Are you tired of feeling like you’re overpaying for your auto and homeowners insurance? It’s a frustrating problem that many of us face. But don’t worry, I’m here to share some insider tips and tricks to help you unlock significant savings on your insurance premiums without compromising on the coverage you need.

As a seasoned insurance shopper myself, I know how daunting it can be to navigate the complex world of auto and homeowners insurance. But with the right strategies, you can find the perfect balance between affordability and comprehensive protection. In this article, I’ll walk you through the ins and outs of getting the best auto and homeowners insurance quotes, from understanding the key factors that influence your premiums to leveraging the power of bundling and comparison shopping.

Decoding Auto and Homeowners Insurance Quotes

Let’s start with the basics: what exactly are auto and homeowners insurance quotes, and how do they work? Well, think of them as the insurance version of a car dealership price tag. These quotes are estimates of the premiums you’ll pay for coverage, and they’re based on a variety of factors.

For auto insurance, the big ones are your driving record, age, location, the type of vehicle you drive, and your desired coverage levels. Homeowners insurance, on the other hand, takes into account your home’s value, location, coverage options, building materials, security features, claims history, and deductible amount.

Understanding these factors is crucial because they directly impact the cost of your insurance. For example, if you live in a high-crime area, your homeowners insurance premiums will likely be higher than someone living in a safer neighborhood. Similarly, if you have a history of speeding tickets or accidents, your auto insurance rates will be steeper than a driver with a spotless record.

Exploring Your Coverage Options

Now that you know the key factors behind those insurance quotes, let’s dive into the different types of coverage you can get for your car and home. Auto insurance typically includes liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage. Homeowners insurance, on the other hand, covers your dwelling, personal property, liability, medical payments, and additional living expenses.

It’s important to familiarize yourself with these coverage types and how they can protect you in the event of an accident or disaster. For instance, liability coverage has got your back if you’re at fault in a crash and cause damage to someone else’s property or injuries.

Comparing Quotes Like a Pro

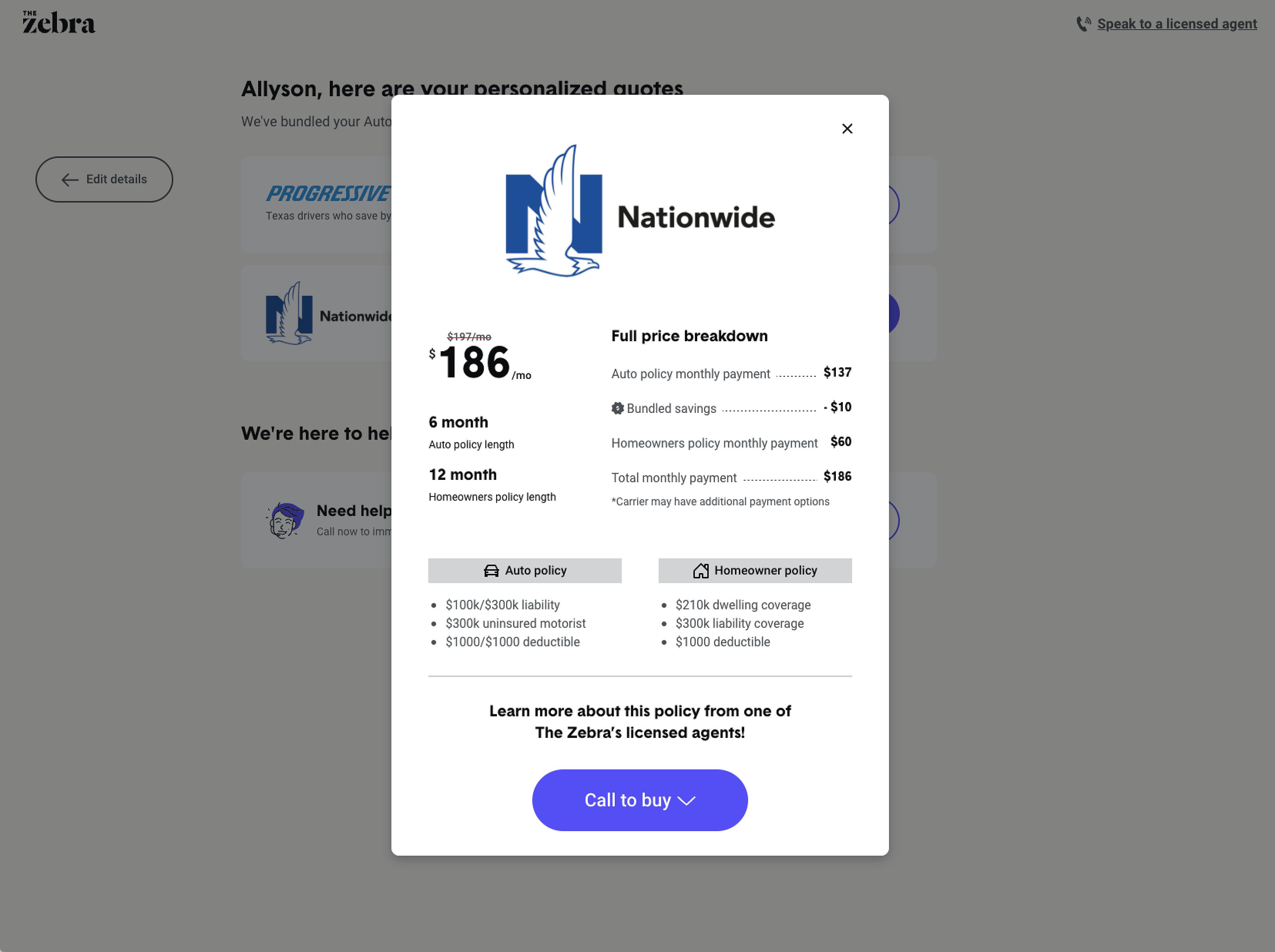

One of the best ways to find the best auto and homeowners insurance quotes is to use online comparison tools. These nifty websites, like The Zebra, Policygenius, and Insurify, let you enter your information once and then spit out quotes from multiple insurance companies in just a few minutes. It’s a real time-saver and gives you an unbiased look at your options.

But don’t just rely on these tools – it’s also super valuable to work with a licensed insurance agent. These pros can help you understand your coverage options, identify potential discounts and savings opportunities, and provide personalized recommendations tailored to your needs. Plus, they can act as your advocate, making sure you get the right coverage at the best possible price.

The Power of Bundling

Now, let’s talk about one of the most effective ways to save money on your insurance: bundling your auto and homeowners policies with the same provider. Many insurers offer discounts, often ranging from 5% to 20%, for customers who choose to bundle their policies. Talk about a win-win!

Bundling also has some added benefits, like convenience and a streamlined claims process. Instead of dealing with multiple companies and policies, you’ll have just one point of contact for payments, updates, and filing claims. This can be a real lifesaver, especially if you ever need to make a claim.

But hold up – bundling might not always be the most cost-effective option. In some cases, getting separate policies from different companies could be more affordable, even after the bundle discount. That’s why it’s so important to compare both bundled and unbundled quotes to ensure you’re getting the best deal.

Finding Your Perfect Insurance Match

When it comes to auto and homeowners insurance, there are a few standout companies that consistently deliver competitive rates and excellent customer service. Some of the top-ranked insurers include USAA (for military members and their families), State Farm, GEICO, Progressive, Nationwide, Liberty Mutual, and Allstate.

These companies have earned high marks from industry experts and customers alike, making them a great starting point for your insurance shopping journey. As you compare quotes, be sure to consider factors like coverage options, customer satisfaction, and financial stability to ensure you’re choosing the right provider for your needs.

Tips for Getting the Best Quotes

Alright, now that you’re armed with all the knowledge about auto and homeowners insurance quotes, let me share some practical tips to help you get the best deals:

-

Shop around: Don’t just settle for the first quote you receive. Get quotes from multiple insurance companies to ensure you’re getting the best possible deal.

-

Consider bundling: Explore the potential savings of bundling your auto and homeowners insurance policies with the same provider.

-

Ask about discounts: Many insurance companies offer discounts for things like good driving records, safety features in your home, and bundling multiple policies.

-

Review your coverage options: Carefully consider the coverage levels you need to protect your assets, and don’t be afraid to adjust your policies as your needs change.

-

Be honest and accurate: When providing information to insurance companies, be sure to give them the most up-to-date and accurate details about your vehicle, home, and driving history.

-

Utilize an insurance agent: A licensed agent can offer personalized advice and help you navigate the insurance landscape to find the best deals.

-

Stay on top of it: Set a reminder to review your auto and homeowners insurance policies every 12-24 months, as rates and your needs may change over time.

By following these tips and leveraging the power of comparison shopping, you can unlock significant savings on your insurance without compromising on the coverage you need. Trust me, it’s totally worth the effort!

Additional Factors That Can Impact Your Rates

Beyond the standard considerations like driving record and home value, there are other factors that can influence your auto and homeowners insurance rates. Understanding these factors can help you make more informed decisions and potentially find ways to lower your premiums.

For auto insurance, factors like your credit score, marital status, and even your occupation can play a role in your rates. Insurance companies often view married individuals and those with stable jobs as lower-risk, which can translate to lower premiums.

When it comes to homeowners insurance, the age and condition of your home’s roof, plumbing, and electrical systems can impact your rates. Insurers may view newer, well-maintained homes as less risky, leading to lower premiums. Additionally, the proximity of your home to fire hydrants and police/fire stations can also influence your homeowners insurance costs.

By being aware of these lesser-known factors, you can take proactive steps to manage your rates, such as maintaining good credit, making home improvements, or even considering a different location for your next home purchase.

FAQ

Q: What is the best way to compare insurance quotes? A: The best approach is to use a combination of online comparison tools and working with a licensed insurance agent. Online tools provide quick and easy comparisons, while an agent can offer personalized advice and help you find the best deals.

Q: How often should I shop for new insurance quotes? A: It’s a good idea to shop for new quotes at least every 12-24 months, as insurance rates can fluctuate due to changes in your personal circumstances, the insurance market, and the overall economy.

Q: What should I do if I’m not happy with my current insurance company? A: If you’re unsatisfied with your current insurance provider, the first step is to contact them and explain your concerns. If you’re still not satisfied, you can shop around for a new insurance company and switch providers.

Conclusion

Well, there you have it – my personal guide to getting the best auto and homeowners insurance quotes. By understanding the key factors that influence your premiums, leveraging online comparison tools and licensed insurance agents, and exploring the benefits of bundling, you can unlock significant savings without sacrificing the coverage you need.

Remember, the insurance landscape is constantly evolving, so it’s important to stay on top of your policies and review them regularly. With the right approach, you can be confident that you’re getting the protection you deserve at a price that fits your budget. Happy insurance shopping, my friends!