As an insurance expert, I understand the importance of protecting your financial well-being, whether you’re a homeowner or a renter. In today’s world, having the right insurance coverage is essential, and the good news is that you can save money by bundling your renters and auto insurance policies. To see how much you could save, get an auto and home insurance quote today.

The Necessity of Renters Insurance

Renters insurance is often overlooked, but it’s a critical safeguard for anyone who doesn’t own their own home. This type of policy covers your personal belongings, liability, and additional living expenses in the event of a covered incident, such as a fire, theft, or natural disaster. Without renters insurance, you’d be responsible for replacing your belongings out-of-pocket, which can quickly become a financial burden.

Imagine a scenario where a fire breaks out in your apartment building. While your landlord’s insurance would cover the structure itself, it wouldn’t compensate you for the loss of your personal possessions. With a renters insurance policy, you’d be reimbursed for the cost of replacing your furniture, electronics, clothing, and other valuables. And if someone were to get injured in your home, your liability coverage could help cover the medical bills and any legal fees.

Despite the clear benefits, studies show that only about 40% of renters have insurance. Don’t be part of the uninsured majority — investing in a renters policy is an affordable way to protect your financial wellbeing.

Unlocking Savings Through Auto and Home Insurance Quotes

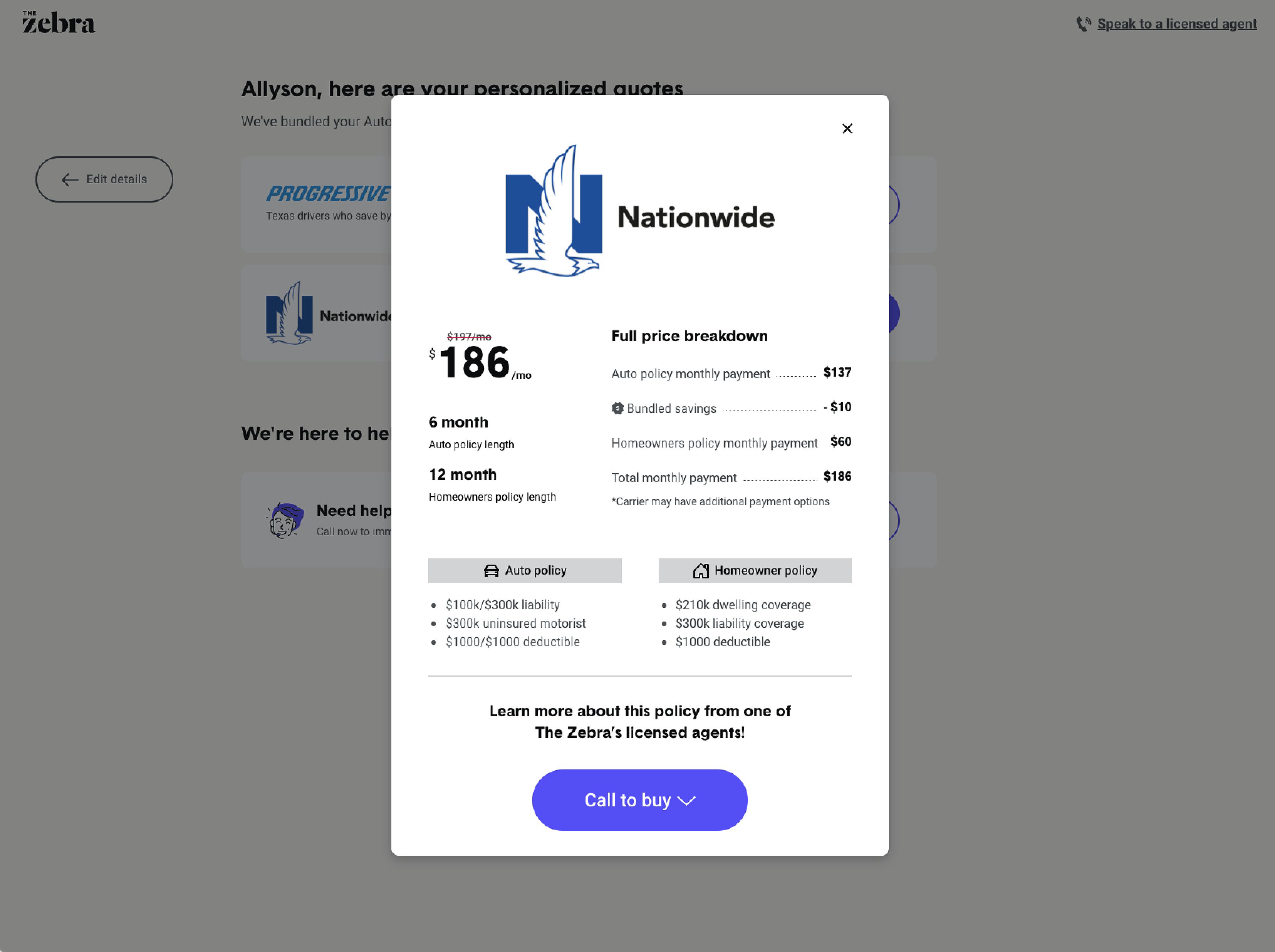

Now, let’s talk about how you can save money by bundling your renters and auto insurance policies. Insurance providers often offer discounts, typically ranging from 5% to 20%, when you combine your home and auto coverage into a single package. This multi-policy discount can result in significant annual savings, especially when compared to purchasing separate policies.

Beyond the financial incentive, bundling also offers convenience. Managing your insurance needs becomes much simpler when you can handle your renters and auto policies through a single provider. This streamlines the billing process, claims handling, and any necessary policy updates or changes. No more juggling multiple insurance companies and due dates.

Flexibility is another key advantage of bundling. As your life circumstances evolve — perhaps you move to a new apartment or acquire a new vehicle — your bundled policy can adapt. Your insurance provider can easily adjust your coverage to meet your changing needs, ensuring you’re always properly protected.

Of course, it’s important to weigh the pros and cons of bundling. While the discounts and convenience can be enticing, it’s still crucial to compare both bundled and unbundled quotes to ensure you’re getting the best overall deal. Occasionally, you may find that mixing and matching policies from different insurers is more cost-effective than a traditional bundle.

Navigating the Quoting Process

Finding the perfect auto and renters insurance bundle starts with understanding your coverage needs. Take some time to evaluate the value of your personal belongings and consider your driving history, vehicle type, and location. This will help you determine the appropriate coverage limits and deductibles for both your renters and auto policies.

Next, it’s time to start shopping around. Utilize online insurance comparison tools, like those offered by The Zebra, to obtain personalized quotes from a variety of providers. These platforms allow you to input your details and receive side-by-side comparisons of bundled and unbundled policies, making it easy to identify the most cost-effective option.

Once you’ve gathered several quotes, it’s time to consider the bundling option. Reach out to insurance agents, either through the comparison website or directly, to discuss the potential savings and coverage details of bundling your renters and auto policies. They can provide valuable insights and guidance to ensure you get the best deal.

Remember to carefully review the policy terms and conditions, including coverage limits, deductibles, and any exclusions. Understanding the fine print will help you make an informed decision and avoid any unwelcome surprises down the line.

Maximizing Your Savings

Maximizing your savings doesn’t stop at bundling. Here are some additional tips to help you get the most out of your renters and auto insurance policies:

-

Increase Your Deductibles: Opting for higher deductibles can significantly lower your monthly premiums, though you’ll need to be prepared to pay more out-of-pocket in the event of a claim.

-

Improve Your Credit Score: Insurance providers often use credit-based insurance scores to determine rates, so maintaining a strong credit profile can qualify you for discounts.

-

Take a Defensive Driving Course: Many insurers offer discounts to policyholders who complete an approved defensive driving course, helping to lower your auto insurance costs.

-

Review Your Policy Regularly: Don’t set it and forget it — make a habit of comparing quotes and reviewing your coverage at least once a year. This ensures you’re still getting the best deal as your needs and the insurance market evolve.

By combining these strategies with the power of bundling, you can enjoy substantial savings on your renters and auto insurance premiums.

Additional Savings Opportunities

In addition to the multi-policy discount you can receive by bundling your renters and auto insurance, there are several other ways you can save money on your coverage.

One overlooked opportunity is the “homeowner’s discount” on auto insurance. Even if you’re a renter, your status as a homeowner or condo owner can qualify you for lower car insurance rates. Insurance companies view homeowners as more financially responsible, which translates to a lower risk of filing claims.

Another way to save is by taking advantage of any available discounts through your employer, professional organizations, or affiliations. Many insurers offer group discounts to members of certain associations or employers, so be sure to inquire about any eligible programs.

Lastly, consider raising your deductibles on both your renters and auto policies. While this will increase your out-of-pocket costs in the event of a claim, it can significantly reduce your monthly premiums, especially if you have a good driving record and a well-maintained rental property.

FAQ

Q: How much renters insurance do I need? A: The amount of renters insurance coverage you need depends on the value of your personal belongings. Consider the cost to replace your furniture, electronics, clothing, and other valuables. A typical renters policy provides between $15,000 to $30,000 in personal property coverage.

Q: What does renters insurance cover? A: Renters insurance typically includes three main coverage types: personal property, liability, and additional living expenses. Personal property coverage protects your belongings in the event of a covered loss, like theft or fire. Liability coverage helps pay for injuries or damage you cause to others. Additional living expenses coverage can help pay for temporary housing and other costs if your rental becomes uninhabitable due to a covered peril.

Q: Is it worth bundling my renters and auto insurance? A: Bundling your renters and auto insurance can be a great way to save money, but it’s not always the cheapest option. Be sure to compare both bundled and unbundled quotes to ensure you’re getting the best deal. The multi-policy discount offered by bundling can result in significant savings, but it’s important to weigh the potential cost savings against your specific coverage needs.

Conclusion

As an insurance expert, I can confidently say that renters insurance is a vital safeguard for protecting your personal belongings and financial wellbeing. By bundling your renters and auto insurance policies, you can unlock valuable savings and enjoy the convenience of managing your coverage through a single provider.

Take the time to assess your coverage needs, compare quotes from multiple insurers, and explore the bundling options available to you. With the right insurance plan in place, you can rest assured that your possessions and liability are covered, allowing you to focus on enjoying your rental lifestyle.

Remember, the key to finding the best deal is to shop around, compare quotes, and take advantage of all available discounts and bundles. With a little effort, you can protect your financial future while keeping more money in your pocket. By implementing these strategies, you’ll be well on your way to maximizing your savings on renters and auto insurance.