Tired of feeling like you’re overpaying for your auto and home coverage? The Insurance Whiz is here to help you find the best auto and home insurance quotes and make the process as smooth and enjoyable as a Sunday drive. Navigating the world of insurance can feel like a maze, but with my insider tips and tricks, you’ll be zooming through those quotes like a Formula 1 racer. Let’s dive in and uncover the secrets to saving big on your auto and home insurance policies!

Understanding the Ins and Outs of Insurance Quotes

Before we start hunting for the best deals, it’s important to understand the different types of coverage available for both your car and your home. Trust me, once you get the hang of it, it’ll be a breeze!

Decoding Auto Insurance

Auto insurance is like having a trusty co-pilot by your side. There are several key coverages to consider, such as liability (protecting you from claims made by others), collision (covering damage to your vehicle), and comprehensive (protecting against non-collision incidents like theft or natural disasters). Now, let’s say you live in an area prone to severe storms — you might want to prioritize that comprehensive coverage to keep your ride safe and sound.

Exploring Homeowners Insurance

Alright, let’s talk about protecting your castle — your home, that is. Homeowners insurance is like a shield against the unexpected, covering the structure of your house, your personal belongings, and even liability if someone gets injured on your property. Trust me, you don’t want to skimp on this one, especially if you have some valuable items, like that vintage baseball card collection or your grandma’s priceless jewelry.

Factors That Influence Insurance Quotes

Now, you might be wondering, “What’s going to affect my rates?” Well, my friend, it’s a combination of factors, including your driving record, credit score, and the type of car or home you have. But don’t worry, there are ways to improve these factors and potentially lower your premiums. For example, maintaining a clean driving history and boosting your credit score can work wonders.

Comparing Auto and Home Insurance Quotes: The Key to Saving Big

Alright, let’s get down to the nitty-gritty — how do you actually find the best insurance quotes? Well, I’ve got a few tricks up my sleeve.

Online Comparison Tools: Your Insurance Sidekicks

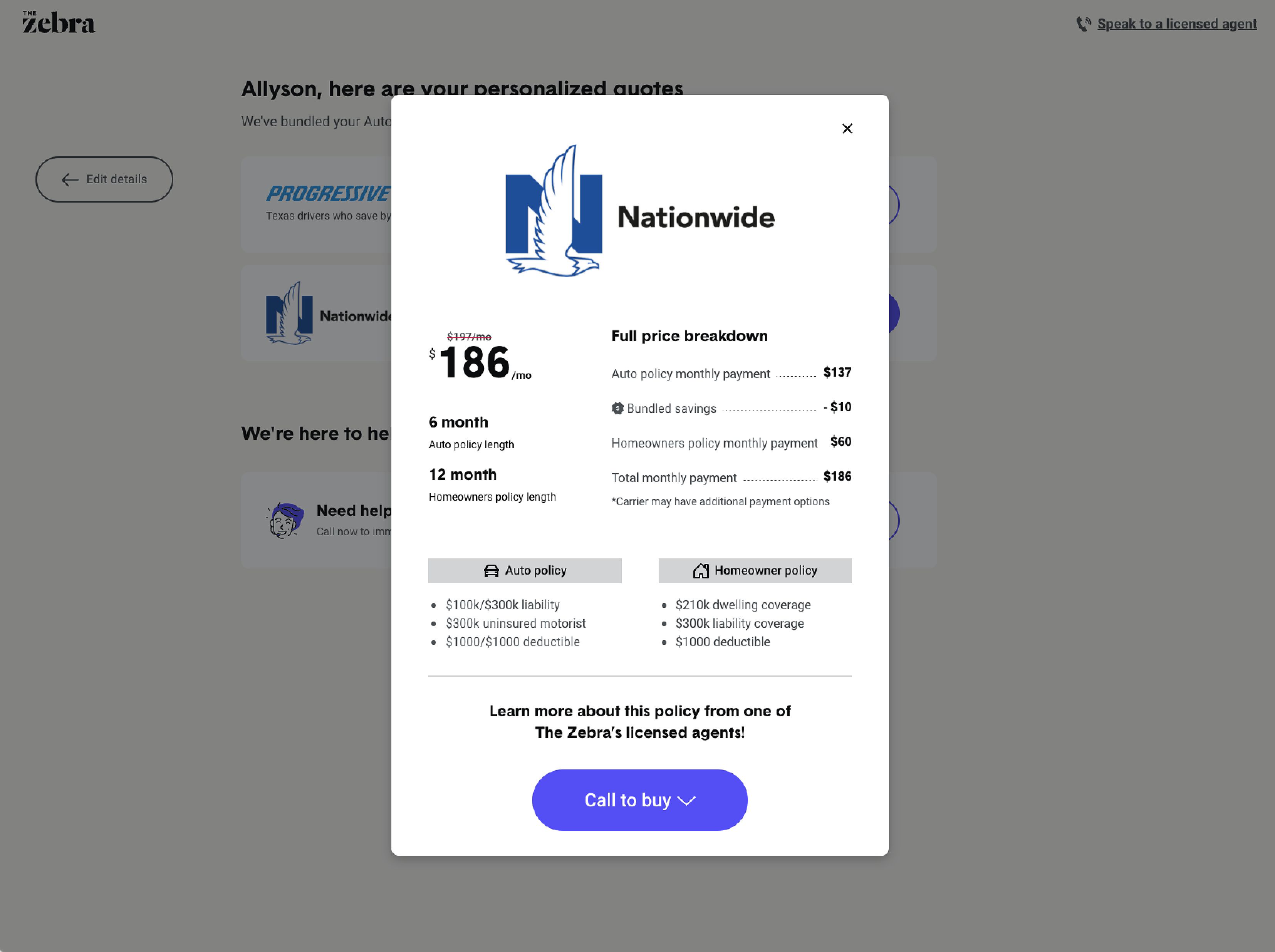

Nowadays, you’ve got all these nifty online tools that can do the heavy lifting for you. Just input your info, and BAM! — you’ve got a bunch of personalized quotes from different insurance companies. It’s like having a personal assistant doing all the research for you. Just remember to compare apples to apples, so you’re getting the same coverage levels.

Direct Quotes from Insurers: Get the Inside Scoop

But wait, there’s more! You can also reach out to insurance companies directly and get quotes from the source. This way, you can ask all the questions you want and really dig into the details. Just be ready to provide your driving history, property features, and any past claims — the more info you can give, the more accurate your quotes will be.

Factors to Consider: Beyond Just the Price Tag

Now, when you’re comparing all those quotes, don’t just focus on the price tag. Sure, that’s important, but you also want to look at the coverage options, deductibles, and the insurance company’s reputation. After all, you want a provider that’s going to have your back when you need them most.

Bundling for Maximum Savings

Alright, here’s a little secret that can really pay off: bundling your auto and home insurance policies. It’s like hitting the jackpot — you can potentially save anywhere from 5% to 20% on your premiums! Plus, it makes managing your policies a breeze.

The Benefits of Bundling: Discounts Galore

Think about it — one point of contact, one payment to worry about, and a whole lot of savings. It’s a win-win-win situation! And the best part? Many insurers offer special discounts just for being a loyal multi-policy customer. So, why not take advantage of that and watch your savings grow?

Bundling Like a Pro: Tips and Tricks

Now, when it comes to bundling, you’ll want to make sure you’re getting the best deal possible. Start by chatting with your current insurer and see what kind of discounts they can offer. If they can’t match the competition, then it might be time to shop around and find a provider that can give you the ultimate bundle package.

Bundling Considerations: Weigh Your Options

But hold up, there’s one thing to keep in mind — sometimes, bundling might not be the way to go. If one of your policies is significantly more expensive than the other, the savings might not be as substantial as you’d hoped. So, always do your homework and make sure the numbers add up in your favor.

Strategies for Saving on Insurance Quotes

Alright, let’s get down to the nitty-gritty — how can you save even more on those insurance quotes? Well, I’ve got a few tricks up my sleeve.

Discounts and Savings: The Secret Sauce

First off, let’s talk about those sweet, sweet discounts. Insurance companies love to reward their customers for being safe drivers, good students, and loyal policyholders. So, make sure you’re taking advantage of every single discount you qualify for. Trust me, those savings can really add up!

Driving Like a Boss: Keeping Your Record Squeaky Clean

And you know what else can help lower your auto insurance rates? Keeping that driving record of yours spotless. Avoid those speeding tickets and accidents like the plague, and you’ll be rewarded with lower premiums. If you need a little extra help, consider taking a defensive driving course — some insurers offer discounts for that.

Home Safety Hacks: Protecting Your Castle

Now, when it comes to your home insurance, there are a few things you can do to save some cash. Simple things like installing a security system, smoke detectors, and deadbolt locks can show your insurer that you’re serious about protecting your property. And guess what? They’ll often reward you with discounts for taking those safety measures.

Choosing the Right Insurance Provider: The Ace up Your Sleeve

Alright, now that you’ve got all the tricks up your sleeve, it’s time to find the perfect insurance provider. But it’s not just about the price tag, my friends — there are a few other factors to consider.

Customer Service: Your Wingman in Times of Need

When the unexpected happens, you want an insurance company that’s going to have your back, right? That’s why it’s so important to look for providers with a reputation for excellent customer service and efficient claims handling. Trust me, you don’t want to be dealing with a bunch of headaches when you’re already stressed.

Financial Stability and Reputation: The Solid Foundations

And let’s not forget about the financial strength and overall reputation of the insurance company. You want to know that they’re going to be around to pay out your claims, no matter what. So, do a little research, check out their ratings, and make sure they’ve got a solid track record in the industry.

Coverage Options and Flexibility: Tailor-Made for You

Last but not least, make sure the insurance provider you choose offers the coverage options and flexibility you need. After all, your needs might change over time, so you want a company that can adapt with you. Don’t be afraid to ask questions and make sure you’re getting the perfect policy for your situation.

FAQ

Q: What’s the best way to get multiple insurance quotes?

A: The best way to get multiple insurance quotes is to use a combination of online comparison tools and direct quotes from insurance companies. Online tools make it quick and easy to compare quotes, while reaching out to insurers directly can give you more personalized information about coverage options.

Q: How often should I compare insurance quotes?

A: It’s a good idea to compare insurance quotes at least once a year, or more frequently if you experience any major life changes, like getting married, buying a new car, or moving to a new home. This helps ensure you’re always getting the best deal.

Q: What kind of discounts can I expect for bundling auto and home insurance?

A: When you bundle your auto and home insurance policies, you can typically save between 5% and 20% on your premiums. The exact discount will depend on the insurance company and your specific situation, but it’s definitely worth looking into to maximize your savings.

Conclusion: Buckle Up for Savings!

Well, there you have it, folks — everything you need to know about finding the best auto and home insurance quotes. From understanding the coverages to comparing providers and maximizing your savings, you’re now an insurance expert in the making.

So, what are you waiting for? Hop in the driver’s seat and let’s start hunting for those deals! With my insider tips and your newfound knowledge, you’ll be cruising towards big-time savings in no time. Happy quoting, my fellow insurance enthusiasts!