coverage while minimizing costs. One such strategy that has proven to be increasingly popular is the bundling of auto and home insurance policies. By combining these essential insurance needs under a single provider, individuals can unlock a range of benefits that can lead to substantial long-term savings. To explore the potential savings and coverage options available, it’s essential to compare auto home insurance quotes from reputable insurers.

Understanding the Power of Bundling Auto & Home Insurance

The concept of bundling, also known as a multi-policy discount, is a common practice in the insurance industry. When policyholders choose to consolidate their auto and home insurance needs with a single insurer, they are often rewarded with discounted rates on one or both policies. This symbiotic arrangement recognizes the value of the customer’s combined business and the potential for reduced administrative costs for the insurance provider.

The primary advantages of bundling auto and home insurance include:

Significant Cost Savings

The multi-policy discount can translate to substantial savings on the overall insurance premiums. Industry data suggests that homeowners who bundle their auto and home insurance policies can enjoy an average savings of around 10% on their total insurance costs.

Streamlined Insurance Management

By consolidating multiple policies with a single provider, policyholders can simplify their insurance management. This includes streamlined billing, policy updates, and claims processing, saving time and reducing the administrative burden.

Enhanced Customer Service

When all of an individual’s insurance needs are handled by a single company, they often receive a higher level of personalized attention and support. This prioritized service can be particularly beneficial when navigating the complexities of insurance claims or policy adjustments.

Strategies for Finding the Best Auto Home Insurance Quotes

To maximize the benefits of bundling, it’s essential to conduct a thorough market comparison and explore the options available from multiple insurance providers. Here’s a step-by-step guide to help you find the most advantageous bundled auto and home insurance quotes:

Leverage Online Comparison Tools

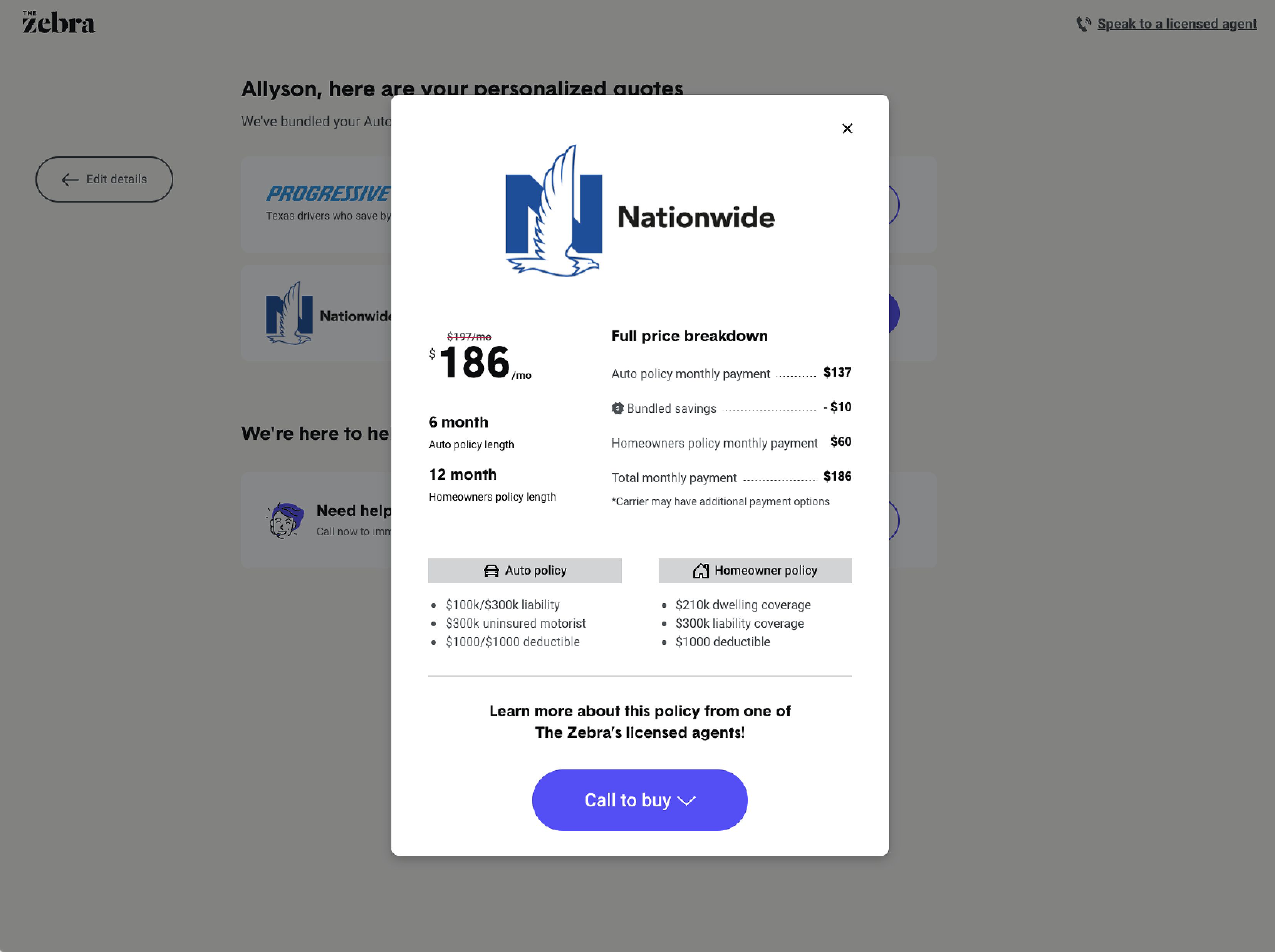

Websites like The Zebra have made it easier than ever to compare bundled insurance quotes side-by-side. By inputting your relevant details, you can quickly access a range of options and identify the most cost-effective solution for your specific needs.

Engage with Insurance Agents

While online tools provide a convenient starting point, it’s also valuable to consult with local insurance agents. These professionals can offer personalized guidance, explore various coverage levels and discounts, and help you navigate the intricacies of the bundling process.

Consider Multiple Providers

Don’t limit your search to a single insurance company. Gather quotes from a diverse range of regional and national insurers to ensure you’re accessing the most competitive rates and comprehensive coverage options.

Evaluate Discounts and Factors

When comparing bundled quotes, be mindful of the various factors that can influence the cost of your auto and home insurance, such as driving history, vehicle type, home value, and the desired coverage levels. Additionally, be sure to inquire about any available discounts that could further enhance your savings.

Optimizing Your Insurance with Discounts and Considerations

In addition to the bundling discount, there are several other ways to maximize your savings on auto and home insurance premiums. By understanding the common discounts and key factors that shape your rates, you can strategically position yourself to get the best value for your money.

Common Discounts to Explore

- Safe Driver Discount: Maintain a clean driving record, and you may qualify for reduced auto insurance rates.

- Good Student Discount: If you have a high-performing student in your household, they may be eligible for additional savings on their auto insurance.

- Home Security Discount: Investing in home security systems, fire alarms, or other protective measures can lead to savings on your homeowners insurance.

- Loyalty Discount: Remaining with the same insurance provider for an extended period can earn you additional cost-saving benefits.

Factors Influencing Insurance Costs

- Auto Insurance Factors: Your driving history, vehicle characteristics, location, age, and gender can all play a role in determining your auto insurance premiums.

- Home Insurance Factors: The value of your home, its location, age, and condition, as well as the desired coverage levels, will shape your homeowners insurance costs.

By understanding these factors and actively seeking out available discounts, you can position yourself to obtain the most favorable bundled insurance rates.

Choosing the Right Insurance Provider

When bundling your auto and home insurance, the selection of the insurance provider is a crucial decision. It’s essential to prioritize factors such as the company’s reputation, financial stability, customer service, and claims handling capabilities.

Reputation and Financial Strength

Research the insurance company’s financial ratings from reputable organizations like A.M. Best to ensure their long-term viability and ability to reliably fulfill claims.

Exceptional Customer Service

Review the provider’s reputation for responsive and helpful customer service, as you’ll likely need to interact with them for policy updates, billing inquiries, and claims processing.

Efficient Claims Handling

Understand the company’s claims process and its track record of fair and timely resolutions, as this can be a critical factor in the event of an accident or disaster.

By carefully evaluating these essential criteria, you can feel confident that you’ve selected an insurance provider capable of delivering the comprehensive coverage and exceptional service you deserve.

FQAs

Q1: What are some of the best insurance companies for bundling auto and home insurance? According to industry data and customer reviews, USAA and State Farm are often regarded as top-tier insurers for bundling auto and home insurance. These companies consistently offer competitive rates and receive high marks for customer satisfaction.

Q2: How much can I save by bundling my auto and home insurance? On average, homeowners who bundle their auto and home insurance policies save around 10% on their total insurance costs. However, the exact savings can vary depending on factors such as location, coverage needs, and the specific insurance provider.

Q3: What are the potential drawbacks of bundling auto and home insurance? The primary potential downside of bundling is the possibility that the discounted rate may still be more expensive than getting separate policies from different insurers. It’s essential to compare both bundled and unbundled quotes to ensure you’re getting the best deal for your unique situation.

Q4: Should I bundle my auto and home insurance if I have different types of vehicles? Yes, you can still benefit from bundling even if you have a mix of vehicles, such as a car and a motorcycle. The bundling discount typically applies to your overall insurance package, not just the specific policies.

Q5: Is it better to bundle with a single company or get separate policies from different companies? There is no one-size-fits-all answer, as the best approach depends on your specific insurance requirements and the available rates. It’s essential to compare quotes from multiple insurers, both for bundled and separate policies, to determine the most cost-effective solution for your unique situation.

Conclusion

In the ever-evolving landscape of insurance, the strategy of bundling auto and home policies has emerged as a compelling way for consumers to optimize their coverage while achieving substantial cost savings. By understanding the benefits of bundling, leveraging online tools and insurance agent expertise, and taking advantage of available discounts, individuals can navigate the insurance market with confidence and find the most advantageous insurance solutions.

Whether you choose to bundle your policies or maintain separate coverage, the key is to approach the process with a strategic and well-informed mindset. By staying up-to-date on industry trends, exploring all available options, and prioritizing the factors that matter most to you, you can rest assured that you’re making the best decision for your insurance needs and your financial well-being.

So, take the time to explore the bundling opportunities in the insurance market and unlock the potential savings that could be waiting for you. With the right approach and a commitment to diligent research, you can uncover the most cost-effective and comprehensive auto and home insurance protection for your unique circumstances. By doing so, you can enjoy the peace of mind that comes with knowing your most valuable assets are safeguarded, all while keeping your insurance costs under control.